Gold Rises to New Record Sterling on Global Debt Contagion Risk

Commodities / Gold and Silver 2011 Jun 20, 2011 - 07:09 AM GMTBy: GoldCore

Gold is trading at $1,535.85/oz, €1,080.37/oz and £950.28/oz.

Gold is trading at $1,535.85/oz, €1,080.37/oz and £950.28/oz.

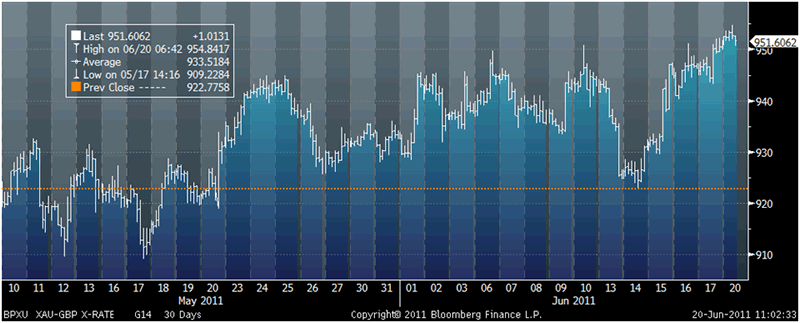

Gold is being supported as default risk has increased after EU finance ministers failed to agree on a new Greek loan package. Gold priced in sterling rose to new record nominal highs this morning at £954.84/oz and the weakness of the euro has seen gold rise to touching distance (9 euros) from new record highs in euro terms at €1,088/oz.

Equities have also fallen and Greek bonds are under selling pressure again – as are Portuguese bonds. The Eurozone debt crisis is creating the real risk of global financial contagion. Interbank and commercial paper markets are increasingly nervous about the ghosts of the Lehman Brothers collapse.

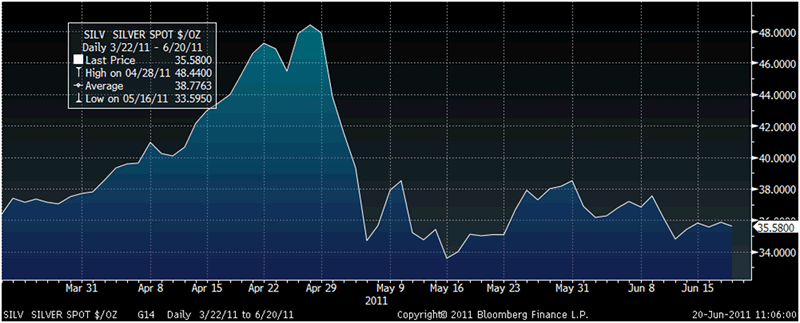

Silver continues to consolidate between $33/oz and $39/oz (see commentary below).

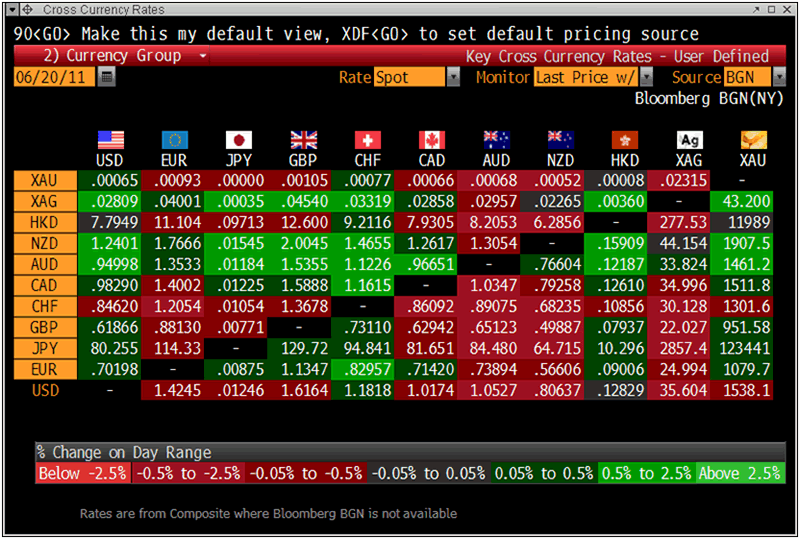

Cross Currency Rates

The cost of borrowing euros for three months in the interbank market continued to rise today with the three month Euro Interbank Offered Rate, or Euribor, fixed at 1.510%, up from 1.502%.

Corporate borrowing costs in the U.S. as measured by U.S. swaps rose sharply from 20 to 26.99 last week - the highest so far in 2011.

Gold in Sterling – 30 Days (Tick)

Gold and silver continue to consolidate at these levels after their most recent sell off. Concerns that gold is a bubble remain high – especially amongst those uninformed about the fundamentals of the gold market (see Commentary).

Societe Generale SA raised its third quarter gold forecast by $90 to $1,580 an ounce and silver by $3.50 to $42 an ounce.

SILVER

Silver appears to have found its footing in May and June and looks like it is consolidating between $33/oz and $39/oz.

Silver in U.S. Dollars – 3 Months (Daily)

Further short term weakness may be seen and volatility should be expected but the long term fundamentals remain as sound as ever.

Silver continues to get little or no media coverage despite the recent surge in price. This is an indication of the lack of animal spirits and irrational exuberance from mainstream participants in the silver market.

Silver remains a fringe investment and silver bullion is owned by a small fraction of investors in the U.S. and by an even smaller fraction of investors and savers in Ireland, the UK and EU.

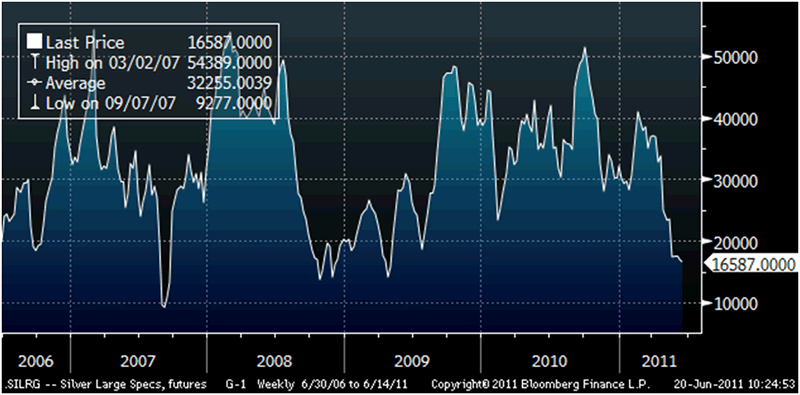

Another good indication that the worst of the selloff in silver is over is seen in the latest Commitment of Traders (COT) data.

The U.S. Commodity Futures Trading Commission data for the week ended June 14, shows that hedge-fund managers and other large speculators decreased their net-long position in New York silver futures again last week.

.SILRG Index Silver Large Specs, futures – Net long Positions

Speculative long positions or wagers that prices will rise, outnumbered short positions by 16,587 contracts on the COMEX division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 412 contracts, or 2 percent, from a week earlier. This is the lowest position since the first week of February 2010.

Net long positions are now near the levels seen late August 2007, late 2008 and in 2009 – which were all good silver buying opportunities.

While silver has had a large run up those continuing to focus solely on price and not on value and the actual real world tight supply and demand situation will continue to not understand the silver market and the importance of a diversification into silver in order to protect against sovereign, currency and systemic risk.

SILVER

Silver is trading at $35.42/oz,€24.92/oz and £21.92/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,730.50/oz, palladium at $733/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.