Gold and Silver Investors, Don't Underestimate The Chinese

Commodities / Gold and Silver 2011 Jul 02, 2011 - 03:46 AM GMT Premier Wen Jiabao has just completed a tour of Europe. When you listen to the media, they will inform you of the benefits to the countries visited, but there is another agenda that is not highlighted. Look at what is happening in China -- gold markets and the activities of the central bank in that market -- and a very clear picture emerges of what is likely to happen with gold as China moves towards its prime objectives.

Premier Wen Jiabao has just completed a tour of Europe. When you listen to the media, they will inform you of the benefits to the countries visited, but there is another agenda that is not highlighted. Look at what is happening in China -- gold markets and the activities of the central bank in that market -- and a very clear picture emerges of what is likely to happen with gold as China moves towards its prime objectives.

Do not be misled. China has only China's interests at heart. Any benefits gained by other countries in this process are purely designed to serve China's interests in the long run. In fairness to China, it is following a path that would be followed by any government if it was in the same position of power. China appears to have, at this point in time, no ambitions outside China other than those that would support China's development.

So what are the developments that could affect gold and silver?

China's Growth

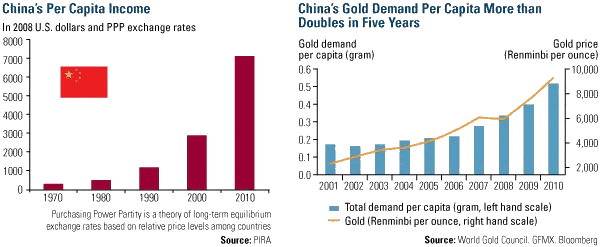

Over the last 15 years China has been developing at an incredible rate. It has succeeded in turning itself from a economically, relatively-insignificant nation, into the world's second largest economy in the world. It exports to the whole world, has a growth rate that averages 10% over that period, and has a population of 1.3 million people - all of whom are hard-working, obedient and fairly well-educated people in the world. Its population is four times the size of the U.S.; it's middle class, the size of the entire, U.S. population.

It has become a formidable economic force at a time when military power, as a force that decides global positions has waned to the point where financial power is a greater force. And it has only just begun to walk down this road. The downside for the Chinese government is that it needs to get around two-thirds of those people into city-based employment with the remaining third of the population earning enough to stop them from becoming a source of social unrest. This is to keep its reins on power, and China will do whatever is necessary to achieve this.

Chinese Financial Imperialism

To make sure that China keeps on this helter-skelter race to full development, China has to suck in vast natural resources. It has to secure these through contracts, loans and the export of its people to make sure the flow of resources goes unabated. The different types of governments of the countries in which they are investing, is of no concern to them. It is their policy, and they are succeeding. For example, they invested around $5 billion in the Congo, which will go into railways and roads designed to facilitate the export of minerals from this very mineral-rich country. Should the Congo default on their loans -- which is almost a given -- the Chinese will accept the rights to mine and export the minerals to China.

The current foreign exchange reserves of $3 trillion (and growing) are the treasure chest that is making this possible. But more than the simple sourcing of resources, China is doing everything in its power to keep its markets in good enough condition to receive its exports. Premier Wen Jiabao's tour of Europe came with announcements of support for Europe, buying Hungarian bonds (it bought Spanish bonds earlier). They may even step in to assist in a wider Eurozone crisis soon. After all, the markets of the developed world bought all those Chinese goods that kick started the growth of China. They will keep doing this for decades to come as well, so China must assist in keeping them in good order.

The neat feature of financial imperialism is that it appears to bring immediate benefits with cheaper goods to the people of the developed world, who are seeing their spending power reduced daily as inflation rises. Obtusely, every time Europe or the States stimulates their economies (and consumers) the first to benefit is China because European and Chinese shoppers go for the cheaper goods from China. So China's growth is set to continue well past 2020, by which time its economy will dwarf that of both Europe and the States. This is where their view on gold and currencies suddenly becomes more than pertinent!

China in the Currency Markets

Being one of the largest economies in the world, China must use the advantages that come with this status. One of the most important is the benefits of having a global reserve currency. We have seen the U.S. use this to extraordinary advantage over the last 60 years, and China, no doubt, will do this too.

For the last three years China has fast-tracked the development of its banking industry and capital markets. Slowly, the Renimbi (Yuan) has become more widely used on the borders of China and has seen its European 'door', Hong Kong, develop Yuan-capital markets. International trade is increasingly being done in the Yuan. Oil and Gas will be bought from Russia in the Yuan and the Rouble in the future.

But the vital part of these developments is rather like the launch of a Hollywood movie. A movie will be screened first. If the screening is successful there, then it is launched across America, et al.

The Chinese banks have succeeded in several launches of Yuan bonds. More global customers are dealing in the Yuan and soon the Yuan will be ready for its global launch. Part of Wen Jiabao's tour of Europe has been to promote the globalization of the Yuan. So we are now at the marketing stage of the arrival of the Yuan on the world scene. If successful (and there is no reason it should not be) then we will see a huge acceleration in the use of the Yuan in both commercial transactions, first, followed by capital transactions, second.

The global public must be able to easily access the Yuan before this can happen. The Chinese and global banks are, we believe, in the process of gearing up for this event. Once ready, its arrival will be all-encompassing. The accelerant to speed up the process will be either the option to pay, or be paid, in Yuan followed by the pricing of goods solely in the Yuan, forcing buyers of Chinese goods to buy Yuan first - just as one has to buy the U.S. dollar to buy oil, at present.

The realignment of central bank foreign exchange reserves will be orderly but eventually show a marked decline in the use of the U.S. dollar as a global reserve currency. Most countries will feel considerably less secure than they do at present with the simple, single global reserve currency of the dollar (i.e. Pax Americana) which will have been changed to a shared financial power base.

With such ideological and cultural differences between the two nations - nations with completely diverse political interests -- the element of financial uncertainty will increase. This will favor a 'currency-counter' asset in all central bank reserves. This is where precious metals hasten to the world stage.

China and the World's Gold Markets

Mao Tse Tung banned Chinese ownership of gold back in the fifties and only in 2005 have they been able to own it as individuals. In the second quarter of 2009 China's gold reserves jumped from 600 tonnes of gold to 1,054.1 tonnes. Since then there has been silence on China's central banks reserves. But China uses an intermediate semi-government agency to purchase its gold. They in turn hand over that gold once every few years to the People's Bank of China (it was seven years prior to that that they increased their reserves).

We will have to wait until the Chinese are ready to report their reserves before we know how much the central bank's is buying. To us, it appears that the 454.1 tonnes of gold bought by China from 2002 to 2009 could have been the entire local production. Local production has risen to 340 tonnes per years and may well rise to 700 tonnes in the next few years. If the Chinese are buying local gold for their central bank reserves, then taking this growing production since 2009 until 2014 may see the figure of 2,000 tonnes added to the People's Bank of China's gold holdings. This would raise the total to 3,000 tonnes.

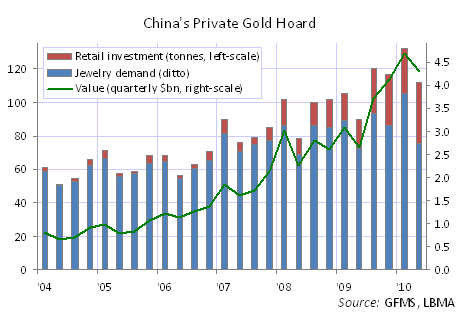

The Chinese government has licensed many local and foreign banks to import gold from outside of China. Imported gold exclusively supplies the local Chinese retail market. This tonnage is moving over 350 tonnes per annum at the moment. It should accelerate faster than local production does in the next few years.

The Chinese government is actively encouraging this demand. In the first quarter of this year, China overtook India to become the largest market for private gold sales...

From January to March, Chinese consumers and investors bought 93.5 tonnes of gold in the form of coins, bars and medallions. This was more than double the amount of last year over the same period. It was a 55% jump from the previous quarter.

China overtaking India as the largest buyer of gold products on an annual basis is just a matter of time. The average gold holding in China is only one fourth of the global level, and China's per capita individual income is much higher than India's. The growth of local retail demand should move in line with the growth of the Chinese middle classes. Expect this growth to continue in the years ahead at a minimum of 20% from this year onwards.

It is likely that growth will far outrun even the most optimistic projections.

It is also possible that China will buy foreign gold mines and import the gold from those mines to its reserves or retail markets. It may attempt, at least, to buy gold direct from producing nation's central banks. Local gold production is bought by the central bank and paid for in local currency. The central bank sells it on the international market for dollars and imports it direct into central bank reserves too.

The Chinese government has made it clear that it wants gold to be bought and held inside China in both reserves and in its citizen's hands in the foreseeable future.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2011 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazin![]() es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.