Government Attacks on Gold Retailers and Student Loan Debtors

Commodities / Gold and Silver 2011 Jun 12, 2011 - 02:33 AM GMTBy: Jeff_Berwick

We have been writing here at The Dollar Vigilante for nearly one year exactly, this coming July 1st, about such things as getting your gold outside of the control of your own government and about how US student loans are an entrapment for, what we believe, will be military conscription.

We have been writing here at The Dollar Vigilante for nearly one year exactly, this coming July 1st, about such things as getting your gold outside of the control of your own government and about how US student loans are an entrapment for, what we believe, will be military conscription.

Canadian Government Raids Reputable Gold Retailer

In our subscription newsletter we warn subscribers every month to geo-politically diversify their gold holdings and to keep a significant portion outside of their home country. We speak about it at nearly every investment conference and we have written about it numerous times in our Blog, including in the blog piece from last September entitled, "Get Your Gold Out of the US". Interestingly, in that blog piece we also nominated now famous, Anthony Weiner, for our IPOD (Idiot Politician Of the Day).

In that piece we warned about how the US Government was looking to "regulate" gold selling companies. Regulate is a code-word for, take-over, destroy or monopolise.

We have been warning that we expect this to happen regularly and today in Canada it did.

Kitco, a highly respected gold retailer, was raided by the Canadian province's version of the I.R.S. today. Revenu Quebec, the province's tax collector, didn't press charges but says it has "reason to believe" that Kitco AND other gold retailers have avoided paying more than $150 million in taxes.

Kitco has been a highly respected and reputable precious metals dealer for decades in Canada and it is highly, highly unlikely that they have done anything improper.

What is much more likely is that the Government has begun to crack down on gold retailers. Something we have warned about repeatedly.

It is for this reason that we advise subscribers to keep their gold holdings widely diversified amongst numerous countries, institutions, companies and locations to give yourself the best chance of avoiding being attacked and robbed by the government.

We often recommend some of the best countries and companies with which to store gold in our newsletter. Often these vaults are located in capitalist, free-market non-western countries such as Hong Kong, Singapore and in freedom stalwarts such as Switzerland.

We expect many more of these types of attacks so if you have not diversified your gold holdings - especially outside of the control of your own home government - time is running out.

US Government S.W.A.T. Team Raids Man Over Student Loan Debts

In our May 26 editorial, "The Door is About to Shut for Americans", we stated the following:

"A 2005 decree from the Bush Administration stated that student loan debt could not be dissolved through bankruptcy proceedings. The only other scenario where this "no-escape" clause exists is debt from criminal acts and debt from fraud. In other words, student loan debt is seen, by the US Government, as being similar to proceeds from crime!

What will this mean with more young Americans in student loan debt than any other time? It's anyones guess but it would not be out of the realm of possibility to force students who can not pay off their debt into the military to repay their debt."

We also commented in March about the Department of Education buying shotguns that they were soon going to crack down hard on people who owe student loans.

This week that also came true.

A man with no criminal record, whose estranged wife owed money on student loans, had his house raided by a 15 member S.W.A.T. team and was pulled out onto his lawn at 6am and put him and his children in a squad car to be interrogated for six hours (see video here).

Time Is Running Out to Protect Yourself From TEOTMSAWKI

If you have been listening to our advice but think you still have a number of years to square your affairs before The End Of The Monetary System As We Know It (TEOTMSAWKI) you are taking inordinate risks tantamount to standing in the middle of the track at a live NASCAR race and thinking you might have a few minutes before you get hit so why rush.

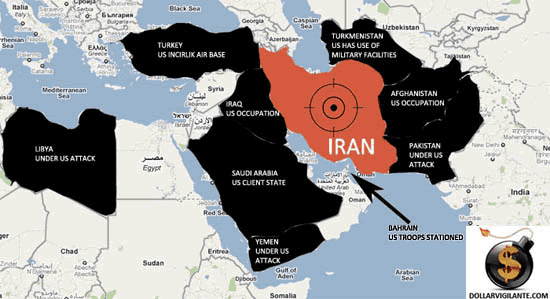

We here at TDV are tracking all of the geopolitical actions that appear to be all aligning for what could be one very hot summer. With QE2 scheduled to wrap up on June 30 the US Government will likely be targeting a major event on or around that date to take the public's mind off of its outright bankruptcy. What form this takes is anyone's guess. A forced default by Greece leading to a Euro crisis? An attack on Iran, as has been planned for the last decade and with the US now having Iran practically surrounded?

Or perhaps another false flag attack in Europe or inside the US?

If you haven't yet moved to get significant assets outside or the financial system and outside of the control of your home government you should run, not walk, to do so.

And if you don't have significant assets you should be looking at investing anything you have into items such as precious metals and gold stocks now. If any of the above occurs we could see 10,000%+ type gains on gold stocks and 1,000%+ gains on precious metals.

We think this is going to be one long, hot summer.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.