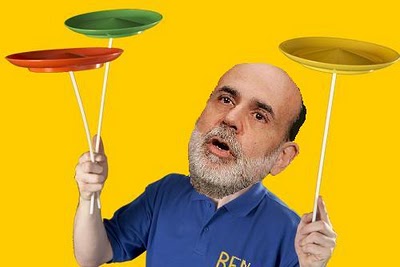

Bernanke, A Blinking Idiot and the Banking System

Stock-Markets / Financial Markets 2011 Jun 24, 2011 - 05:45 AM GMTBy: PhilStockWorld

Interview with Lee Adler of Wall Street Examiner

Interview with Lee Adler of Wall Street Examiner

Ilene: Lee, I've gathered from reading your material lately that you think it's time to be out of speculative trades, such as oil, now?

Lee: Yes, the Fed is serious about stopping speculation, and they are not waiting till the end of QE2. Bernanke wants to break the back of this thing. So if you want to trade the long side now, you’re playing with fire. The powers that be have put out the message that they won’t keep tolerating speculation in the oil and commodities markets.

Lee: Yes, the Fed is serious about stopping speculation, and they are not waiting till the end of QE2. Bernanke wants to break the back of this thing. So if you want to trade the long side now, you’re playing with fire. The powers that be have put out the message that they won’t keep tolerating speculation in the oil and commodities markets.

Ilene: Because of the inflation that Bernanke denies exists?

Lee: Yes, the inflation is disastrous. They’ve known all along that inflation is real. You know it when you’ve got this situation in Libya with people getting killed. It started with food riots in Tunisia, but then it morphed into something else. People are starving all over the world because of these commodity prices, and the idea that it is not affecting Americans is crap because 80% of the people are affected by gas prices at these levels. They have to cut back on other spending, and the top 10% can’t carry the ball. If you’re spending an extra $100 - $200 to fill up your car and put groceries on the table, that affects your ability to service your debts, and that affects the banking system. This inability to pay back loans is showing up in mortgage delinquencies and credits card delinquencies.

Ilene: You also have written that the Dollar and commodities have an inverse relationship, why is that?

Lee: Because commodities, such as oil, are traded in Dollars. Commodities are basically a cash substitute at this point. The players don’t want to hold Dollars because the Fed is trashing the Dollar. If you’re a trader outside the U.S., and your native currency is the yen, for example, and you want to buy oil or gold futures, you need to sell Dollars in exchange for the gold or oil futures contracts you’re buying. So your action of buying the commodities in Dollars is in effect creating a short position in the Dollar.

So if commodities collapse and you’re forced to sell your positions, you’ll reverse that short position in the Dollar - trading the commodities back for Dollars. That creates demand for the Dollar. That’s why commodities and the Dollar definitely do have an inverse relationship.

With the margin increases that were implemented in the last month or so, the Fed is beginning to reverse the commodities price run up. This is the precursor to the end of QE2. The Fed is sending warning shots across the bow. After the Jan 26 FOMC meeting, banks’ reserves began to skyrocket. Why did bank reserves suddenly skyrocket? There’s no overt reason. Something was going on behind the scenes. I think banks and Primary Dealers (PDs) got the back channel message that it’s time to start building reserves because they’re really going to end QE in June - they really, really are. I give it six weeks to two months since the whole thing collapses and they have to start printing money again.

Ilene: Why do commodities and the Dollar have a more persistent relationship than the Dollar and the stock market, for which there is an inverse relationship now, but this is not always the case?

Lee: The Dollar/stock market inverse relationship is a correlation due to a common cause - essentially the actions of the Fed. It’s not a cause and effect relationship.

Elliott: Will the Fed defend the Dollar?

Lee: They are starting to, but not officially. They’re doing it behind the scenes. That’s my theory. I’m a tinfoil hat guy.... I didn’t start out this way. I arrived at my tinfoil hat after paying careful attention to the data for 8 or 9 years. After a while I realized it’s kabuki theater.

Elliott: As you say it is kabuki theater, and as Phil says, we don’t care if the markets are rigged, we just need to know HOW the market is rigged so we can place our bets correctly.

Lee: Exactly. All you need to know is what the Fed is doing. That’s my bread and butter. I watch what the Fed is doing every day. I’m so familiar with the data that stuff jumps out and screams at me. The margin increases were not an accident. They were completely out of character, and they followed Bernanke’s press conference where he claimed he couldn’t stop speculation. He’s so manipulative. He says one thing and does another.

Elliott: But being Chairman of the Fed, doesn't he have to lie? If he came out and said exactly what he’s planning to do, wouldn’t everyone and his dog get on the right side of the trade?

Lee: That’s what he does though - he lies, but in his backchannel way. He tells the favored groups exactly what he’s going to do. You have to read between the lines. The meeting minutes are pure propaganda. That is how they send coded messages to the market.

In the last meeting minutes, or maybe the one before, the Fed said that wage increases were to be eradicated. I went ballistic when I saw that.

Elliott: Especially because they create all this inflation, and it trickles it’s way down. This is trickle down inflation. It’s gotten to the point where the people trying to make a living and ultimately buy things are being told that although prices are going up, we can’t allow you to earn anymore money...

Lee: It’s a moral outrage and a terrible policy. But that's what they want. Their purpose is to keep the bankers in business. The Fed serves the banking system. That’s why it’s there, to make sure the banking system is profitable.

Ilene: So they are accomplishing their goal.

Lee: For the time being. In the end they cannot fulfill their purpose because the banking system is dead. This is Frankenstein’s monster. This is another one of Bernanke’s economic science experiments, Dr. Bernankenstein. And the result of his policies is bernankicide - the financial genocide of the elderly in America.

Elliott: Then if Dr. Bernanke is Dr. Frankenstein, then what exactly is his monster?

Ilene: The banking system?

Lee: Yes, it’s got these screws coming out of its head, and stitches across its forehead. It’s the walking dead. The banks don’t make any money, the only way they appear to make money is by lying about it.

Ilene: But the people running the banks make money.

Lee: It’s a criminal syndicate for god's sake.

*****

Pic credit: Jesse's Cafe Americain

Try out PSW's Stock World Weekly, free, here >

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.