Hyperinflation Lesson From Starving Billionaires

Currencies / Fiat Currency Jun 23, 2011 - 06:11 AM GMTBy: GoldSilver

As you may all ready know today, for the first era in human history, all currencies of the world are fiat currencies. This means every paper and digital currency around the world derives it's value by mere decree and or force.

As you may all ready know today, for the first era in human history, all currencies of the world are fiat currencies. This means every paper and digital currency around the world derives it's value by mere decree and or force.

Only gold and silver are money, they cannot go bankrupt. For bullion, default is not an option. Silver and gold need no coercion nor decree, they have been and always will be money.

History shows that all fiat currencies come to an end. The average lifespan of a fiat currency is approximately 40 years.

Fiat currencies have no intrinsic value. Unlike real money, fiat paper currencies cannot hold their value over long periods of time. It is a fact of life that all fiat currencies have expiration dates. They all end at their intrinsic values of nothingness.

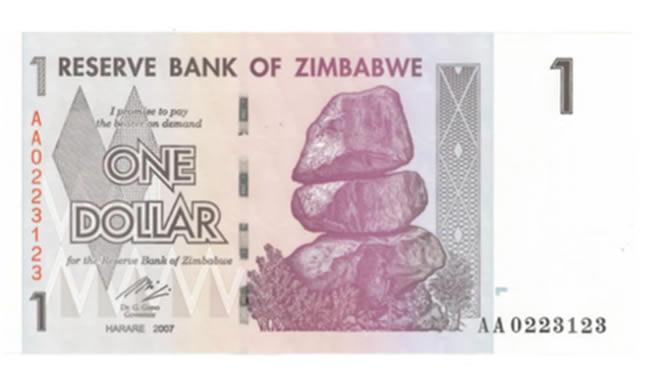

The following is a less than 30 year, fiat currency birth to death lesson:

In 1980, Zimbabwe issued a new dollar currency in which 1 ZWD was worth $1.47 United States.

Twenty seven years later, in 2007, the Zimbabwe economy was undergoing severe turmoil and distress. This led to the progression of a monetary hyperinflation, a state of rampant paper currency debasement:

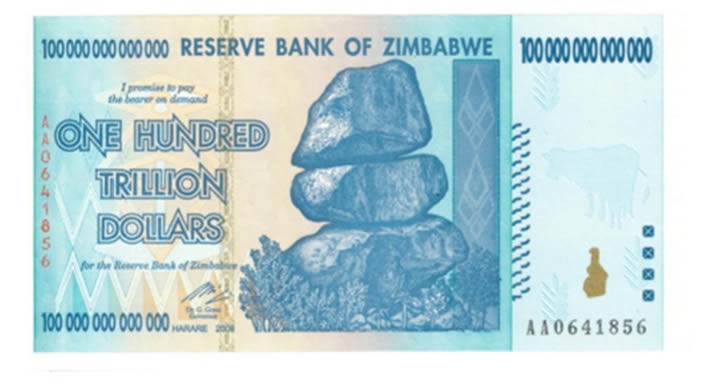

Eventually 300,000,000,000,000 Zimbabwe dollars equaled 1 United States dollar!

In February 2009 the Zimbabwe dollar was re-denominated for the last time before it was finally abandoned for foreign fiat currencies in April of 2009.

Today all fiat currencies like euros, yen, pounds, pesos, dollars, etc... seem to be devaluing together!

In the next currency crisis, the world may not have alternative fiat currencies to run to, for this reason we own physical gold and silver bullion.

We believe the greatest wealth transfer in history is ahead. We encourage and applaud you who have taken action, history has a way of favoring the prepared.

For undeniable proof of how all fiat currencies continue to devalue versus real monies, gold and silver, click the image below:

Worldwide Race to Debase - 2000 through Q1 2011

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2011 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.