U.S. Core Wholesale Prices to Consumer Prices Pass Through is Not Here Yet

Economics / Inflation Jun 15, 2011 - 02:55 AM GMTBy: Asha_Bangalore

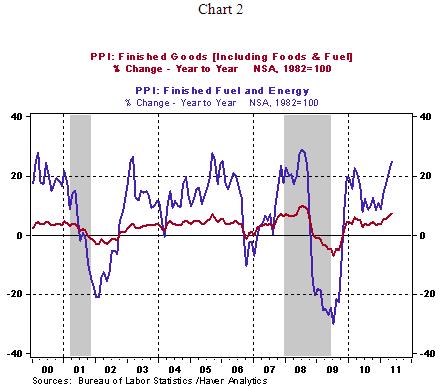

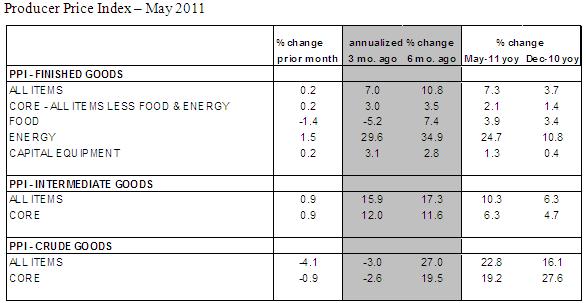

The Producer Price Index (PPI) of Finished Goods increased 0.2% in May, following larger gains in each of the past five months. A 1.5% jump in energy prices was offset partly by a 1.4% drop in food prices during May. The BLS indicated that energy prices accounted for a large part of the increase in the wholesale price index. Energy prices have risen for eight straight months.

The core PPI, which excludes food and energy, rose 0.2% in May after a 0.3% increase in the prior month. A 1.2% gain in the price of plastics explains part of the increase in the core PPI of finished goods. Women's clothing costs rose 0.3% in May, while house furnishings posted a 3.5% jump, the largest since 1981 and appears to be a one-off event.

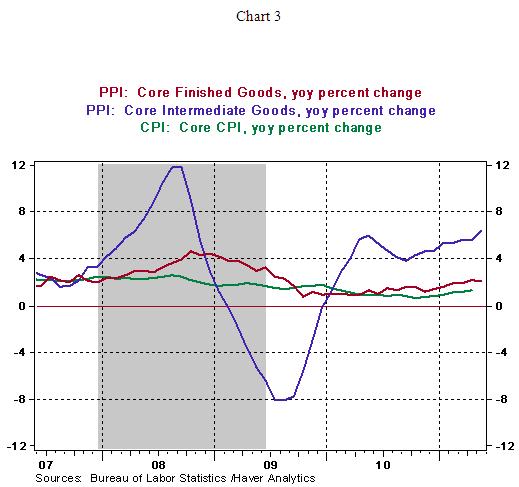

At the earlier stages of production, the intermediate goods price index and core intermediate goods price measure advanced 0.9% in May. The latter has risen for ten consecutive months and the increase in May is traced to higher prices of industrial chemicals. Despite the sustained upward of core intermediate goods prices and the core finished goods prices, core consumer prices show a mild upward trend, implying that a complete pass-through of higher wholesale prices to consumer prices is not visible, as yet.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.