Goldman Sucks, Risk Trade Returns

Stock-Markets / Financial Markets 2011 Jun 29, 2011 - 05:38 AM GMTBy: Adam_Brochert

The "risk on" trade seems to have returned. It may last 2 weeks or it may last 8, potentially even a few more. It may even be good for a new high in "advanced" Western markets like the United States. Everyone knows Greece is going to blow up, along with lots of other countries.

The "risk on" trade seems to have returned. It may last 2 weeks or it may last 8, potentially even a few more. It may even be good for a new high in "advanced" Western markets like the United States. Everyone knows Greece is going to blow up, along with lots of other countries.

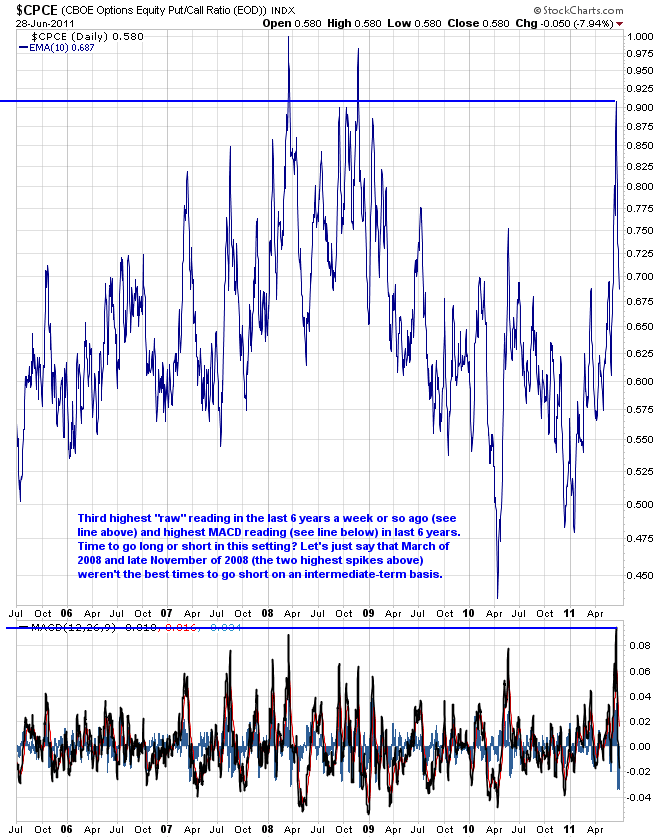

That doesn't mean the market is going to crash tomorrow, since this information is already well known and was likely partly behind the massive spike in the equity put-to-call ratios seen a few weeks back (chart below shows only the exponential 10 day moving average in this ratio over the past 4 years to get rid of the "noisiness" of the daily data):

Now, having shown this chart for the second time and having previously warned against being bearish based on this data, I understand people who are feeling bearish. The whole global economy is being held together only by unprecedented government guarantees/interference and massive currency debasement. It is sad, really. And it isn't right when viewed from the perspective of conservative savers and the future generations that will have to deal with the chaos that is sure to result from the ridiculous decisions being made on "our" behalf by those who clearly either don't have a clue and/or are selling out their countries for their own personal interest.

Speaking of such biased parties, Goldman Sucks (i.e. Goldman Sachs) has certainly become a magnet for the current populist rage, particularly in the United States. I can't say I have any sympathy for this firm. The fact of the matter is that this corporation has been pulling the same scams for decades, but few notice or care when times are good. As the social mood continues to deteriorate with the economy, let's just say the partners at Goldman Sucks would be wise to keep a much lower profile.

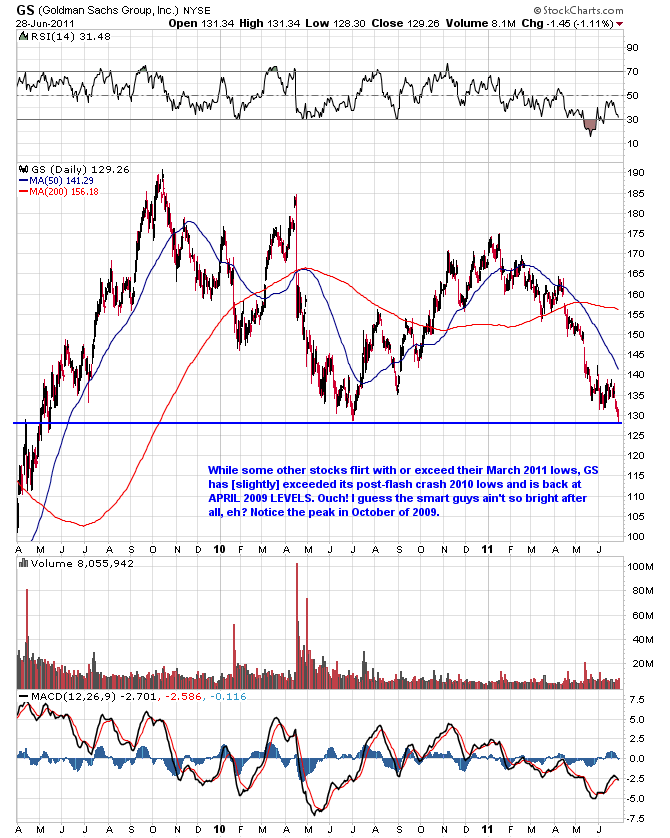

But the chart of this firm, which of course only exists due to the generosity of the government, doesn't look healthy. The "smartest guys in the room" apparently didn't see the Great Fall Panic coming at all, since they were thoroughly bankrupted and needed a helping of government teat milk to stay solvent. Those of us out here trading in the real world that made a fortune shorting firms like Goldman Sucks and JP Whore-gan in the teeth of the late 2008 storm despite government bans on shorting these "important" corporations know that the piper still hasn't been paid.

Financials remains the weak link and they have been lagging for a while. The current chart of the poster child of government largesse (i.e. Goldman, ticker: GS) makes me think they are going to need another bailout sooner or later. Apparently, they haven't had enough time to detoxify their balance sheet despite all the money they were given and the time they have had to sell their toxic crap to Uncle Sam and the so-called federal reserve (not federal and they have no reserves, so Orwell would be proud, much like with the so called patriot act - but I digress).

Here's a chart of Goldman Sucks over the past 27 months to show you what I mean:

Living proof that fascism (i.e. corporatism for those that don't like harsh terms to describe our "modern" world) doesn't work. But all needling of Goldman aside, it is not a good sign for common stocks in the U.S. when Goldman can't do well. Our so-called "FIRE" (i.e. finance, insurance, real estate) economy needs the financial sector to do well until we figure out a way to re-tool our economy. And trust me, though the situation may get darkest before the dawn, the U.S. could potentially have a massive economic renaissance after all the bad debt gets liquidated, but only if we can figure out a way to massively slash the size and scope of our government and their corporate parasites/ticks.

In any case, such weakness in the financials is why I am currently bullish on the short to intermediate term in risk assets but am still bearish on the longer term. I think Gold and silver bottomed yesterday for this shorter-term time frame but I don't see a massive rally taking place right now. I still like the idea of a triangle correction in Gold over the summer before a fall rally once governments realize it's fraudulent money printing or Armageddon part 2 in the financial markets. Austerity in Greece will work as well as fur coats in the desert during a heat wave.

Please keep in mind that Goldman is due for a bounce higher from current levels, so I wouldn't be shorting them right now. The character of the bounce in GS may or may not suggest a good opportunity in the future, but I would be careful shorting "important" (i.e. those with lots of government bribe money) financial firms in the U.S. given the previous bans on shorting connected financial corporations in 2008. I think there will be better and safer opportunities out there.

Watch the apparatchiks cave later this summer and watch the currency of kings respond when this happens the way you would expect - with a massive rally in the Gold price in all major currencies despite any and all attempts to stop it. In truth, things are someday soon going to get desperate enough that central bankstaz are going to start praying for and encouraging a higher Gold price. Hold your Gold outside the banking system until the Dow to Gold ratio hits 2 (and we may get below 1 this cycle) and if you're crazy enough to attempt trading in this environment, consider subscribing to my low-cost trading service.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.