Gold and Silver Long Range Arc Points Upward

Commodities / Gold and Silver 2011 Jun 30, 2011 - 02:00 PM GMTBy: Jeb_Handwerger

One of the functions of Gold Stock Trades is to help subscribers separate the daily chaff from the long term view of the economic grain. The markets will do what they have always done, which is to confuse, misdirect and obfuscate.

One of the functions of Gold Stock Trades is to help subscribers separate the daily chaff from the long term view of the economic grain. The markets will do what they have always done, which is to confuse, misdirect and obfuscate.

It is important for investors to stay on target and not be swayed by skewed media reports and questionable economic data, which often serve to mislead us as we go through the investment jungle.

The long range arc of gold (GLD), silver (SLV) and miners (GDX) universe moves on a labyrinthian path, however it must be remembered that the path ascends upward over time. As precious metal investors, we must view temporary corrections through the perspective of an eagle's eye surveying the economic landscape. We see a chaotic game-plan unfolding below the headlines.

At times like this we must avoid such turbulent winds that only serves to divert our course. Precious metals will remain the true compass to guide us on the path toward investment profits.

Our leaders are charting a different course. President Obama's reelection campaign is already on the road towards 2012. The current administration is embarking with an increasing concentration on its own interests. This was highlighted by his selfish move to release 30 million barrels of emergency reserve oil (OIL). This oil is supposed to be used for emergencies, not votes. Why did it come right as QE2 ends? Is this a stimulus in whatever disguise necessary?

We are admonished by the politicians that unless the national debt ceiling is raised quickly and unconditionally, the nation would be adversely affected. Standard & Poor's threatened that if the U.S. government fails to raise its borrowing limits, that they would give the lowest credit rating possible forcing interest rates to soar and causing a deflationary nightmare. The U.S. has until August 2nd to increase its debt limit. Since 1960 they have raised it over sixty times. Spending, entitlements and deficits will increase and the long term upward trend in gold and silver should proceed.

Gold Stock Trades believes that this trend of raising debt limits will continue. Its an election year and politicians jobs are at stake. The last thing they want is default. A lower credit rating would cause borrowing costs to skyrocket, which would cripple the U.S. to pay back its soaring debts. Do not forget that the U.S. is the world's biggest spender. This is the third year that the deficit has exceeded a trillion dollars.

The opposition to such threats is supine and voiceless. The Republicans are accused of "brinksmanship" and plunging us into a fiscal abyss. Instead of viewing this as a major lever in obtaining important concessions from our leaders, only the "voice of the turtle" is heard through the land. Consequently, the U.S. national direction heads toward a European kind of centralized government, which the current administration hopes to effect once they are reelected.

As precious metal investors we observe a different vista. We sense that the "Summer Goldrums" is creating a base right here in precious metals. It is a short term pullback in a secular uptrend.

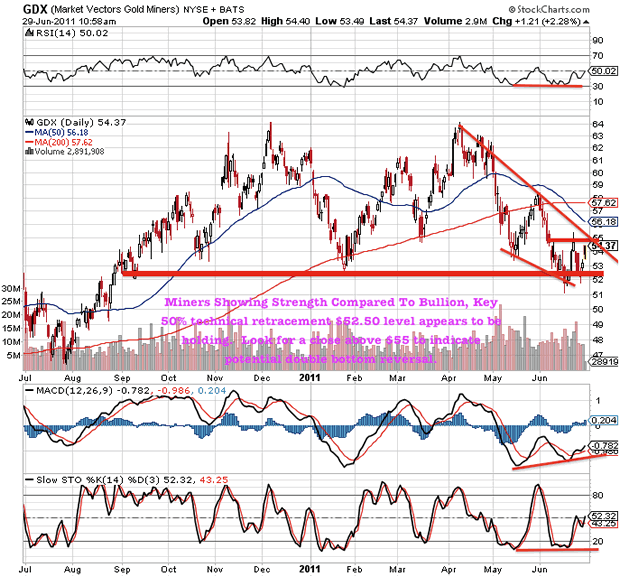

Mining stocks may be affording us with a pivotal turning point from which a profitable new rise may emerge. Miners (GDX) have currently tested the key $52.50 level successfully, the 2011 low on low volume indicating a lack of buying rather than aggressive selling.

We are keeping an eagle eye on what may be a good reentry point for the commitment of new funds. Gold Stock Trades reiterates our conviction in the long term upward trend of the mining stocks and precious metals. Gold maintains its strong uptrend evident on long term charts and many who have been calling a finale, will realize that this period is just an intermission. Follow my daily intelligence and potential turning points for free by clicking here.

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.