Gold Bear Raid?

Commodities / Gold and Silver 2011 Jun 15, 2011 - 01:30 PM GMTBy: Brian_Bloom

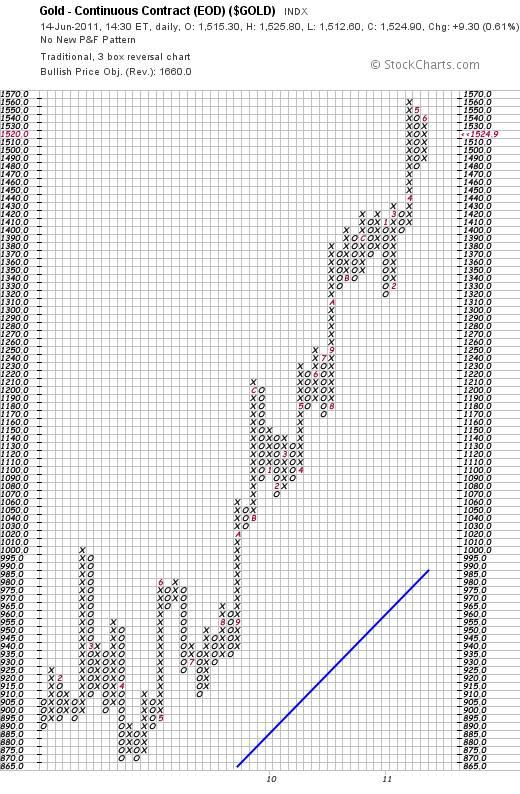

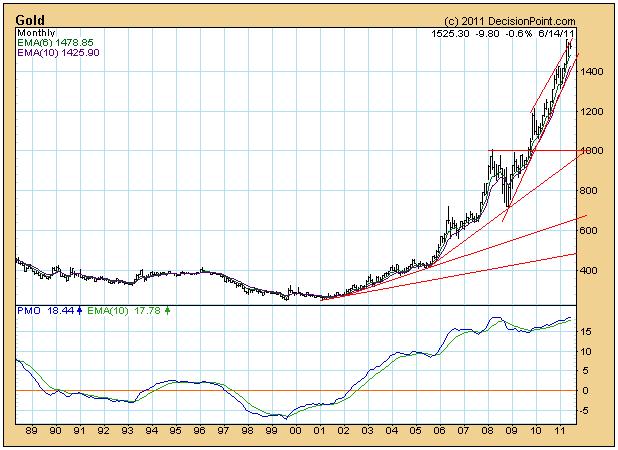

I am not pessimistic on gold. I am a long term bull. But the charts are signalling that the gold price is facing risks.

I am not pessimistic on gold. I am a long term bull. But the charts are signalling that the gold price is facing risks.

It needs to bounce up from here in order to remain above its 50 day MA

(Charts reproduced from yahoo.com; Stockcharts.com, Decisionpoint.com)

If not, then $1480 next stop

MACD doesn’t look happy

MACD on weekly also looks like it wants to break down – reinforced by the position of RSI

$1410 looks like most logical support level

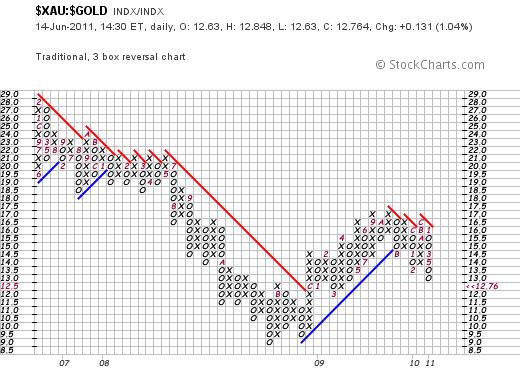

Relative strength chart (shares divided by bullion price) looking weak but also looks like it wants to bounce

Bounce may arise because shares are oversold

But look at the position of the 50 day MA relative to the 200 day MA. Crossover will represent a serious sell signal.

Conclusion

My interpretation of all of the above is that the gold price might consolidate whilst the shares bounce up. Thereafter, both may head south

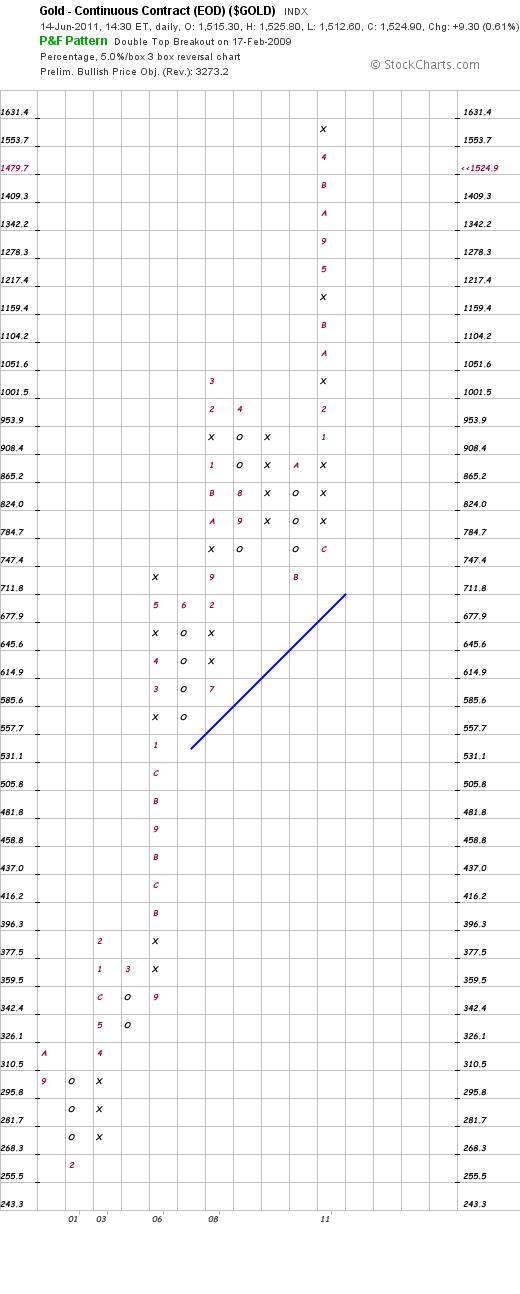

In terms of the chart below, the absolute price below which gold MUST not fall is $1340. If it does, it will be extremely vulnerable to further falls – from a technical perspective only. It “could” come all the way back to $1050 and still be in a strong bull trend.

Under what circumstances might it fall to $1050?

In my view, the Fed and the world’s Central Banks are fighting to keep the world economy on life support. The world economy seems to be deteriorating. Best outcome would be a slow deflation (devoid of panic). Best way to avoid panic is to suppress the gold price. We might be facing a bear raid on gold.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2011 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.