Key Economic Reports Prior to June 21-22 FOMC Meeting

Economics / US Economy Jun 14, 2011 - 02:12 AM GMTBy: Asha_Bangalore

It is widely recognized that the U.S. economy has lost momentum in the second quarter. The FOMC meeting of June 21-22 and Chairman Bernanke's press conference of June 22 will focus on this aspect. In the meanwhile, a string of economic reports are scheduled for publication prior to the FOMC meeting. Of these reports, retail sales, Consumer Price Index, industrial production, and housing starts should be the major market movers and they will have a bearing on the policy outlook presented after the close of the FOMC meeting.

It is widely recognized that the U.S. economy has lost momentum in the second quarter. The FOMC meeting of June 21-22 and Chairman Bernanke's press conference of June 22 will focus on this aspect. In the meanwhile, a string of economic reports are scheduled for publication prior to the FOMC meeting. Of these reports, retail sales, Consumer Price Index, industrial production, and housing starts should be the major market movers and they will have a bearing on the policy outlook presented after the close of the FOMC meeting.

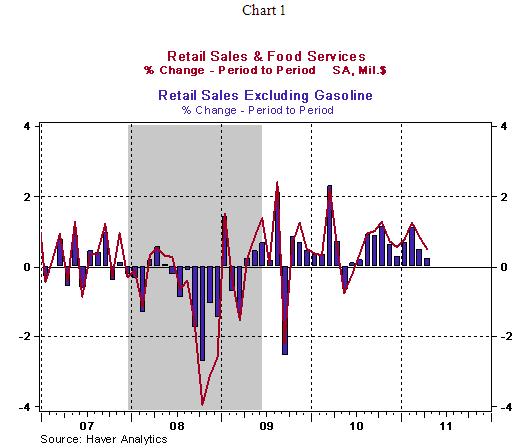

Retail sales excluding gasoline rose only 0.2% in April, while total retail sales showed a 0.5% increase. Based on April retail sales numbers, consumer spending in the second quarter is most likely to show close to a 2.0% annualized increase. The weakness in auto sales in May (11.79 million units vs. 13.22 million units in April) is another aspect that will be noted at the FOMC meeting. The Fed is on a watch-and-wait mode in the near term until demand and employment conditions improve. Retail sales are predicted to have risen 0.1% in May after a 0.5% jump in the prior month.

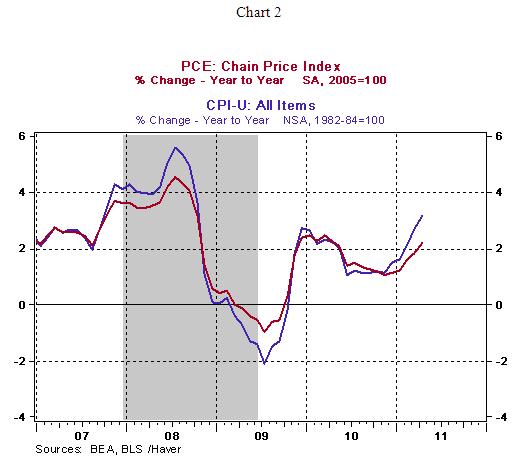

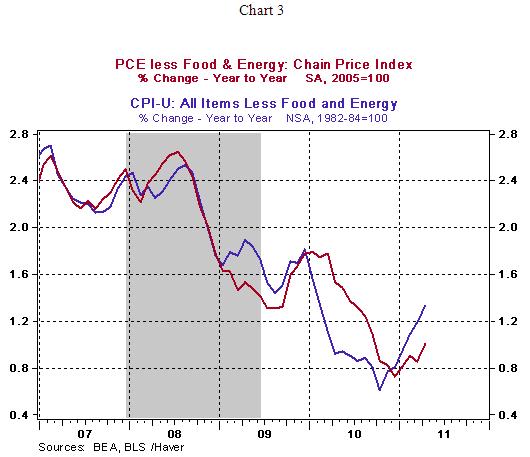

Overall inflation readings, lifted by higher food and energy prices, have risen above the Fed's tolerance mark of about 2.0%, (see Chart 2). The Fed's forecast for overall inflation in 2011 is 2.1% to 2.8% on a Q4-to-Q4 basis. The personal consumption expenditure price index posted a 2.1% increase on a year-to-year basis in April. Gains in core prices indexes, which exclude food and energy, are holding a little above 1.0% (see Chart 3). The Fed predicts core inflation to range between 1.3% and 1.6% in 2011.

Core inflation remains contained, as do inflation expectations, which the Fed is tracking very closely. Inflation expectations have declined to 1.99% (June 10, 2011) from a high of 2.45% (April 29, 2011) following Chairman Bernanke's press conference on April 27. Excluding energy prices, the CPI is most likely to show another benign monthly reading, which should allow the Fed to maintain its current easy stance. The CPI in May is expected to show a mild gain of 0.1% and the core CPI is also predicted to show a similar increase.

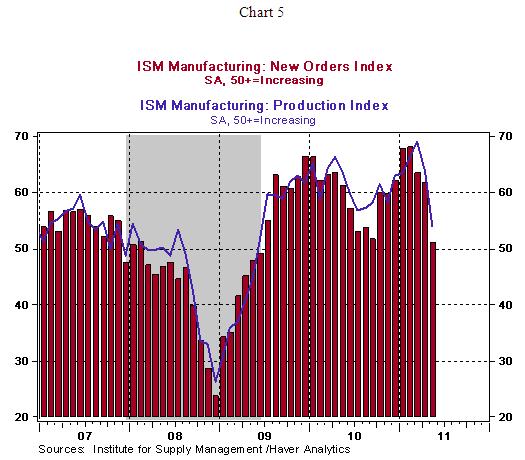

After the plunge in the new orders and production components of the ISM manufacturing survey in May (see Chart 5), actual factory production data from the industrial production report should indicate if, in fact, factory production slowed in May. The 0.1% increase of the manufacturing man-hours suggests a tepid increase in factory production during May.

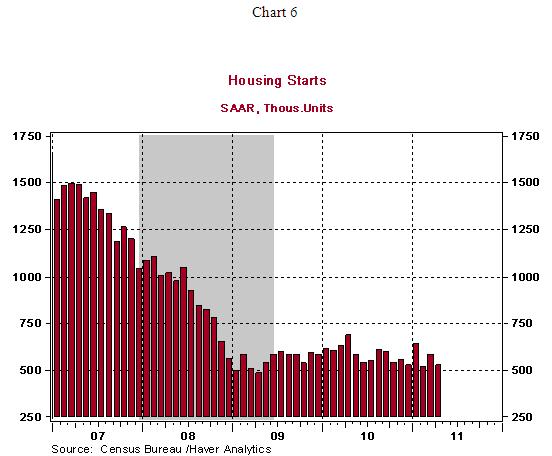

The housing sector, a major source of concern for policy makers, is moving sideways in recent months. Housing starts are continuing to move along cycle lows (see Chart 6). Housing starts fell 10.6% in April to an annual rate of 523,000, which is close to the record low mark of 478,000 seen in April 2009. Housing permits for multi-family units fell 7.7% in April, while that of single-family units eked out a small increase of 0.8%. These numbers augur poorly for housing starts in April. The bottom line is that economic reports of this week are most likely to suggest that conditions are not favorable for a tightening of monetary policy in the near term and that additional support may be necessary later in the year.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.