Agri-Foods Coming Full Circle

Commodities / Agricultural Commodities Jul 05, 2011 - 02:18 PM GMTBy: Ned_W_Schmidt

Circles are somewhat special. They have no starting point nor ending point. Where they end is where they start. Such the time-worn phrase of "coming full circle." This Summer in Agri-Foods where we started this time last year is where we begin again.

Circles are somewhat special. They have no starting point nor ending point. Where they end is where they start. Such the time-worn phrase of "coming full circle." This Summer in Agri-Foods where we started this time last year is where we begin again.

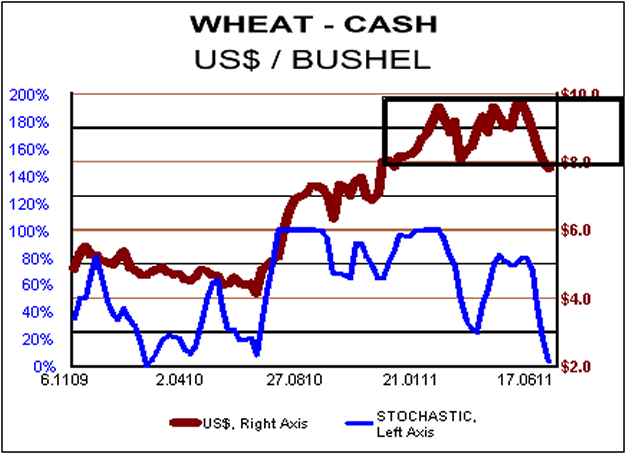

In the above chart is plotted the price for U.S. cash wheat. Last Summer two shocks had their epicenter in the global wheat market. Russia was one of those shocks when a dismal wheat harvest forced that nation to ban exports of wheat. That was followed by the Jasmine Revolution , a wildfire that spread across the Middle East consuming in flames despots wherever possible.

Those two events set off a scramble to buy wheat. Russia had for years been viewed as the world's wheat bin. Governments assumed that Russian wheat would always be available, as it had been. Suddenly, it was not. Governments also scrambled to buy wheat with which to make to bread to appease their unruly populations. If bread was not available, those crowds might actual demand liberty.

Wheat prices promptly moved from US$4 per bushel to US$7. That price movement, while certainly appreciated by those with wheat in the bins, actually influenced the supply of wheat very little. In the short-term, supply of any Agri-Foods is price inelastic.

That descriptive term means supply does not respond to price with any speed. No matter what the price of wheat might do, no more wheat would be produced in the Northern Hemisphere till the Summer of 2011. Wheat is not made in a factory. It grows in dirt with addition of adequate nutrients and water. Money alone will not produce wheat, nor corn nor canola nor oats nor barley.

Since that earlier time two events occurred. First, governments in panic mode over bought wheat. Second, the calendar dropped some pages. As happens about the same time each year, the Northern Hemisphere wheat harvest recently occurred. Wheat again flowed to the mills. Russia, apparently having more wheat than originally expected, is moving to resume wheat exports this month. However, buyers are not lining up for that Russian wheat.(Financial Times, 5 July 2011)

Additionally, supply bears recently received a fairly large shock. Expectations had been that the U.S. plantings of corn would be far from adequate. Wheat acres were also expected to decline for the same reason, wet weather. USDA report last week on plantings held no food for the supply bears. U.S. corn planting will reach a near record, second highest since 1944. Wheat acreage planted also appears to be up. The supply bears snarled in revulsion, and prices for corn and wheat promptly plunged.

As highlighted by the rectangle in the wheat price chart, wheat price broke down decisively from the price range in which had been trading. The US$8 support level now seems to be a resistance level for wheat prices. Likewise, corn broke the US$7 support level, turning that price into what looks like a resistance level.

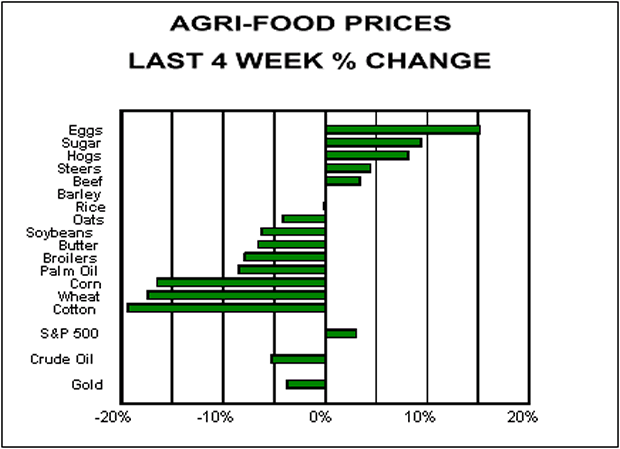

Chart above portrays the percentage change of prices for major Agri-Food commodities over the previous month. Only sources of real strength have been in the meats. Eggs are in a seasonal upswing while sugar is again having a problem with the Brazilian crop. Note corn and wheat.

What might all this mean for Agri-Investments? First tier Agri-Equities, the large, multinational companies, are likely to continue correcting through the end of Summer. Relative growth in the Asian Agri-Equities should continue to move in a more positive manner. Given the recent crescendo of negative psychology on the Asian Agri-Equities and positive fundamentals, that group of stocks likely saw their bottom in June. Given that few economic sectors have the structural advantages of Agri-Foods over the next decade, investors should spend the Summer learning why hog prices are at a high and for what reasons rice could be the price surprise of the coming year.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.