UK Inflation Forecast 2008 (RPI and CPI)

Economics / Inflation Nov 26, 2007 - 12:01 AM GMTBy: Nadeem_Walayat

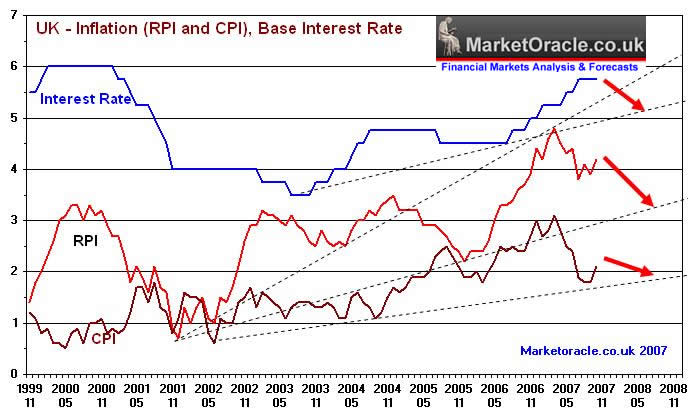

The recent up tick in UK inflation has sparked inflation concerns to continue going into 2008. However the Market Oracle anticipated the recent up tick as a consequence of money supply growth earlier in the year as an indicator of future inflation and that the up tick would prove temporary as many factors converge towards deflationary pressures during 2008 that will allow the Bank of England to start cutting UK interest rates towards a target of 5% before the decline in UK inflation starts and for UK inflation to subsequently fall towards the Market Oracle targets of 3% RPI and 1.8% CPI towards the end of 2008.

The recent up tick in UK inflation has sparked inflation concerns to continue going into 2008. However the Market Oracle anticipated the recent up tick as a consequence of money supply growth earlier in the year as an indicator of future inflation and that the up tick would prove temporary as many factors converge towards deflationary pressures during 2008 that will allow the Bank of England to start cutting UK interest rates towards a target of 5% before the decline in UK inflation starts and for UK inflation to subsequently fall towards the Market Oracle targets of 3% RPI and 1.8% CPI towards the end of 2008.

The following analysis presents some of the key factors that will result in the fall in UK Inflation during 2008.

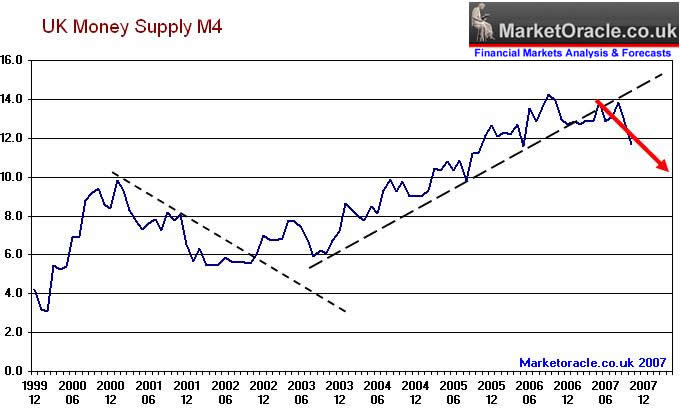

UK Money Supply M4

The anticipated trend in Money supply growth continues to moderate from the high levels of 14% plus towards a trend to below 10% as per the analysis of 18th Sept 07. Money supply is an important contributory indicator for future inflation between 6 and 12 months forward. Hence money supply growth near 14% during mid 2007 was expected to result in higher inflation in the immediate future going into 2008 (22nd August 07).

The expectation is that the inflationary surge will conclude by the start of 2008 and that despite higher inflation, the Bank of England will take the drop in M4 to below 10% as a better indicator for future inflation than the most recent inflation data would suggest at that time and therefore start cutting UK interests in line with the Market Oracle forecast for the first cut to occur in January 2008.

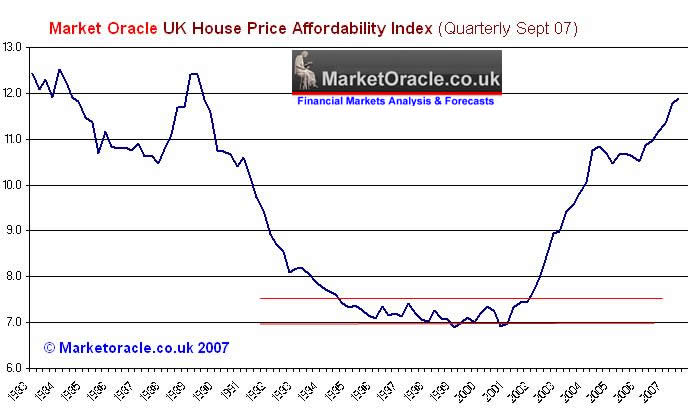

UK Housing Affordability and Credit Crunch Deflation Impact During 2008

The uptrend in UK house prices since late 2005 has not been sustainable and is purely a consequence of the cheap credit environment that evaporated during August 2007. This is already resulting in the first fall in UK house prices for several years which is expected to accelerate going into 2008. As house prices decline, this will have a deflationary effect on the UK economy as consumers will tend to spend less due to the impact of higher costs of servicing properties, reduction in equity withdrawals for consumption and a much tougher credit environment.

Reduction in equity withdrawals are already being observed with the number of approvals falling from 48,000 12 months ago to 38,000 for October 07. There has been an even sharper fall in the number of loans for house purchases which has dropped from 70,000, 12 months ago to 44,000 today (Source BBA). These are indicators of sharp slowdown in the UK housing market that is to be followed by an increase in repossessions on the 2007 figure by some 100% towards a target of 80,000. The consequence of this is for a UK house price deflation of 15% over 2 years as of the analysis of 22nd August 07.

The impact of the credit crunch is expected to continue well into 2008. The effect of which is most clearly observed in the 3 month interbank lending rate which again this week surged to above 6.5%. It is this rate and not the BoE base rate that determines your overall mortgage costs. During much of the housing boom the interbank rate would tend to signal rises and falls in UK interest rates by discounting falls and leading rises. However the freeze in the interbank money markets has led to a state where the money markets are trading at a 0.75% premium to the base rate despite increasing expectations for a cut in UK interest rates. This is due to the mortgage lenders increased perceived risks of default on loans and therefore the requirement of a premium over the base rate. The effect of which is equivalent to a rise in base rates to at least 6% and therefore the credit crunch has a very strong deflationary effect on the UK economy and will continue to do so despite cuts in UK base rates during the whole of 2008.

The reason again is the global nature of the credit crunch which is as a consequence of the US subprime mortgage meltdown as mortgage interest rates adjust to much higher rates than those originally fixed at during 2005 and 2006. How this effects UK banks is due to the way the subprime mortgage debt was sliced and diced and packaged and sold with other debt across the world as CDO's/ Which now makes it difficult for banks the world over to value their whole CDO packages and therefore the market for the CDO's has become frozen. It is unlikely that anything can be done to unfreeze the credit markets until the banks have been able to value the debt packages and make the appropriate bad debt provisions. Therefore conditions for the UK housing market can only become tighter as we have our own variety of subprime mortgages that are expected to blow-up during 2008 namely the buy to let market.

US Dollar Devaluation

With dollar denominated commodity prices on the rise, you may wonder why a falling dollar is deflationary for the UK economy. Well there are several deflationary consequences of a falling dollar for the UK.

1. That an estimated 25% of earnings from our biggest are in US dollars and therefore the corporate sector is expected to be squeezed which will result in lower corporation tax revenues and thus impact on the UK economy.

2. The Chinese are still maintaining the overall policy of pegging the Yuan against the US dollar. This means that as the US dollar drops so do the price of goods chinese will continue to get cheaper in terms of the British Pound and other currencies that are not pegged to the falling dollar. So China will again be exporting deflation abroad (mostly to Europe) and importing part of the UK's inflation.

3. US Goods and Services become cheaper and therefore the UK will enjoy a deflationary effect as the US current account deficit corrects itself. But at the same time UK goods and services are becoming more expensive to the US market and therefore again have a deflationary effect on the UK corporate sector.

Off course at some point the above trends will impact on sterling, as the UK economy slows and interest rates are cut. This is most likely to occur as the US interest rate cutting cycle comes to an end, which will probably be some time during the second half of 2008.

The British Pound looks set to maintain its uptrend against the falling US Dollar. At the current rate of advance and allowing for significant corrective action during the year. The British Pound is targeting a trend towards £/$ 2.25 by October 2008. Which would imply a further 10% dollar devaluation on the current exchange rate.

UK Inflation Trend Forecasts

The current up tick in inflation is expected to terminate early 2008, probably by the release of the January statistics, after which the trend is expected to resume lower with trends forecasting a sharper fall for the RPI than the CPI. RPI is forecasting a trend towards 3.2% and the CPI is forecasting a trend towards 1.9% by September 2008. Additionally UK Interest rates also target downtrend towards 5% by the same timeframe.

Conclusion : Inflation Forecast 2008

Despite the current upward trend continuing into the immediate future, UK Inflation as measured by the RPI is expected to fall sharply to or below 3% by November 2008 (current 4.2%). The CPI is expected to fall to 1.8% by November 2008 (current 2.1%). This takes into account the above analysis as well as anticipated fall in GDP growth to significantly below the governments forecast of 2.5%, moderating energy prices and continuing deflationary effect of migrant workers which help to cap wage demands.

What to do about falling UK inflation ?

1. Fixed Rate Savings and Bonds - Lock in higher interest rates amongst Fixed rate savings products which currently range between 6.3% and 6.75% today as a consequence of the credit crunch. Remember to fully utilise your ISA TAx Free Savings Accounts Annual Allowances which on an 6.5% rate are equivalent to a 9% gross return for a higher rate UK tax payers.

Also UK Gilts are expected to continue the up trend as yields continue to fall.

2. Lower inflation implies lower commodity prices and therefore those sectors that benefit from higher commodity prices may see a retracement at least in sterling terms.

3. Invest in Overseas Growth

Your portfolio should aim to be invested in companies with exposure to high growth countries which have not become too far overvalued. The recent analysis of 18th November 07 highlighted the markets most likely to perform well during 2008 as indicated by the above chart.

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of analysing and trading the financial markets and is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.