Greece Debt Crisis Long-term Solution E.U. Unification Under One Leader?

Economics / Euro-Zone Jun 25, 2011 - 03:11 PM GMTBy: James_Loong

As Papandreou, Greek PM, plans to put together another austerity package worth more than €6.5 billion ($9.3 billion) by the end of the month, the protesters outside the parliament building, unwilling to accept the prime minister’s course of action, shouted: “Thieves, traitors. What happened to our money?”

As Papandreou, Greek PM, plans to put together another austerity package worth more than €6.5 billion ($9.3 billion) by the end of the month, the protesters outside the parliament building, unwilling to accept the prime minister’s course of action, shouted: “Thieves, traitors. What happened to our money?”

Euro zone members on Monday gave the green light to a permanent system to prop up ailing euro-zone economies after 2013. The new measure will take effect in mid-2013, replacing the current temporary bailout fund. The approved fund, called the Europe Stability Mechanism (ESM), will total some €500 billion ($713 billion). It was initially approved at an EU summit in March this year. Jean-Claude Juncker, euro-group head, said the decision reflected the bloc’s determination to shore up the currency’s stability. The euro-bloc countries will, according to the plan, guarantee more than €620 billion and member states will pay €80 billion directly. Of that, Germany must pay almost €22 billion, payable in five annual installments of €4.3 billion starting in 2013.

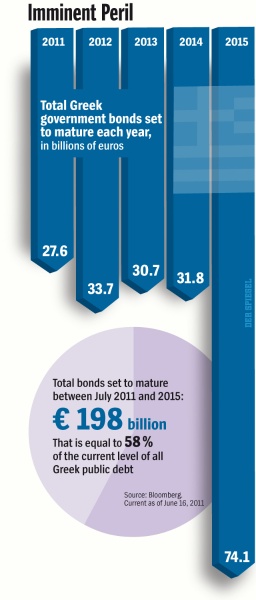

A quick check on the Greek maturing debt schedule shows that nearly 200 bn euros need to be returned till 2015 with more than 74 bn of them be paid in the last year. And yet this only accounts for 58% of the overall leverage in the Greece economy.

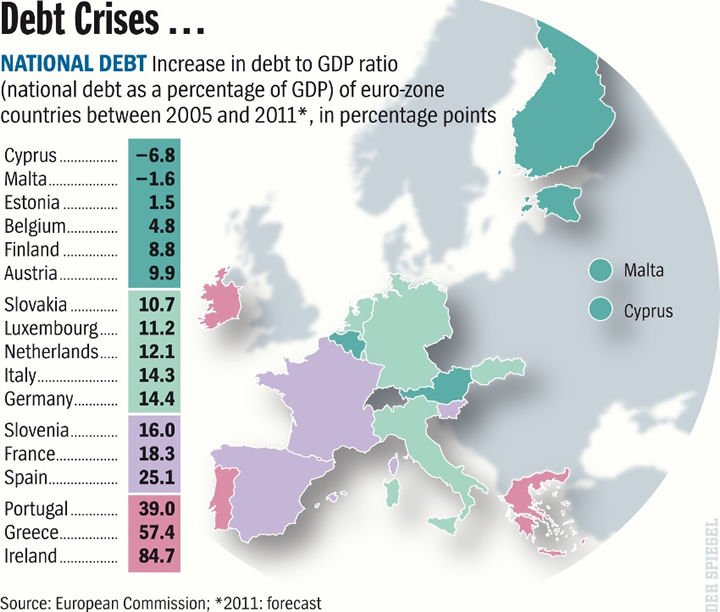

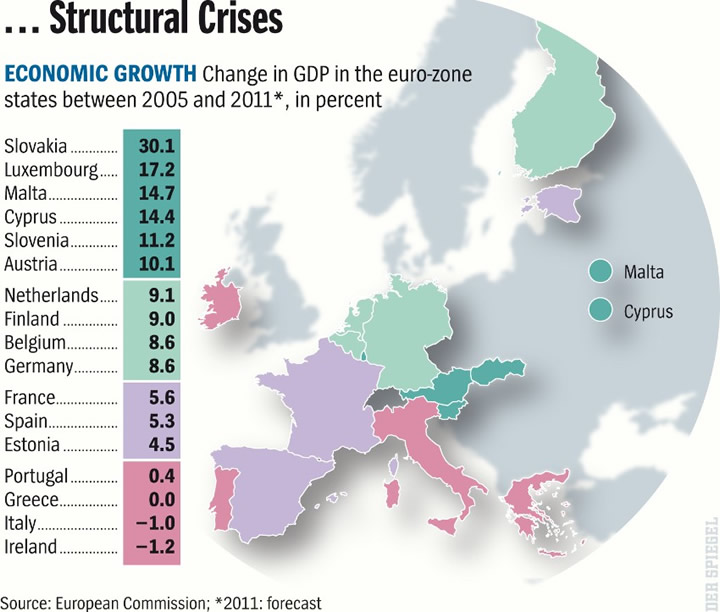

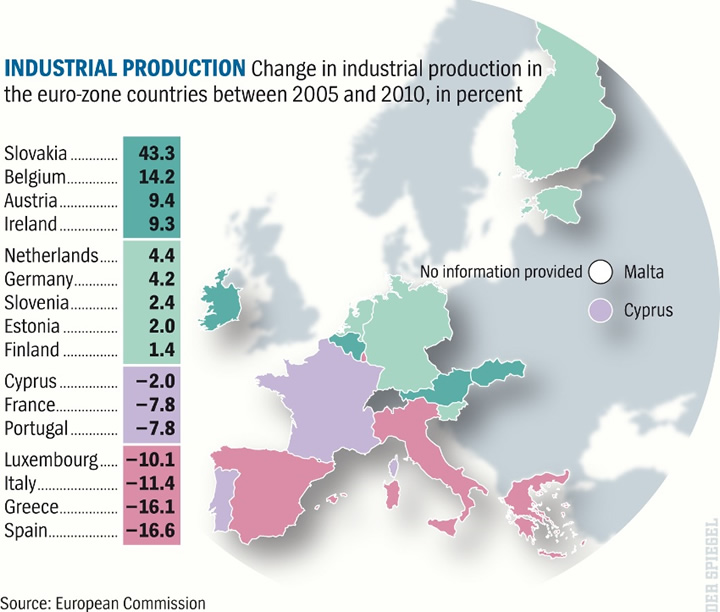

Greece and Ireland has seen 57% and 85% increase in its Debt/GDP ratio while even frugal Germany has seen its debt increasing to its GDP by 14%. The Greece crisis has been spurred not just by Debt but also by a contracting GDP which has worsened the situation. Greece Industrial production has fallen 16% between 2005-2010 as noted below, a period during which China and India grew 8% and 9% CAGR growth.

Greece economy simply stagnated while it accumulated debt. The question to ask is what was Moody and Fitch doing while debt was being loaded? How did Greece maintain its AAA rating all through 2008,2009.

And no wonder German banks have reduced their exposure to Greece bonds. Since the beginning of 2010, they have reduced their total exposure from €34.8 billion to €17.3 billion, not including debt held by the state-owned development bank KfW. Insurance companies have reduced their investment in Greek bonds from €5.8 billion to only €2.8 billion in the last year.

In Germany, it is state-owned banks who have the greatest exposure to Greek debt. Commerzbank, a quarter of which is owned by the federal government, holds €2.9 billion in Greek bonds. The state-owned regional banks known as Landesbanken and their so-called bad banks hold additional risks of more than €4 billion.

On May 2, the euro countries and the International Monetary Fund (IMF) approved a €110 billion bailout package for the beleaguered country. Although the German portion of the loans was coming from the government-owned development bank KfW and not the budget, the federal government still served as guarantor. Every euro the Greeks do not repay will constitute a burden on the German taxpayer.

The Greece story from 2010 has been one of lost opportunity and lapses. The Greece story has completely exposed the loosely knit EU framework based on monetary union rather than regulatory frameworks based on political union. Greece was the first lapse for EU, the first violation of the European treaties, which categorically rule out aid payments to needy euro countries. This so-called no-bailout clause was intended to guarantee that the monetary union didn’t become a transfer union, and that the strong wouldn’t have to pay for the weak. It was crucial to the acceptance of the treaty by the national parliaments; without it the German parliament, the Bundestag, would not have agreed to the monetary union.

The second lapse occurred soon afterwards. On May 9, 2010, the first euro bailout fund was launched. Although the volume of €440 billion alone made it clear that the opposite was the case, Merkel and Finance Minister Wolfgang Schäuble tried to downplay the importance of the European Financial Stability Fund (EFSF). They insisted that the fund was purely a precaution, would not be used and, most of all, was temporary.

“An extension of the current bailout funds will not happen on Germany’s watch,” Merkel said in Brussels on Sept. 16, 2010. This promise, too, lasted only a few months. On March 25, 2011, the leaders of the euro zone approved a new, constant crisis mechanism. Although it has a different name, the European Stability Mechanism (ESM), it will function on the basis of the same principle as its predecessor fund, the EFSF, beginning in mid-2013. The euro countries want to pry loose €700 billion for the fund, which will include a cash contribution for the first time. The Germans will be asked to pay at least €22 billion. To do so, Germany would have to take on additional debt.

Since May 2010, the ECB has spent €75 billion purchasing government bonds from ailing euro countries. Its goal was to bring calm to the markets and prevent the risk premiums for the bonds from skyrocketing. But many used the opportunity to unload the risky securities on the central bank. The ECB is believed to have spent €40-50 billion to date on Greek government bonds. In addition, as of the end of April it had refinanced Greek banks to the tune of €90 billion.

Will Greece lead to Euro Bonds

If nothing else works, ECB will simply have to be offered bonds that satisfy its requirements. A 10-member “Greece Task Force” at the German Finance Ministry has worked out how this could function. The experts propose that the Greek government, in addition to the €90 billion-€120 billion in fresh cash it may receive from the euro-zone countries and the IMF as part of a second bailout, also be given access to bonds issued by the EFSF, the euro rescue fund. It could pass on these securities, which have the rating agencies’ highest rating of AAA, to Greek banks, which in turn could use them as collateral to obtain liquidity from the ECB.

The problem is that this measure would make the new bailout package significantly more expensive. To ensure that the EFSF had sufficient funds for the operation, its financial scope would have to be increased so that it could really make €440 billion available, as it was originally intended to do. To achieve this, the member states would have to double the scope of their respective guarantees. Germany, for example, would be liable for €246 billion in the future, instead of the current €123 billion.

The would-be euro rescuers are also considering accessing the so-called Hellenic Financial Stability Fund. This fund, set up as part of the first Greek bailout package in May 2010, contains €10 billion, which could be used to boost the capital of Greek banks in an emergency. The fund hasn’t been touched yet.

Long term solution: EU Unification under one leader?

Make no mistake: If Greece defaults, the story of EU is over! To prevent this from happening, many politicians specializing in financial and economic affairs recommend bringing about the political union of Europe as quickly as possible, a union with a strong central government. They argue that if the nations in the euro zone formed a closer union, they could coordinate their financial systems more effectively, thus providing the common currency with a political foundation.

This would make it easier to implement reforms in the recipient countries and improve their competitiveness. Just recently, ECB President Jean-Claude Trichet proposed installing a European finance ministry equipped with the right to intervene in the individual member states.

German Reunification: The role model?

But it isn’t quite that easy. More integration doesn’t necessarily mean that economic imbalances would disappear as a result. No one understands this better than the Germans, who had similar experiences with the monetary union between the two Germanys about 20 years ago. Effective July 1, 1990, the deutschmark became the official currency of East Germany. It was largely exchanged for the former East German mark at a ratio of one-to-one. The East German states joined the Federal Republic of Germany only three months later. It was the model case of a monetary union that was accompanied by a political union.

But anyone who believed that rapid unification would lessen the economic shock of the monetary union between the two Germanys was soon disappointed. In fact, the economic imbalances in reunified Germany became entrenched after that. Thousands of companies in the former East Germany went out of business, because they were unable to bring productivity up to Western standards.

The unemployment figures exploded, and financial transfers between the two parts of the country soon exceeded the trillion mark. To this day, the former East German states still lag behind the former West German states in terms of economic strength, productivity and income.

German reunification did nothing to change this. It merely helped to financially cushion the negative consequences of the monetary union. The states of the former East Germany were incorporated into the West German inter-state fiscal adjustment system (under which money is transferred from richer to poorer states) under favorable terms, and the former East Germans were suddenly given access to the blessings of the generous West German social system.

Such a model would in any case be incompatible with the European treaties. New agreements would have to be negotiated and ratified by all national parliaments, and perhaps even approved in referendums. It is a compromise or a necessity that EU will ultimately have to live with.

by James Loong

Editor: The GMB post

Bio: Worked with European Hedge fund for 7 years and now work on financial edition, The GMB post.

© 2011 Copyright James Loong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.