Europe and America and the The Global Debt Crisis

Economics / Global Debt Crisis Jun 22, 2011 - 03:22 PM GMTBy: LEAP

On December 15, 2010, in the GEAB N°50, LEAP/E2020 anticipated the explosion of Western government debt (1) in the second half of 2011. We were then describing a process that would start with the European government debt crisis and then set fire to the heart of the global financial system, namely US federal debt (2). And here we are with this issue at the start of the second half of 2011, with a global economy in complete disarray (3), an increasingly unstable global monetary system (4) and financial centres in desperate straits (5), all this despite the thousands of billions of public money invested to avoid precisely this type of situation. The insolvency of the global financial system, and of the Western financial system in the first place, returns again to the front of the stage after just over a year of political cosmetics aimed at burying this fundamental problem under truckloads of cash.

On December 15, 2010, in the GEAB N°50, LEAP/E2020 anticipated the explosion of Western government debt (1) in the second half of 2011. We were then describing a process that would start with the European government debt crisis and then set fire to the heart of the global financial system, namely US federal debt (2). And here we are with this issue at the start of the second half of 2011, with a global economy in complete disarray (3), an increasingly unstable global monetary system (4) and financial centres in desperate straits (5), all this despite the thousands of billions of public money invested to avoid precisely this type of situation. The insolvency of the global financial system, and of the Western financial system in the first place, returns again to the front of the stage after just over a year of political cosmetics aimed at burying this fundamental problem under truckloads of cash.

We estimated in 2009 that the world had about 30 trillion USD in ghost assets. Almost half went up in smoke in the six months between September 2008 and March 2009. For our team, it's now the other half's turn, the 15 trillion USD of ghost assets remaining, purely and simply vanishing between July 2011 and January 2012. And this time, it will also involve government debt, unlike 2008/2009 where it was mostly private players who were affected. To gauge the extent of the coming shock, it is worth knowing that even US banks are starting to reduce their use of US Treasury Bonds to guarantee their transactions for fear of the increasing risks weighing on US government debt (6).

For the financial world's players, the Autumn 2011 shock will literally be the ground giving way beneath their feet, since it's really the foundation of the global financial system, the US Treasury Bond, which will plunge sharply (7).

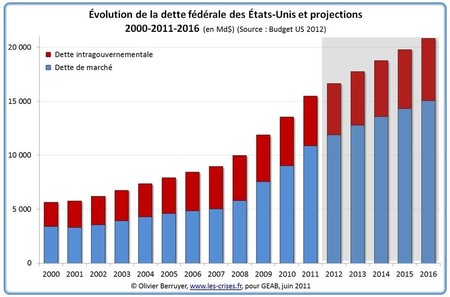

US Federal debt and forecasts (2000-2016) (in billions USD) - Sources: US Treasury/ Berruyer / GEAB, 06/2011 In this issue, we discuss the two most dangerous aspects of the Autumn 2011 shock, namely:

. the detonating mechanism of European government debt

. the explosion process of the US bomb in terms of government debts

At the same time, in the context of the acceleration of the rebalancing of global power relationships, we introduce the anticipation of a fundamental geopolitical process for the holding of a Euro-BRICS summit by 2014.

Finally, we focus our recommendations on the means of avoiding being part of the 15 trillion USD in ghost assets that will go up in smoke in the coming months, with a special mention for developments in real estate in Europe whose collapse we used to anticipate for 2015 will start in fact as early as 2012.

In the public announcement of this GEAB issue, we introduce a portion of the anticipation on the detonating mechanism of European government debt.

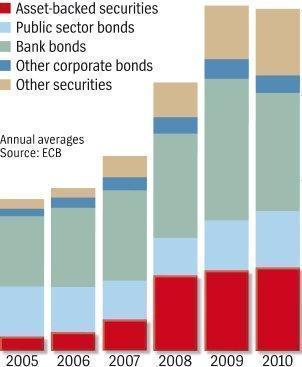

European Central Bank balance sheet holdings (red: asset backed securities / light blue: public sector bonds / green: bank bonds / dark blue: other corporate bonds / beige: other securities) - Sources: Spiegel / BCE, 05/2011 The detonating mechanism of European government debt The Anglo-Saxon financial operators have played sorcerer's apprentice for the last year and a half and the first headlines in the Financial Times in December 2009 on the Greek crisis quickly became a so-called "Euro crisis". We will not dwell on the vicissitudes of this enormous chicanery with a news item (8) orchestrated from the City of London and Wall Street, as we have already devoted many pages to it in a number of GEAB issues throughout this period. Suffice it to say that eighteen months later the Euro is doing well while the dollar continues its downward spiral against major world currencies; and that all those who bet on the collapse of the Eurozone have lost a lot of money. As we anticipated the crisis favors the emergence of a new sovereign, Euroland, which now allows the Eurozone to be much better prepared than Japan, the United States or the United Kingdom (9) for the Autumn 2011 shock ... even if it ends up, quite reluctantly, playing the role of detonator. The "bombardment" (since we must call things by their proper name) (10), interspersed with breaks of several weeks (11), to which Euroland has been subjected during all this time, in fact had three consecutive major effects, two of them far from the results expected by Wall Street and the City:

1. at first (December 2009 - May 2010), it removed the European currency's sense of invulnerability formed in 2007/2008, introducing doubts about its durability and more precisely putting the idea that the Euro was the natural alternative to the US dollar (or even its successor) into perspective

2. then (June 2010 - March 2011), it conducted Euroland leaders to start work at "top speed" on all measures to safeguard, protect and strengthen the single currency (measures which should have been taken many years ago). In so doing it has revitalized European integration and reinstated the founding core at the head of the European project, thus marginalizing the United Kingdom in particular (12). At the same time it has boosted increasing support for the European currency from the BRICS, headed by China, which after a moment of hesitation became aware of two fundamental points: first Europeans were acting seriously to face up to the problem and secondly, given the Anglo-Saxon determination, the Euro was obviously an essential tool for any attempt to exit the "dollar world" (13).

3. Finally, (April 2011 - September 2011), it is currently compelling the Eurozone to start reaching for the sacrosanct private investors to make them contribute to solving the Greek problem especially via “voluntary” repayment rescheduling (or any other form of cuts in expected profits) (14).

As one can imagine, if the first blow really was one of the objectives pursued by Wall Street and the City (besides the fact of turning attention away from the United Kingdom and United States' massive problems), on the other hand the other two had effects totally opposite to the desired outcome: to weaken the Euro and reduce its attractiveness worldwide.

Especially since a fourth series is gearing itself up which will see, by early 2012 (15), the launch of a Eurobond mechanism, enabling the sharing of a part of Euroland countries' debt issuance (16), and the inevitable growing political pressure (17) to increase the share of the private contribution in this broad process of restructuring (18) the debt of the Eurozone's peripheral countries (19).

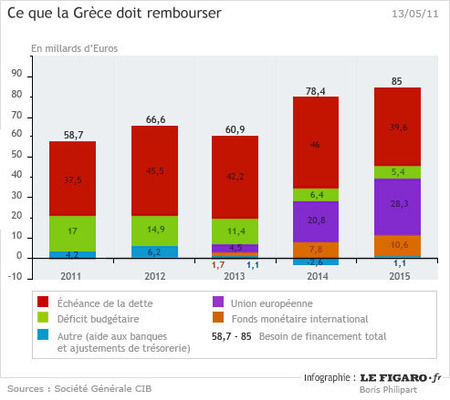

Progression of Greek debt and its structure (in € Billions (red : expiring debt ; green : budget deficit ; violet : EU loans ; brown : IMF loans ; blue : other - Sources : Le Figaro / SG CIB, 05/2011 And with this fourth series one enters the heart of the contagion process that will trigger the US federal debt bomb. Because, first, in creating a global media and financial environment ultra-sensitive to the issues of government indebtedness, Wall Street and the City have revealed the unsustainable size of US, British and Japanese government deficits (20). This has even forced the rating agencies, faithful watchdogs of the two financial centres, to engage in a mad race to downgrade countries' ratings. It is for this reason that the United States now finds itself under the threat of a downgrade, as we had anticipated, even though it seemed unthinkable to most experts only a few months ago. At the same time, the United Kingdom, France, Japan... also find themselves in the rating agencies' crosshairs (21).

Remember that these agencies have never forecast anything of importance (neither subprime, nor the global crisis, nor the Greek crisis, nor the Arab Spring, ...). If they downgrade willy nilly today it's because they have been caught at their own game (22). It's no longer possible to downgrade A without affecting B's rating if B is no better off. The "assumptions" on the fact that it's impossible for any particular state to default on its debt have not withstood three years of crisis: this is where Wall Street and the City have fallen into the trap which threatens all aspiring sorcerers' apprentices. They have not seen it would be impossible for them to control the hysteria kept up over Greek debt. So today it's the US Congress, with the bitter debate on the debt ceiling and massive budget cuts, that the consequences of the misleading articles in recent months about Greece and the Eurozone enlarge. Once again, our team can only stress that if history has any sense, it's certainly a sense of irony.

Industrial production in China (red) and India (green) (2006-2011) - Source: Marketwatch / Factset China / India Stats, 06/2011 ----------

Notes :

(1) Including the fact that private investors (especially banks) would be required to contribute to resolve the Greek debt problem.

(2) Without forgetting, of course, US local “muni” debts.

(3) The United States is falling back into recession. Europe is slowing as is China and India. The illusion of a global recovery is now truly over. It is precisely this very disturbing situation which explains why large companies hoard their cash: they don't want to find themselves, like 2008/2009, dependent on banks which are short of liquidity themselves. According to LEAP/E2020, it's worthwhile SMEs and individuals giving careful thought to this situation. Source: CNBC , 06/06/2011

(4) James Saft renowned columnist for Reuters and The New York Times, is even on the point of wishing "good luck to dollar hegemony". Source: Reuters , 05/19/2011

(5) The stock exchanges know that the "party" is over with the end of Quantitative Easing in the US and the return of the recession. And financial operators no longer know how to find profitable and not too risky investments.

(6) Source: CNBC/FT , 06/12/2011

(7) Even Saudi Arabia is now publicly concerned, with Prince AlWaleed referring to the "US debt bomb". Source: CNBC , 05/20/2011

(8) The latest example: the June 4th anti-austerity protest in Athens who had painstakingly assembled less than 1,000 protesters, while the Anglo-Saxon media again made headlines of this proof of rejection by the Greek population ... conjuring up thousands of demonstrators. Sources: Figaro , 06/05/2011; Financial Times , 06/05/2011; Washington Post , 06/06/2011

(9) The Telegraph of 06/07/2011 writes, for example, that since 1980 the UK spent £700 billion more than it earned. Much of that sum accounts for the 15 trillion USD in ghost assets which will disappear soon.

(10) We can see the exhaustion of the "end of the Euro" dialogue by the fact that Wall Street is now reduced to get Nouriel Roubini to intervene regularly to attempt to try to give credibility to this fairy story. Poor Roubini, whose forecasting work neither foresaw the global crisis, nor ever exceeded six months, finds himself reduced to having to foresee the "end of the Euro" in the next five years, or at least a fundamental reform of the Eurozone… potentially leading to increased European integration. We quote the author from his recent speech at a Singapore conference repeated in the Figaro of 06/14/2011. So if we summarize Nouriel Roubini's prediction there would be an end to the Euro in 5 years, unless in fact the Euro is strengthened through the permanent establishment of a "new sovereign", Euroland. What forecasting! Beyond the effect of an eye-catching announcement, which consists of saying that within five years (an infinitely long time in a time of crisis, and Roubini spoke of much shorter maturity dates only a few months ago), one thing or the other can happen. Thank you Dr. Roubini! It's hard to try to forecast and to work for Wall Street at the same time. But indeed, you must take your part in the general (vain) attempt to convince Asians not sell dollar-denominated assets in favor of those in Euros.

(11) When the Anglo-Saxon experts and media really can't invent anything more to justify keeping « the Euro crisis » as a headline.

(12) But also Sweden whose elite continue to live in the world after 1945, that in which they have been able to enrich themselves by taking advantage of the problems of the rest of the continent. As regards the United Kingdom, the City continues to try in vain to avoid going under the control of the European authorities as we see from this Telegraph article of 05/30/2011. The funniest in this article is the image chosen by the newspaper: a European flag in tatters. Yet it's really the City which is losing its historic independence in favor of the EU and not the opposite. It is a glaring illustration of the inability to understand the events unfolding in Europe through the British media, even when it's the Telegraph, otherwise excellent in terms of its coverage of the crisis.

(13) Hence their motivation to buy Euroland debt. Source: Reuters , 05/26/2011

(14) Sources: YahooActu , 06/13/2011; Deutsche Welle , 06/10/2011; Spiegel , 06/10/2011

(15) The crisis will not allow Euroland to wait for 2013, the projected date for revising the system adopted in May 2010, to resolve this discussion.

(16) Various options are being studied but most likely all organized around a system of dual tier government debt issuance: an issue carrying Euroland's common signature (and, therefore, a very low interest rate) in respect of an amount up to a maximum percentage of each state's GDP (40%, 50%, 60% ... it's for Euroland leaders to choose); beyond this threshold, the issue is only guaranteed by the single signature of the State concerned, rapidly involving very high rates for the less serious students in the class.

(17) In this regard, it is regrettable that the international media are more interested in a few thousand Greek demonstrators (see further in this issue for a glaring example of the huge difference between the true numbers and those of the Anglo-Saxon media) supposed to embody the refusal of European austerity and Eurozone weakness rather than the Greeks' actual expectations through this Greek intellectuals' open letter which accuses not Euroland, but their own political and financial elite of being unable to respect their commitments and calling for the upgrading of the Greek politico-social system with that of the rest of Euroland. Source: L'Express , 06/09/2011

(18) As regards the word "restructuring", over which the articles or broadcasts of economists and financiers of all kinds rave at length, our team wishes to bring a clear and simple accuracy to it: it is obvious that part of the Greek debt belongs these 15 trillion USD ghost assets that will evaporate in the months to come. No matter the word used, "restructuring", "default"..., as we indicated in previous GEABs, Euroland will organize a process that will cause the least powerful or most exposed creditors to lose significantly on their Greek exposure. This is called a crisis, and it's exactly what we are going through. And the "national interest" always works in the same way. But anyway, at this point, the problem will be moved to the United States, Japan and the United Kingdom and nobody will pay attention to the Greek case where the amounts are ridiculous in comparison: Greece, €300 billion; USA, 15 trillion dollars.

(19) And the upcoming review by the Karlsruhe Constitutional Court of Appeal against the European Stabilization Fund if it doesn't call into question judgments already given, will increase the pressure in Germany that the private sector should have a stake in the solutions, that's to say losses. Source: Spiegel , 06/13/2011

(20) A simple calculation allows us to measure the difference between the current Greek problem and the US crisis in the background: banks in particular will be forced to take a charge of between 10% and 20% of the cost of the Greek debt bailout, being between 30 and 60 billion €. That's what "excites" the rating agencies about European banks these days. The explosion of the US federal debt bomb will at least impose a cost of similar proportions on the banks and other institutional holders of this debt. Therefore, in this case we are talking about (which is a conservative estimate because the very nature of US Treasury Bonds use involves a larger private contribution) amounts between 1,5 and 3 trillion USD. This is consistent with our estimate of 15 trillion in ghost assets which will disappear in the coming quarters.

(21) Sources: Reuters , 06/08/2011; Le Monde , 06/11/2011; FoxNews , 05/30/2011

(22) And one of the consequences of this game is that the Europeans are preparing not only to severely regulate the rating agencies' methods, but they will quite simply create competitors to Anglo-Saxon agencies, as the Chinese have already done whose Dagong agency believes that the United States has entered a process of defaulting on its debt. By losing the monopoly on measuring risk, Wall Street and the City will thus lose their ability to make or lose fortunes. Sources: CNBC , 06/02/2011; YahooNews , 06/10/2011

GEAB is an affordable and regular decision and analysis support instrument intended for all those whose work involves some understanding of ongoing and future global trends seen from a European point of view: advisors, consultants, researchers, experts, heads of public institutions, research centres, international companies, financial institutions and major NGOs.

Available in: Français, English, Deutsch, Español

Frequency: Monthly - 10 issues a year published on the 16th of each month (interruption in July/August)

Contributors: Every issue is coordinated by Franck Biancheri and mobilises the totality of our research teams

© 2011 Copyright LEAP - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.