Technically Speaking, U.S. Dollar Flirts With Trendline Support

Currencies / US Dollar Jul 05, 2011 - 01:28 AM GMTBy: Joseph_Russo

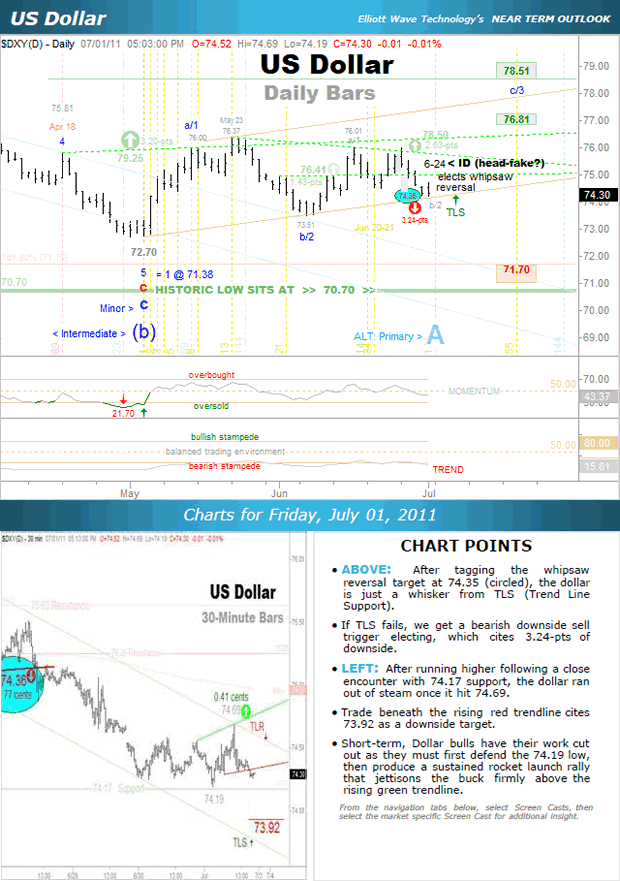

After tagging a short-term downside whipsaw reversal target of 74.35 last Thursday, the US Dollar is just a whisker away from (TLS) trendline support on the daily bar chart.

After tagging a short-term downside whipsaw reversal target of 74.35 last Thursday, the US Dollar is just a whisker away from (TLS) trendline support on the daily bar chart.

Near-term, if daily TLS fails, it elects a bearish downside sell trigger upon breach of this nearby support trajectory. From such a breach, we're looking at a downside risk potential in excess of 3-pts.

Short-term, Dollar bulls have their work cut out as they must first defend horizontal support at 74.19 then run price back up well north of the recent pivot high at 74.69. If they fail, 73.92 is the nearest downside price target vs. that pivot.

Technically Speaking Video

I trust and hope that you have extracted something of actionable value from this syndicated distribution of Technically Speaking.

Until next time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.