Long-Term Trends in Global Natural Gas and Crude Oil Supply and Demand Point to Much Higher Prices

Commodities / Energy Resources Nov 24, 2007 - 11:44 AM GMTBy: Joseph_Dancy

The energy consulting firm of Groppe Long & Littell made a presentation to the Kansas Independent Oil & Gas Association last month on the outlook for the energy sector. Two charts prepared by that firm are worth reviewing:

The energy consulting firm of Groppe Long & Littell made a presentation to the Kansas Independent Oil & Gas Association last month on the outlook for the energy sector. Two charts prepared by that firm are worth reviewing:

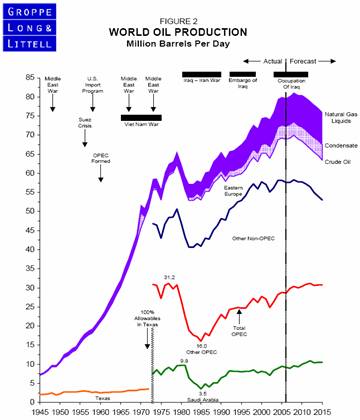

WORLD OIL PRODUCTION

Note the explosive growth in global production from 1945 to 1970. Much of the oil and gas regulatory and legal structure was established during this period of explosive growth.

- In 1972 the largest swing oil producer at the time – the State of Texas – saw excess productive capacity shrink to zero. The Texas ‘allowable' – how much an operator could produce – was raised to 100%, the maximum legal limit.

- Note the steep growth in production from both OPEC and Other Non-OPEC countries from 1985 to 2005, and the projected plateau and decline of production in Non-OPEC countries starting in 2005

- Liquids production from condensate and natural gas liquids increased substantially from 1985 to 2005. Without these incremental liquids the global supply situation would be much tighter.

- While global production is expected to peak in the 2010 time frame according to the presentation, global demand has been increasing at roughly 1.5% per year. Global economic growth and crude oil use are strongly correlated.

-

Long term trends in global supply and demand point to higher prices – possibly much higher prices.

Long term trends in global supply and demand point to higher prices – possibly much higher prices.

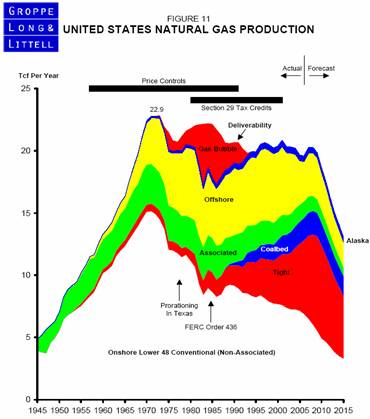

U.S. NATURAL GAS PRODUCTION

- Note that conventional onshore natural gas production in the U.S. peaked in the early 1970's – about the same time U.S. crude oil production peaked.

- Offshore natural gas production has declined the last few years, in part due to hurricane damage that permanently shut-in some of the offshore fields

- Note the explosion of ‘tight' and coalbed methane production since 1990 – these are sometimes referred to as ‘unconventional' natural gas reserves.

- Much of the decline in natural gas production from conventional reserves has been mitigated in the last decade by the boom in the unconventional production.

- Many experts think the future U.S. natural gas production decline will be severe – which is why many planners expect imported liquefied natural gas (LNG) will play a major role in our energy future.

- Long term trends in U.S. supply and demand point to higher prices for natural gas

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2007 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.