U.S. Mixed Economic Reports, Housing Starts Moved Up, Jobless Claims Declined

Economics / US Economy Jun 17, 2011 - 03:13 AM GMTBy: Asha_Bangalore

Economic reports of the past two days present a mixed picture of underlying economic conditions. Factory production data excluding autos moved up but factory surveys - Empire State Manufacturing Survey and factory report from the Federal Reserve Bank of Philadelphia--point to a weakening of activity. The National Association of Home Builders continue to believe that the housing market is in a slump, but today's housing starts data suggest a small turnaround. Jobless claims numbers point to a small improvement, but the level of jobless claims is elevated.

Economic reports of the past two days present a mixed picture of underlying economic conditions. Factory production data excluding autos moved up but factory surveys - Empire State Manufacturing Survey and factory report from the Federal Reserve Bank of Philadelphia--point to a weakening of activity. The National Association of Home Builders continue to believe that the housing market is in a slump, but today's housing starts data suggest a small turnaround. Jobless claims numbers point to a small improvement, but the level of jobless claims is elevated.

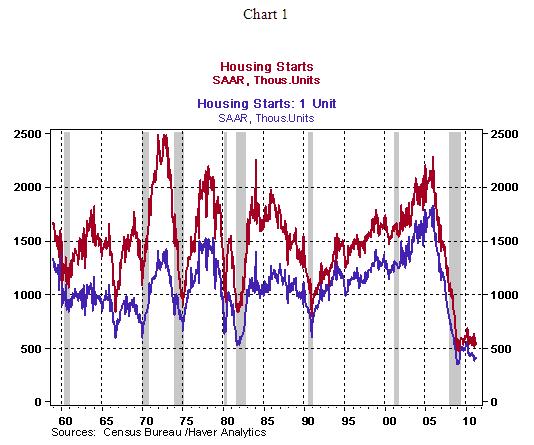

Starts of new homes rose 3.5% to an annual rate of 560,000 in May, with single-family and multi-family starts posting gains of 3.7% and 2.9%, respectively. Builders broke ground for new construction in the South (+1.5%) and West (+18.1%), while housing starts fell in the Northeast (-3.3%) and Midwest (-4.1%). The main take away from Chart 1 is that housing starts are moving around record lows after eight quarters of economic recovery. The improvement in housing starts in May is noteworthy but woefully inadequate still. Permit extensions to build new homes advanced 8.7% to an annual rate of 612,000 which includes a 23.2% jump in permits for multi-family homes and a 2.5% increase in permits for single-family homes. The increase in permits issued bodes positively for home building in June but largely for starts of multi-family units.

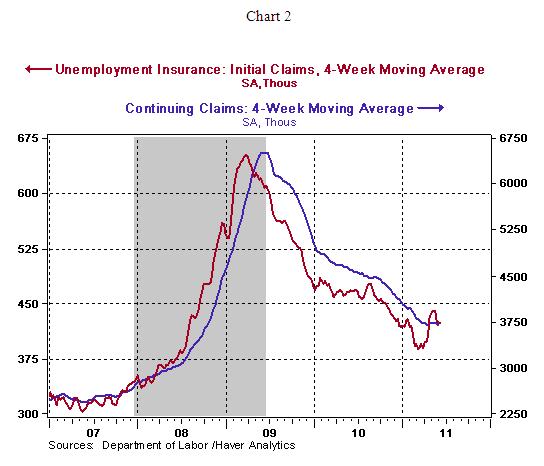

Initial jobless claims fell 16,000 to 414,000 during the week ended June 6. Continuing claims, which lag initial claims by one week, also declined 21,000 to 3.675 million. The level of initial jobless claims after eight quarters of economic growth is troubling and will keep the Fed on hold for several months ahead.

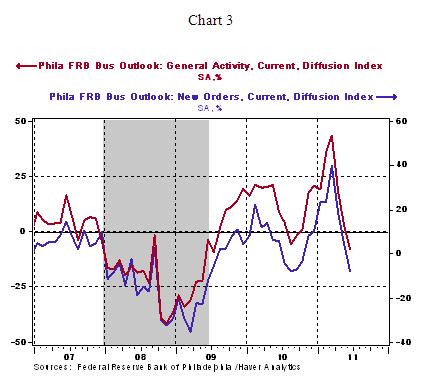

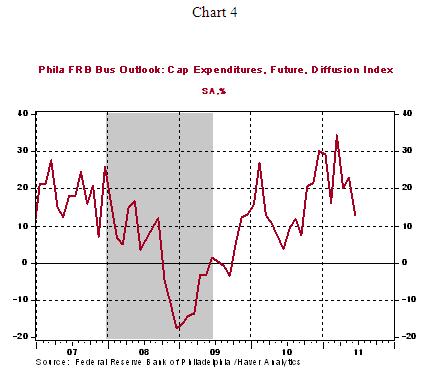

Factory sector activity appears to be experiencing a sluggish phase. The factory sector survey from the Federal Reserve Bank of Philadelphia suggests a weakening of activity in June. Indexes of overall business activity and new orders turned negative. Indexes tracking employment and shipments fell but remained positive (see Chart 3). Plans for capital expenditures in the next six months are discouraging (see Chart 4) as the index fell in June implying that fewer firms have plans to increase capital expenditures compared with the situation in May. As noted in June 15 edition of the daily commentary, are regional factory surveys pointing to a drop in the ISM manufacturing survey's composite index in June?

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.