Stock Market Flashing A Buy Signal

Stock-Markets / Stock Markets 2011 Jul 04, 2011 - 04:40 AM GMTBy: Chris_Vermeulen

I hope you fellow Canadians had a great Canada Day long weekend and Happy Independence Day to those south of the boarder!

I hope you fellow Canadians had a great Canada Day long weekend and Happy Independence Day to those south of the boarder!

A couple weeks back on June 19th I posted my analysis on how the stock market was bottoming and that we needed a couple key sectors to participate before we would get a solid bounce. You can quickly review the charts here if you like: http://www.thegoldandoilguy.com/....

Today’s report plays directly off the June 19th analysis showing you the price movement from then on.

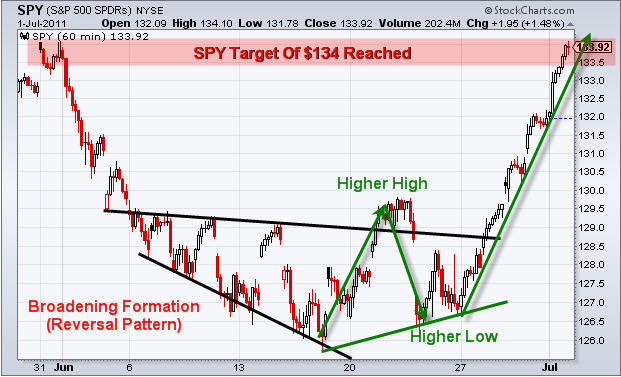

SP500 – SPY ETF Daily Chart

As you can see during early June the market became volatile with a broadening formation. This type of price action is an early warning that a trend reversal is near. It was only two days later when we saw stocks make a new high, which is the first ingredient for a trend reversal to take place. But once a higher high was made sellers quickly jumped back into the market pulling price back down. Keep in mind the higher high which was made was another early sign that a trend reversal was likely to happen.

During this time I was watching the charts like a hawk keeping a close eye on the time and sales window which I have filtered to show me only orders with a market value of $3million dollar or larger. This helps me keep a close eye on what the big money players are doing... Following their coat tails if done correctly will help keep you out of the market at times and also gets you in before the masses jump on the wagon.

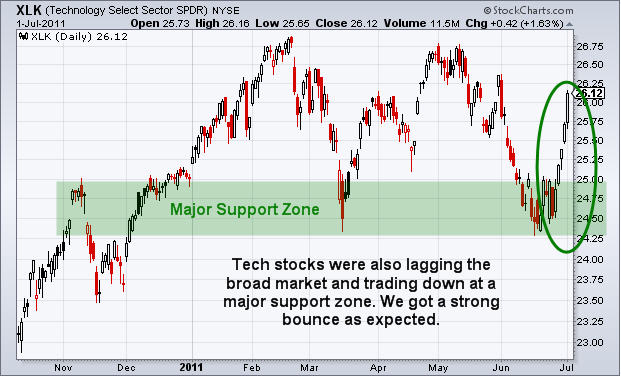

The two key sectors I talked about on June 19th were the Financials and Tech. Both these sectors must move up if we are to get a decent bounce/rally in the market.

Financial Sector Daily Chart:

By zooming out on the daily chart we can see in terms of both price and volume that the financial sector was at a major support level. Also it had just fallen sharply for more than a week making it oversold and ready for a bounce.

Only a couple days later financial stocks rocketed 11% higher as expected and the broad market (SP500) posted some decent gains for us also.

Let’s take a look at the financial sector:

The tech sector was in the same boat as the financials above… Tech stocks jumped an average 6%.

Weekend Trading Conclusion:

In short, I feel the market has shown us some decent upward momentum and everything is now at the point where a pause is likely. I expect some type of pause or pullback in the coming week and then the market has a major decision to make. Will it continue and start a new leg higher or roll over and die… That’s the next key question/action about to take shape and I will help guide you through these times each day with my pre-market morning video analysis.

Get my Daily Pre-Market Trend Trading Videos, intraday updates and weekly market reports for at a sharp discount for July 4th only: http://www.thegoldandoilguy.com/4julyspecial.php

If you would like to get more of my daily analysis to join my newsletter at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.