Chinese Gold Sales to Surge Two Fold and Gold May ‘Rocket’ if Debt Crisis Spreads

Commodities / Gold and Silver 2011 Jun 24, 2011 - 12:12 PM GMTBy: GoldCore

Gold is lower again today after yesterday’s 2% fall in U.S. dollar terms. Gold’s fall in euros yesterday was mild due to euro weakness. Gold is marginally higher in euros today as the euro remains weak on continuing concerns about the Greek and Eurozone debt crisis.

Gold is lower again today after yesterday’s 2% fall in U.S. dollar terms. Gold’s fall in euros yesterday was mild due to euro weakness. Gold is marginally higher in euros today as the euro remains weak on continuing concerns about the Greek and Eurozone debt crisis.

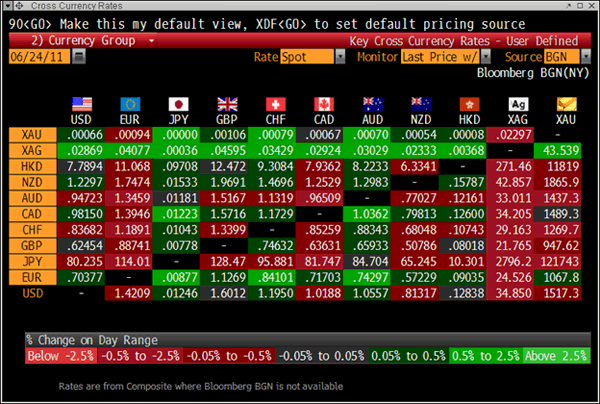

Cross Currency Rates

Irish 10 year government bond yields briefly rose over 12% today (see chart) - new euro era highs on concerns about weak economic growth in Ireland, contagion concerns and concerns as to whether European leaders will manage to save Greece, Portugal, Ireland and other periphery Euro zone countries from bankruptcy.

Ireland Government Bonds 10 Year Note Generic Bid Yield

Further confirmation of very robust demand from Asia and China in particular came from the China Daily overnight (see news).

Zhang Bingnan, secretary-general of the China Gold Association, said that the amount of gold individual buyers purchase as an investment is expected to surge two-fold annually.

Zhang said that the government's gold reserves are "far from enough", and should be increased to fend off global financial risks.

Industry expert Zhang said that, gold's luster is continuing to attract rising domestic demand. China will continue to "outperform" other countries in private consumption of the precious metal. He estimated sales growth would remain above 20% in the next two years.

Since the international financial crisis China has led growth in gold sales worldwide. According to the China Gold Association, domestic gold sales grew 21.26% to 571.51 tons last year from 2009. This looks likely to continue in the coming years as the "average holding of gold by individuals is still too small and the nation's rapid economic growth will further stimulate consumption and investment", Zhang said.

Since China deregulated its gold market in 2008 gold sales as a means of investment have surged, with an annual growth of 100% from 2007 to 2010, compared with 30 percent for the global investment market during that period. Sales can be divided into three categories: ornaments, such as necklaces, investment in gold coins and bars and industrial demand.

"Demand for gold, mostly driven by investment, will grow at least 20 percent this year," he said. "Enthusiasm for gold as an investment will get stronger, and domestic sales in this category will keep doubling in the next two years," Zhang said.

The unrealised important fact that the people of China were banned from owning gold bullion from 1950 (by Chairman Mao) to 2003, means that the per capita consumption of over 1.3 billion people is rising from a tiny base.

Many market participants and non gold and silver experts tend to focus on the daily fluctuations and “noise” of the market and not see the “big picture” major change in the fundamental supply and demand situation in the gold and silver bullion markets – particularly due to investment and central bank demand from China and the rest of an increasingly wealthy Asia.

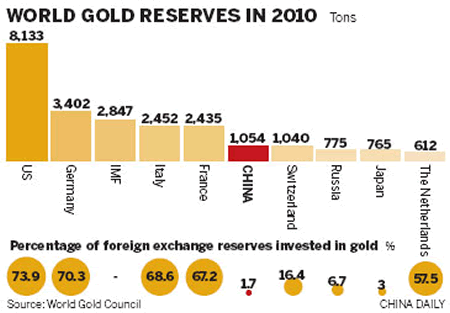

It is worth noting that the People’s Bank of China’s gold reserves are very small when compared to those of the U.S. and indebted European nations. They are miniscule when compared with China’s massive foreign exchange reserves of $3.1 trillion.

The People’s Bank of China is almost certainly continuing to quietly accumulate gold bullion reserves. As was the case previously, they will not announce their gold bullion purchases to the market in order to ensure they accumulate sizeable reserves at more competitive prices. They also do not wish to create a run on the dollar – thereby devaluing their sizeable reserves.

Barclays Capital: Gold Prices are Supported by Central Bank Purchases

Barclays Capital said in an e- mailed report that gold “offers the most supported gains in the near term.”

Bullion purchases by central banks this year are “adding another layer of support to prices,” the bank said.

“We have highlighted previously that despite the amount of gold that had been purchased by the official sector; the swing from sellers to buyers was a significant change given it reignited gold’s relevance as a monetary asset,” Barclays Capital said.

Gold

Gold is trading at $1,509.45/oz, €1,063.29/oz and £943.94oz.

Silver

Silver is trading at $34.87/oz, €24.56/oz and £21.81/oz.

Platinum Group Metals

Platinum is trading at $1,680.50oz, palladium at 733/oz and rhodium at $2,025/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.