Obama's Afghanistan Plan and the Realities of Military Withdrawal

Politics / US Politics Jun 23, 2011 - 07:05 AM GMTBy: STRATFOR

U.S. President Barack Obama announced June 22 that the long process of drawing down forces in Afghanistan would begin on schedule in July. Though the initial phase of the drawdown appears limited, minimizing the tactical and operational impact on the ground in the immediate future, the United States and its allies are now beginning the inevitable process of removing their forces from Afghanistan. This will entail the risk of greater Taliban battlefield successes.

U.S. President Barack Obama announced June 22 that the long process of drawing down forces in Afghanistan would begin on schedule in July. Though the initial phase of the drawdown appears limited, minimizing the tactical and operational impact on the ground in the immediate future, the United States and its allies are now beginning the inevitable process of removing their forces from Afghanistan. This will entail the risk of greater Taliban battlefield successes.

The Logistical Challenge

Afghanistan, a landlocked country in the heart of Central Asia, is one of the most isolated places on Earth. This isolation has posed huge logistical challenges for the United States. Hundreds of shipping containers and fuel trucks must enter the country every day from Pakistan and from the north to sustain the nearly 150,000 U.S. and allied forces stationed in Afghanistan, about half the total number of Afghan security forces. Supplying a single gallon of gasoline in Afghanistan reportedly costs the U.S. military an average of $400, while sustaining a single U.S. soldier runs around $1 million a year (by contrast, sustaining an Afghan soldier costs about $12,000 a year).

These forces appear considerably lighter than those in Iraq because Afghanistan’s rough terrain often demands dismounted foot patrols. Heavy main battle tanks and self-propelled howitzers are thus few and far between, though not entirely absent. Afghanistan even required a new, lighter and more agile version of the hulking mine-resistant, ambush-protected vehicle known as the M-ATV (for “all-terrain vehicle”).

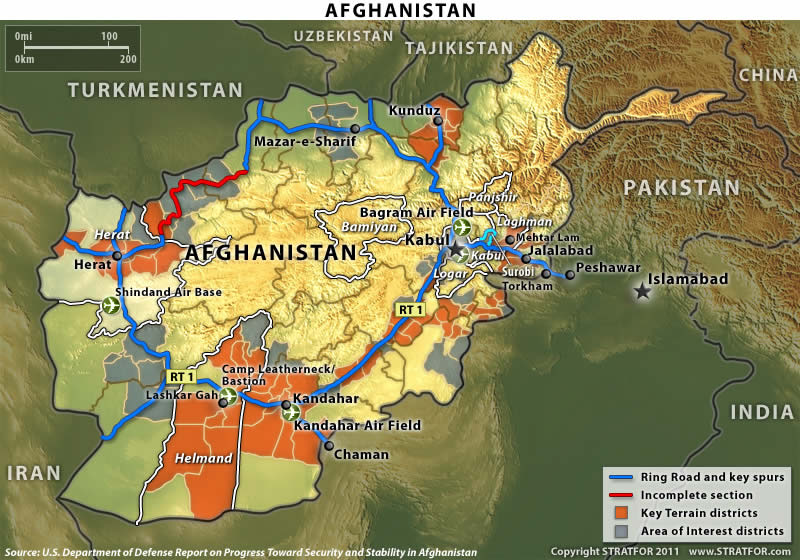

Based solely on the activity on the ground in Afghanistan today, one would think the United States and its allies were preparing for a permanent presence, not the imminent beginning of a long-scheduled drawdown (a perception the United States and its allies have in some cases used to their advantage to reach political arrangements with locals). An 11,500-foot all-weather concrete and asphalt runway and an air traffic control tower were completed this February at Camp Leatherneck and Camp Bastion in Helmand province. Another more than 9,000-foot runway was finished at Shindand Air Field in Herat province last December.

Meanwhile, a so-called iron mountain of spare parts needed to maintain vehicles and aircraft, construction and engineering equipment, generators, ammunition and other supplies — even innumerable pallets of bottled water — has slowly been built up to sustain day-to-day military operations. There are fewer troops in Afghanistan than the nearly 170,000 in Iraq at the peak of operations and considerably lighter tonnage in terms of armored vehicles. But short of a hasty and rapid withdrawal reminiscent of the chaotic American exit from Saigon in 1975 (which no one currently foresees in Afghanistan), the logistical challenge of withdrawing from Afghanistan — at whatever pace — is perhaps even more daunting than the drawdown in Iraq. The complexity of having nearly 50 allies with troops in country will complicate this process.

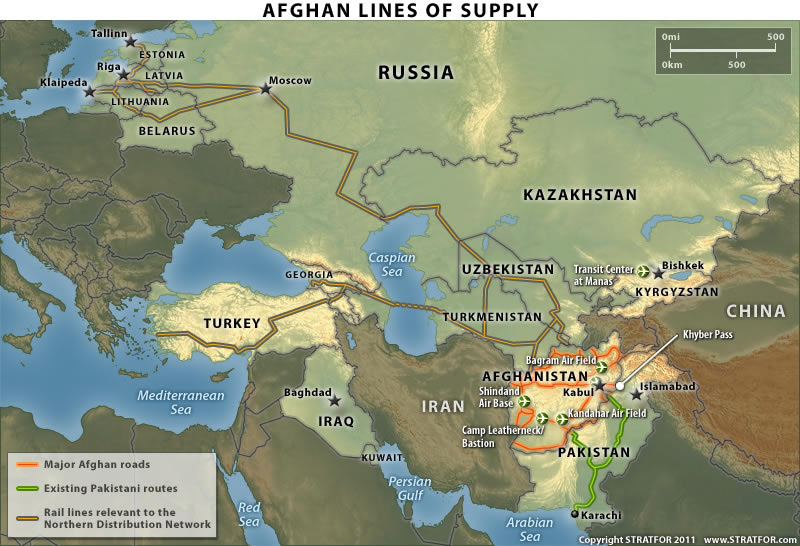

Moreover, coalition forces in Iraq had ready access to well-established bases and modern port facilities in nearby Kuwait and in Turkey, a long-standing NATO ally. Though U.S. and allied equipment comes ashore on a routine basis in the Pakistani port city of Karachi, the facilities there are nothing like what exists in Kuwait. Routes to bases in Afghanistan are anything but short and established, with locally contracted fuel tankers and other supplies not only traveling far greater distances but also regularly subject to harassing attacks. They are inherently vulnerable to aggressive interdiction by militants fighting on terrain far more favorable to them, and to politically motivated interruptions by Islamabad. The American logistical dependence on Pakistani acquiescence cannot be understated. Most supplies transit the isolated Khyber Pass in the restive Pakistani Federally Administered Tribal Areas west of Islamabad. As in Iraq, the United States does have an alternative to the north. But instead of Turkey it is the Northern Distribution Network (NDN), which runs through Central Asia and Russia (Moscow has agreed to continue to expand it) and entails a 3,200-mile rail route to the Baltic Sea and ports in Latvia, Lithuania and Estonia.

Given the extraordinary distances involved, the metrics for defining whether something is worth the expense of shipping back from Afghanistan are unforgiving. Some equipment will be deemed too heavily damaged or cheap and will be sanitized if necessary and discarded. Much construction and fortification has been done with engineering and construction equipment like Hesco barriers (which are filled with sand and dirt) that will not be reclaimed, and will continue to characterize the landscape in Afghanistan for decades to come, much as the Soviet influence was perceivable long after their 1989 withdrawal. Much equipment will be handed over to Afghan security forces, which already have begun to receive up-armored U.S. HMMWVs, aka “humvees.” Similarly, some 800,000 items valued at nearly $100 million have already been handed over to more than a dozen Iraqi military, security and government entities.

Other gear will have to be stripped of sensitive equipment (radios and other cryptographic gear, navigation equipment, jammers for improvised explosive devices, etc.), which is usually flown out of the country due to security concerns before being shipped overland. And while some Iraqi stocks were designated for redeployment to Afghanistan or prepared for long-term storage in pre-positioned equipment depots and aboard maritime pre-positioning ships at facilities in Kuwait, most vehicles and supplies slated to be moved out of Afghanistan increasingly will have to be shipped far afield. This could be from Karachi by ship or to Europe by rail even if they are never intended for return to the United States.

Security Transition

More important than the fate of armored trucks and equipment will be the process of rebalancing forces across the country. This will involve handing over outposts and facilities to Afghan security forces, who continue to struggle to reach full capability, and scaling back the extent of the U.S. and allied presence in the country. In Iraq, and likely in Afghanistan, the beginning of this process will be slow and measured. But its pace in the years ahead remains to be seen, and may accelerate considerably.

The first areas slated for handover to Afghan control, the provinces of Panjshir, Bamiyan and Kabul — aside the restive Surobi district, though the rest of Kabul’s security effectively has been in Afghan hands for years — and the cities of Mazar-e-Sharif, Herat, Lashkar Gah and Mehtar Lam have been relatively quiet places for some time. Afghan security forces increasingly have taken over in these areas. As in Iraq, the first places to be turned over to indigenous security forces already were fairly secure. Handing over more restive areas later in the year will prove trickier.

This process of pulling back and handing over responsibility for security (in Iraq often termed having Iraqi security forces “in the lead” in specific areas) is a slow and deliberate one, not a sudden and jarring maneuver. Well before the formal announcement, Afghan forces began to transition to a more independent role, conducting more small-unit operations on their own. International Security Assistance Force (ISAF) troops slowly have transitioned from joint patrols and tactical overwatch to a more operational overwatch, but have remained nearby even after transitions formally have taken place.

Under the current training regime, Afghan units continue to require advice and assistance, particularly with matters like intelligence, planning, logistics and maintenance. The ISAF will be cautious in its reductions for fear of pulling back too quickly and seeing the situation deteriorate — unless, of course, Obama directs it to conduct a hastier pullback.

As in Afghanistan, in Iraq the process of drawing down and handing over responsibility in each area was done very cautiously. There was a critical distinction, however. A political accommodation with the Sunnis facilitated the apparent success of the Iraqi surge — something that has not been (and cannot be) replicated in Afghanistan. Even with that advantage, Iraq remains in an unsettled and contentious state. The lack of any political framework to facilitate a military pullback leaves the prospect of a viable transition in restive areas where the U.S. counterinsurgency-focused strategy has been focused tenuous at best — particularly if timetables are accelerated.

In June 2009, U.S. forces in Iraq occupied 357 bases. A year later, U.S. forces occupied only 92 bases, 58 of which were partnered with the Iraqis. The pace of the transition in Afghanistan remains to be seen, but handing over the majority of positions to Afghan forces will fundamentally alter the situational awareness, visibility and influence of ISAF forces.

Casualties and Force Protection

The security of the remaining outposts and ensuring the security of U.S. and allied forces and critical lines of supply (particularly key sections of the Ring Road) that sustain remaining forces will be key to crafting the withdrawal and pulling back to fewer, stronger and more secure positions. As that drawdown progresses — and particularly if a more substantive shift in strategy is implemented — the increased pace begins to bring new incentives into play. Of particular note will be both a military and political incentive to reduce casualties as the endgame draws closer.

The desire to accelerate the consolidation to more secure positions will clash with the need to pull back slowly and continue to provide Afghan forces with advice and assistance. The reorientation may expose potential vulnerabilities to Taliban attack in the process of transitioning to a new posture. Major reversals and defeats for Afghan security forces at the hands of the Taliban after they have been left to their own devices can be expected in at least some areas and will have wide repercussions, perhaps even shifting the psychology and perception of the war.

When ISAF units are paired closely with Afghan forces, those units have a stronger day-to-day tactical presence in the field, and other units are generally operating nearby. So while they are more vulnerable and exposed to threats like IEDs while out on patrol, they also — indeed, in part because of that exposure — have a more alert and robust posture. As the transition accelerates and particularly if Washington accelerates it, the posture and therefore the vulnerabilities of forces change.

Force protection remains a key consideration throughout. The United States gained considerable experience with that during the Iraq transition — though again, a political accommodation underlay much of that transition, which will not be the case in Afghanistan.

As the drawdown continues, ISAF will have to balance having advisers in the field alongside Afghan units for as long as possible against pulling more back to key strongholds and pulling them out of the country completely. In the former case, the close presence of advisers can improve the effectiveness of Afghan security forces and provide better situational awareness. But it also exposes smaller units to operations more distant from strongholds as the number of outposts and major positions begins to be reduced. And as the process of pulling back accelerates and particularly as allied forces increasingly hunker down on larger and more secure outposts, their already limited situational awareness will decline even further, which opens up its own vulnerabilities.

One of these will be the impact on not just situational awareness on the ground but intelligence collection and particularly exploitable relationships with local political factions. As the withdrawal becomes more and more undeniable and ISAF pulls back from key areas, the human relationships that underlie intelligence sharing will be affected and reduced. This is particularly the case in places where the Taliban are strongest, as villagers there return to a strategy of hedging their bets out of necessity and focus on the more enduring power structure, which in many areas will clearly be the Taliban.

The Taliban

Ultimately, the Taliban’s incentive vis-a-vis the United States and its allies — especially as their exit becomes increasingly undeniable — is to conserve and maximize their strength for a potential fight in the vacuum sure to ensue after the majority of foreign troops have left the country. At the same time, any “revolutionary” movement must be able to consolidate internal control and maintain discipline while continuing to make itself relevant to domestic constituencies. The Taliban also may seek to take advantage of the shifting tactical realities to demonstrate their strength and the extent of their reach across the country, not only by targeting newly independent and newly isolated Afghan units but by attempting to kill or even kidnap now-more isolated foreign troops.

Though this year the Taliban have demonstrated their ability to strike almost anywhere in the country, they so far have failed to demonstrate the ability to penetrate the perimeter of large, secured facilities with a sizable assault force or to bring crew-served weapons to bear in an effective supporting manner. Given the intensity and tempo of special operations forces raids on Taliban leadership and weapons caches, it is unclear whether the Taliban have managed to retain a significant cache of heavier arms and the capability to wield them.

The inherent danger of compromise and penetration of indigenous security forces also continues to loom large. The vulnerabilities of ISAF forces will grow and change while they begin to shift as mission and posture evolve — and those vulnerabilities will be particularly pronounced in places where the posture and presence remains residual and a legacy of a previous strategy instead of more fundamental rebalancing. The shift from a dispersed, counterinsurgency-focused orientation to a more limited and more secure presence will ultimately provide the space to reduce casualties, but it will necessarily entail more limited visibility and influence. And the transition will create space for potentially more significant Taliban successes on the battlefield.

By Nathan Hughes

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2011 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.