Faber Continues to Like Gold and Silver as Euro-zone Debt Crisis is Flashing Red

Commodities / Gold and Silver 2011 Jun 23, 2011 - 01:20 PM GMTBy: GoldCore

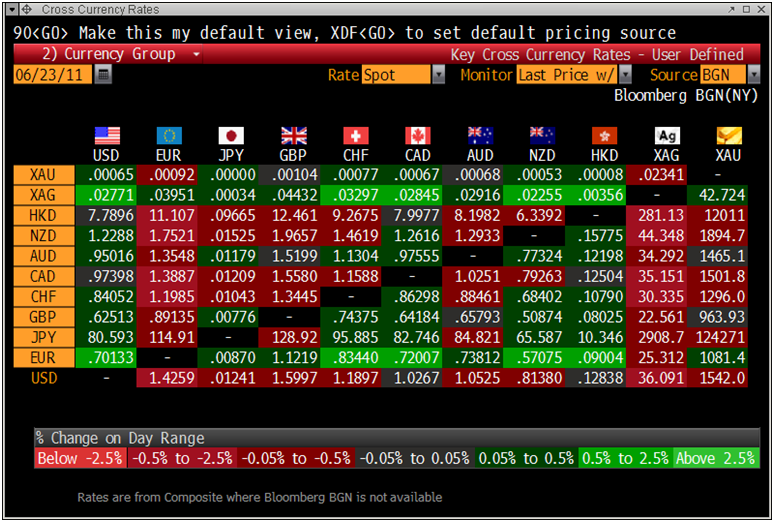

Gold is trading at $1,540.00/oz, €1,081.46/oz and £962.86/oz.

Gold is trading at $1,540.00/oz, €1,081.46/oz and £962.86/oz.

Gold is marginally lower in U.S. dollars but continues to eke out gains in euros. The euro has fallen again today possibly as markets digest Trichet’s grim warning regarding financial contagion. Gold at €1,081.40/oz is less than 1% away from record nominal highs in euros at €1,088/oz.

Currency debasement and sovereign debt and systemic risk remains high which is leading to gold consolidating near record highs in most currencies.

Cross Currency Rates

Bernanke and the FOMC and the BOE minutes yesterday both suggest ultra lose monetary policies and zero percent interest rates are to continue for the foreseeable future. This is a continuing positive for gold prices.

Given the increasingly precarious nature of the U. S. economic recovery, it will be very difficult for the Federal Reserve to end QE2 and thus the money printing experiment of recent years is likely to continue – although in a repackaged manner.

Gold looks set to again reach new record highs in all major currencies. It is important to remember that these are only nominal highs. In order to properly understand the real performance of any asset it is crucial to adjust for inflation.

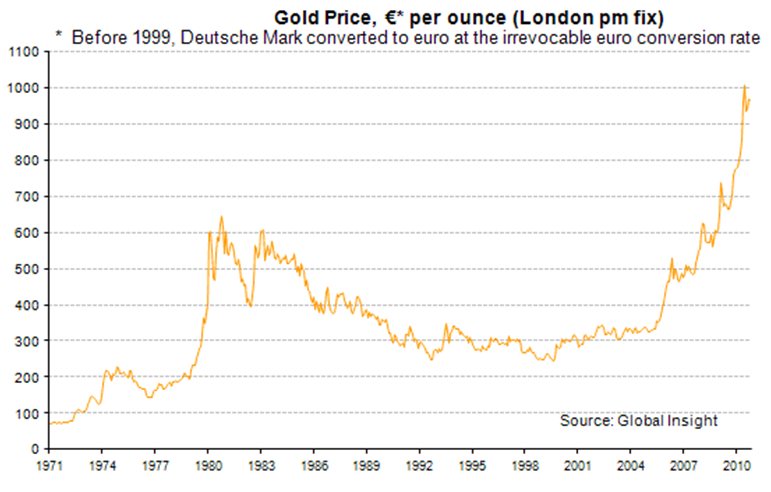

Gold in Euros Targets €1,000/oz – Well Below Inflation Adjusted High of €1,800/oz

Gold’s record nominal high in 1980 was $850/oz. When adjusted for inflation that high was at $2,400/oz. This means that gold is some 45% below its real record price in dollars in 1980. This is just one good indication that gold is not a bubble.

Gold in Euros – 1 Year (Daily)

Gold rose from below 75 Deutsche marks to over 600 Deutsche marks in the 1970’s (see chart below). Gold rose 8 fold and gave a return of 700% in just 9 years in Deutsche marks. The German mark was one of the stronger currencies in the world during that period.

When one adjusts the euro (Deutsche mark converted) for inflation, the record high price of gold in 1980 in Deutsche mark (converted to euros) was over €1,800/oz.

Gold remains nearly half of its price in 1980 when adjusted for inflation in many currencies which should give those calling gold a bubble pause for thought.

Rather than gold rising in price, what is actually happening is that the world’s major currencies are being devalued.

This has happened throughout history. Yet, today it is happening on a scale never seen before through unprecedentedly loose monetary policies and currency debasement which is seeing paper currencies fall in value versus the finite currency that is gold.

Gold in Euros (Deutsche Mark converted) in Nominal Terms and Not Adjusted for Inflation

The paper and digital money creating experiment looks set to continue for the foreseeable future.

Until politicians in the US and other major industrial nations are able to withdraw stimulus spending and restrain public spending, as Ireland has been doing to its cost, gold will likely remain in a bull market.

More importantly, until central bankers raise interest rates to more normal levels and create positive rates of return again (above the rate of inflation) - paper currencies will continue to depreciate.

Unlike bonds, property, equities and most asset classes (and even commodities like oil) which have risen to multiples of their historical record nominal highs, gold is well below the price it was in 1980 in dollars ($2,300/oz) and other major currencies when adjusted for inflation. In January 1980, gold became a bubble after rising by nearly 100% in 1979 alone and a massive 2,400% in dollar terms in just 9 years.

The euro ‘single’ currency experiment looks increasingly shaky and there is the increasing likelihood of a return to European national currencies (drachma, peseta etc).

The euro as we know it today is unlikely to survive the current crisis and therefore gold’s performance in Deutsche mark terms in the 1970s is likely to be repeated and surpassed in euro terms. A 700% increase would see gold in euro terms rise from €250/oz in 2000 to some €2,000/oz in the coming years.

Gold would obviously rise by much more in lira, drachmas, punts or pesetas in the event of voluntary or forced ejection from the monetary union.

Given the scale of the current crisis and the fact that the U.K. and U.S. fiscal positions are far worse than they were in the 1970s, gold’s bull market looks on a very sound footing.

Real diversification and an allocation silver and particularly gold remains very prudent.

Trichet Debt Crisis is Flashing “Red” – Risk of “Potential Contagion Effects Across the Union and Beyond”

The European Central Bank President, Jean-Claude Trichet, was not as optimistic as he usually is, when he raised the alarm level on the debt crisis to “red” late yesterday.

After the meeting of the European Systemic Risk Board in Frankfurt, Trichet who chairs the ESRB, said that risk signals for financial stability in the euro area are rising and flashing “red”. He said “on a personal basis I would say yes, it is red”.

Trichet warned market participants that the crisis is nowhere close to be resolved. Trichet warned of “potential contagion effects across the union and beyond.”

Marc Faber Continues to Like Gold and Silver and Accumulating – Warns Against Trusting Central Banks

Overnight Marc Faber, publisher of the Gloom, Boom & Doom report, told Bloomberg this morning (see interview below) that he still favours gold and silver. He said there could be short term weakness but that he will keep accumulating gold. Faber warned against shorting the precious metals as they are likely to keep going up.

He also warned regarding recent incidents of fraud and corruption by newly listed Chinese companies and said this was indicative a bubble.

In his usual contrarian and witty manner, he said that “not to own any gold is to trust central bankers and that you do not want to do in your life.”

SILVER

Silver is trading at $35.98oz,€25.27/oz and £22.50/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,711.50/oz, palladium at $744/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.