Indian Gold and Silver Imports Surge 222% as Official Inflation Surges to 8.65%

Commodities / Gold and Silver 2011 Jun 21, 2011 - 01:38 PM GMTBy: GoldCore

Gold is trading at $1,544.39/oz, €1,076.08/oz and £954.27/oz. Gold is marginally higher in most currencies today and on the verge of making new nominal highs in dollars, euros and pounds.

Gold is trading at $1,544.39/oz, €1,076.08/oz and £954.27/oz. Gold is marginally higher in most currencies today and on the verge of making new nominal highs in dollars, euros and pounds.

It is holding near record highs as there is no quick end in sight to economic turmoil in Europe after Greece was told to approve brutal new austerity measures to avoid defaulting on its debt. This would threaten the solvency of many western banks and the European Central Bank's Ordonez (member of the ECB’s governing council) warned this morning that the Greek crisis could have ‘transcendent consequences’.

Further evidence of continuing very significant and robust demand from Asia and from China and India in particular was seen in massive Indian gold and silver imports. The figures released overnight showed a huge surge of 222% in May 2011 compared to May 2010.

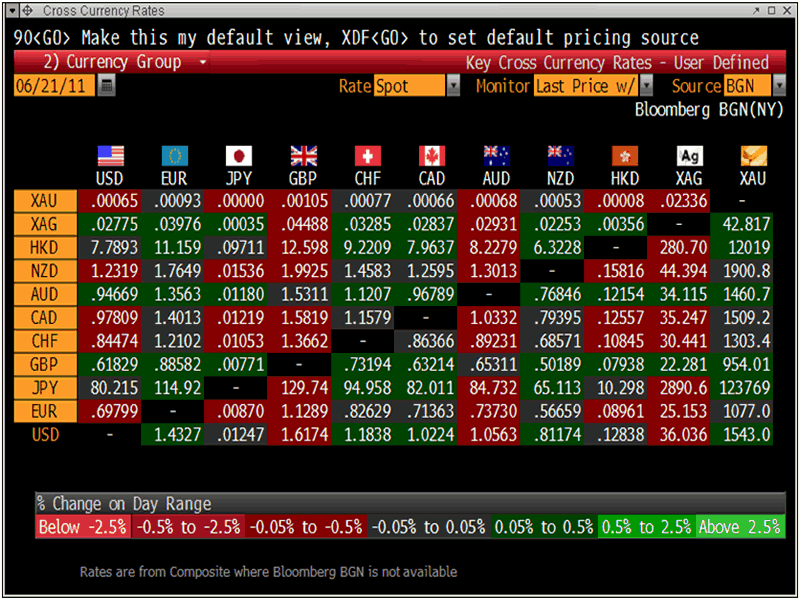

Cross Currency Rates

Imports of gold and silver were a staggering $8.96 billion in May, a growth of 500% over the previous month and 222% over last year.

Official inflation rates in India have surged to 8.65% and people on the Indian sub continent are concerned about the devaluation of the rupee and the erosion of the purchasing power of their savings.

While the rupee has maintained its value against the beleaguered U.S. dollar it has fallen sharply against gold and silver and against oil and the other food and energy commodities.

Gold has always been seen as a store of value against currency debasement, inflation and hyperinflation in Asia. This is especially the case in India and we appear to be witnessing an acceleration in the recent trend of Indians opting to buy gold and silver bullion in order to protect their savings.

India's central bank, the Reserve Bank of India's bought 200 tonnes of gold from the IMF in the months preceding an announcement in November 2009. Given their huge dollar reserves it is likely that they are continuing to diversify their foreign exchange holdings and further announcements of increased gold reserves are likely in the coming months.

Despite the increase in their reserves their gold holdings remain paltry when compared to the U.S. and European gold reserves.

Most creditor nation central banks in the world are now diversifying out of the major currencies, the dollar and the euro, and into gold. These include the People’s Bank of China, the Russian central bank and central banks in Sri Lanka, Bangladesh, Mauritius, Mexico, Iran and Saudi Arabia.

News came yesterday that Russia’s central bank again increased their gold holdings to 26.7 million troy ounces last month, from 26.5 million at the end April. The Bank of Rossii said their gold reserves were valued at $41 billion as of June 1, compared with $40.7 billion a month earlier.

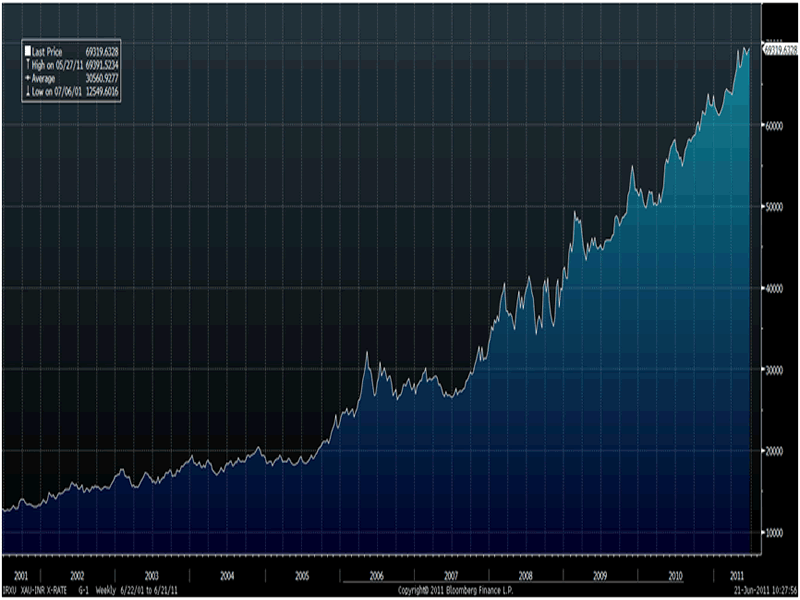

Gold in Indian Rupees – 10 Years (Weekly)

It is interesting that the Reserve Bank of India has granted licenses to seven more banks to import gold and silver bullion and this is indicative of the favourable view of gold and silver in India – both amongst the public and at the official level.

Indian banks are thus likely contributing to the massive increase in demand for gold and silver. Chinese banks are also catering to the increased demand of Chinese people for gold bullion for investment and savings purposes.

This is in marked contrast to their western banking counterparts, the vast majority of which, do not offer gold or silver investments at all.

As of the start of 2011, some 30 banks in India have been granted permission to import gold and silver. New additions to the list were Karur Vysya Bank, State Bank of Bikaner and Jaipur, State Bank of Hyderabad, Punjab and Sind Bank, South Indian Bank, State Bank of Mysore and State Bank of Travancore.

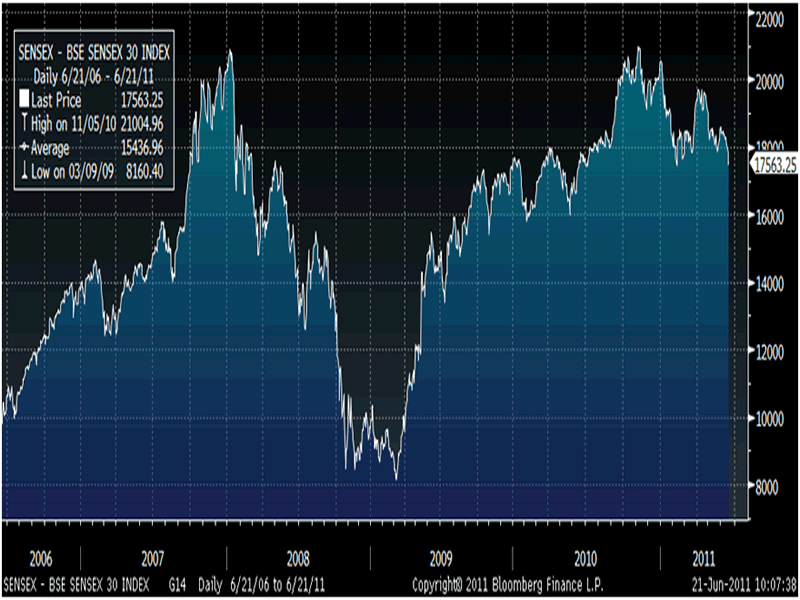

Bombay Stock Exchange Sensitive Index – 5 Years (Daily)

The charts above clearly show how gold is again maintaining purchasing power while the stock market in India is not.

Since the start of 2011, India's benchmark stock index, the Bombay Stock Exchange Sensitive Index, is down by more than 14% while gold in rupee terms is up 9%. The Sensex is essentially flat in the last year and the last 3 years despite soaring inflation.

The increased demand from India and wider Asia is sustainable and one of the fundamental reasons that gold and silver’s bull market remain very much intact.

Importantly, China was expected to surpass India as the world’s largest gold importer this year. After yesterday’s Indian import figures this is now not certain.

Chinese investors more than doubled their purchases of gold during the first quarter in 2011, compared to the same period last year. China invested $4.1 billion into gold bars and coins during this first quarter of 2011.

China’s investment demand increased to 90.0 metric tonnes (40.7 tonnes in the year prior), compared to India’s 85.6 tonnes.

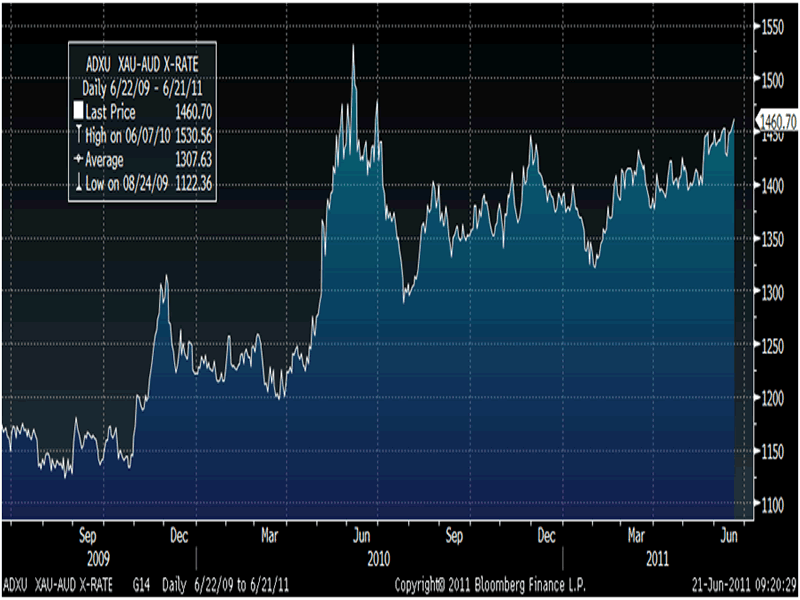

Gold in Australian Dollars Breaking Out?

In a report today, the Australian Bureau of Agricultural and Resource Economics and Sciences conservatively estimated that bullion may average $1,500 an ounce this year. The metal has averaged $1,445 so far in 2011.

“Uncertainty about the ability of many developed economies to stimulate economic growth and control growing budget deficits is expected to encourage investment demand for gold as a lower risk, or safe haven, asset,” the Canberra-based agency said.

Gold in Australian Dollars – 2 Years (Daily)

Despite some calling the Australian dollar a “safe haven” currency, the Australian dollar has been sold recently and gold appears to be in the early stages of breaking out in terms of Australian dollars.

This is another indication of the global nature of gold’s bull market and the fact that all fiat currencies are now vulnerable to currency debasement and devaluation. Focusing on gold solely in U.S. dollar terms remains simplistic and misleading.

Gold’s consolidation in recent months in all currencies and gradual gains since late January suggest that we may be on the verge of a break out in all currencies and a powerful move upward in the next leg of the precious metal bull markets.

SILVER

Silver is trading at $36.19/oz,€25.22/oz and £22.36/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,739.70/oz, palladium at $750/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.