College Graduates: Too Many in China, Not Enough in America?

Economics / Education Jul 04, 2011 - 12:20 PM GMTBy: EconMatters

"They share every similarity with ants. They live in colonies in cramped areas. They're intelligent and hardworking, yet anonymous and underpaid." ~ Lian Si, Author of “Ant Tribe”

"They share every similarity with ants. They live in colonies in cramped areas. They're intelligent and hardworking, yet anonymous and underpaid." ~ Lian Si, Author of “Ant Tribe”

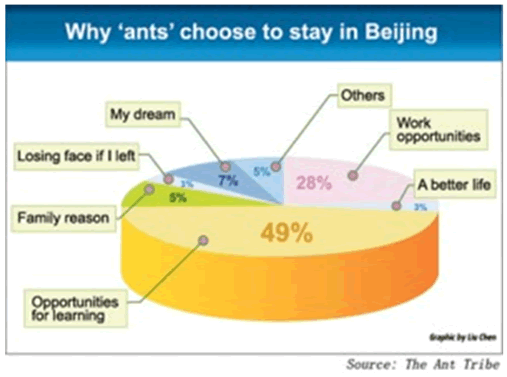

"Ant Tribes" (蟻族), a term coined by sociologist Lian Si, a professor who wrote a book with that title in 2009, broadly describes China’s post-80s generation of "low-income college graduates who live together in communities with poor living standards.”

These youngsters in China are well educated, many with science, engineering and finance degrees. From China Daily:

“A survey in [Lian Si’s sequel] “Ant Tribe II” found nearly 30% of "ants" are graduates of prestigious universities - almost triple last year's proportion. Most had degrees in popular majors, such as medicine, engineering, economics and management….In addition, 7.2% of "ants" have at least a master's degree compared to 1.6% in 2009. An "ant's" average monthly salary is 1,904 yuan ($286), with about 64% of them earning fewer than 2,000 yuan a month.”

There are more than 1 million "ants" living in China's big cities, about 46% spend more than they earn, and 80% have no savings, according to another survey in the 2010 Annual Report on the Development of Chinese Talent, released by the Social Sciences Academic Press in June.

China - 10% Jobless Rate Among College Grads

In June, Xinhua reported that the employment rate of college graduates in China was 89.6% in 2010, about 2% higher than that in 2007, according to a survey by education research company MyCOS Institute.

Separately, China Daily reported that the employment rate among college graduates in 2010 increased by 4.2% year-on-year with 72.2%, or 4.56 million of all graduates in 2010 found jobs as of July 1 last year, based on statistics released by the Ministry of Education.

That suggests around 30%, or 1.76 million, of new college grads in China can't find a job, while the unemployment rate for college graduates is around 10%, which is much higher than the 4.1% average urban jobless rate in China.

And it’s only going to get worse.

China - 7 Million New Grads A Year

The Ministry of Human Resources and Social Security indicated that China will have about 6.6 million college graduates in 2011, vs. 6.3 million in 2010, and acknowledge that the employment situation facing them will be tough.

What’s compounding the issue of the sheer number college graduates en masse is the fact that many graduates' expectations for jobs do not match market demands, according to a statement from a State Council meeting on May 25.

China’s Problem – Oversupplied & Mismatched

Indeed, China is the largest developing country in the world far from being fully industrialized, and lacks the necessary infrastructure to properly place these highly educated young people.

The nation owes much of its GDP (and therefore new jobs) to the manufacturing, industrial, and exporting sector, which mostly have more openings for blue collar workers instead of white collar jobs. There are simply more of them than jobs that they are qualified for, and the lack of affordable housing also has contributed to the “Ant Tribes” formation.

Furthermore, due to the imbalance of social and economic development between urban and rural areas, ‘’Ant Tribes’ are clustered around major coastal regions like Beijing, Shanghai and Guangzhou, whereas rural areas, especially in the western regions, where work environment can be difficult, have a much higher demand for college graduates.

U.S. – 20 Million More College Grads by 2025?

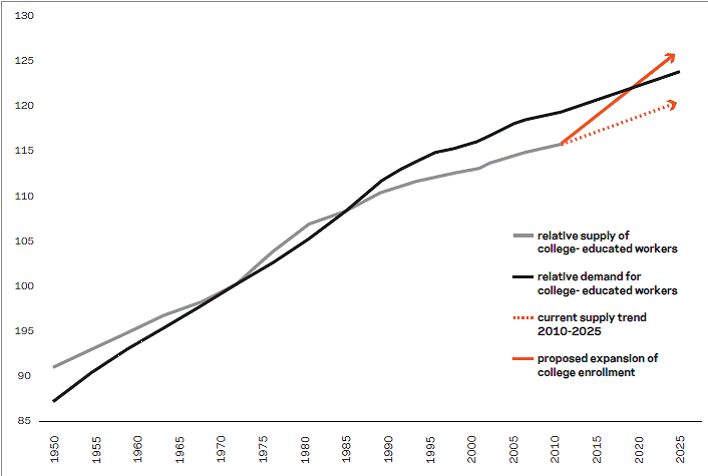

While China seems to have an over-supply of college grads, the United States, on the other hand, is not producing enough college-educated workers to meet economic needs and reduce income inequality, at least according to a new study --“The Undereducated American”--released by Georgetown University Center on Education in June.

The study finds that currently, the number of college-education Americans is growing by just 1% a year, and the nation has been producing too few college-educated workers for more than three decades (See Chart).

If the U.S. is to make up for lost ground and respond to future economic requirements, the report says the rate of new educated workers needs to go up 2.6% a year, adding 20 million college-educated workers, includes 15 million new Bachelor’s degree holders to the economy by 2025. That will boost GDP by $500 billion adding over $100 billion in additional tax revenues.

China – Economic Growth & Urbanization

In China, there’s a central belief of associating education with social and economic status which is ingrained in the Chinese culture dating back even before Confucius. That partly explains the current oversupply of college graduates and “Ant Tribes” as parents sacrifice almost everything just to put their kids through college in pursuit of a better future, and this is unlikely to change in the foreseeable future.

To absorb those graduates, China would have to maintain around 7-8% annual GDP growth rate, diversify its economy into high tech, financial and services oriented, and make a philosophical change to the entire education system based on quality vs. quantity.

Judging from various projections, this growth rate most likely is sustainable; nevertheless, to fundamentally diversify and revamp the economic and educational structure could be an uphill battle and would take decades.

For now, the central government has indicated it will prioritize the creation of jobs for college grads, and aims to create work through loans, subsidies, policies. Ultimately, infrastructure and housing will be built in China, and “Ant Tribes” would eventually dissipate with the expected mass urbanization to take place in the next two to three decades.

China - Beware of Frustration & Revolution

In the medium term; however, since patience is not one of the virtues of the young, Ant Tribes and soon-to-be Ant Tribes are likely to become more and more frustrated. Historically, many riots and revolutions have started when young people (particularly in packs) become frustrated. There are reports of rioting already taking place in some “Ant Tribe” areas. This is probably a greater risk to the country’s stability before its economy could catch up with more suitable jobs.

U.S. – College Degree, But No College Job

In the U.S., the persistently high unemployment rate also presents new college grads with a similarly bleak job outlook as their peers in China.

In May 2011, NYT reported that both employment rates and starting salaries for new college graduates in the U.S. have fallen sharply in the last two years. In 2009, 22.4% of all college grads had no job, and only about half of the jobs landed by these new graduates even require a college degree (See Chart).

U.S. Boomer's Great Job Gap

Some expect the situation to reverse soon with the first baby boomer turning 65 on Jan. 1, 2011 as retiring boomers will leave a huge number of job vacancies. One study by Northeastern University projects that by 2018, there will be 14.6 million new nonfarm payroll jobs, but only be about 9.6 million workers available to fill those positions, leaving a gap of more than 5 million jobs.

U.S. - Skilled & Experienced Labor Shortage

However, the problem is new college grads most likely do not have the required skills, qualifications and experience to fill the job vacancies left by boomers. So I personally see a shortage of experienced and skilled labor, which does not necessarily mean a shortage of new college graduates.

Moreover, many boomers will likely work long past the expected retirement age partly to recoup the lost retirement savings during the Great Recession, which could delay the timeline of the "Great Job Gap".

From that perspective and given the economic outlook of the U.S., I believe there could also be a somewhat oversupply of college graduates, at least in the short-term, and a job and experience mismatch in the U.S., particularly in the experienced professional category, as companies act in haste coping with the Boomer's "Silver Tsunami", and sometimes end up replacing boomers with less qualified personnel.

U.S. - College Grads Employment & Pay Under Pressure

Currently, the unemployment rate among people with a bachelor degree or higher is at around 4.5% as of May, 2011, much lower than the U.S. national average of 9.1%. Overall, college graduates do enjoy higher earnings than their less-educated peers.

However, based on the current U.S. labor market condition, the employment and pay level in this demographic class would be under pressure in the next few years as new college graduates flood the market in a down cycle of the economy.

This labor and demographic shift could pose a long term risk to the U.S. as it could diminish the country's overall competitiveness.

Managing Demographic Dynamics

Needless to say, the college graduate cohorts present two similar yet distinctive demographic and economic puzzles to the top two economies in the world.

Both countries have some systematic supply/demand mismatch between geography, job openings, education level and skill set, which, if not properly managed, could turn out to be a much greater risk than most people realize.

Meanwhile, in the short to medium term, some U.S. companies will still continue to move operations (and jobs) to China to be close to customers and to take advantage of the large skilled labor pool with relatively lower pay scale. But at the same time, there would also be more Chinese companies expanding into the U.S. region bringing new jobs as China's private business sectors become more mature and sophisticated.

Long term, it is up to Washington and Beijing to properly set policies to incentivize businesses, education and social systems, given each country's makeup of the workforce, to have enough resource and job growth in place to match the future direction of their demographic dynamics.

Otherwise, we could see Ant Tribes--The American Style, and/or a Xinhai Revolution 2.0 (辛亥革命) in China in the not too distant future.

Further Reading - 90 Years of Communist China

Disclosure - No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.