NYMEX Crooks (alleged) Crude Oil Futures Fake Out Scam

Commodities / Crude Oil Jun 11, 2011 - 06:09 AM GMTBy: PhilStockWorld

The CROOKS (allegedly, just indictments so far) at the NYMEX are running a scam and they have NO INTENTION WHATSOEVER of accepting delivery of even 1/10th of the 367M barrels they had as open contracts last week. In fact, Wednesday (June 8) they traded their contracts 454,043 times - isn't that amazing? It's a 123% daily churn rate! Of course, it's easy to churn 454M barrels of crude because the only sucker that ends up paying for all those fees is YOU, the end consumer of crude. All those fees are passed on to you as part of the price of oil.

The CROOKS (allegedly, just indictments so far) at the NYMEX are running a scam and they have NO INTENTION WHATSOEVER of accepting delivery of even 1/10th of the 367M barrels they had as open contracts last week. In fact, Wednesday (June 8) they traded their contracts 454,043 times - isn't that amazing? It's a 123% daily churn rate! Of course, it's easy to churn 454M barrels of crude because the only sucker that ends up paying for all those fees is YOU, the end consumer of crude. All those fees are passed on to you as part of the price of oil.

Don't forget to thank Uncle Lloyd and Uncle Jamie (who was whining to Uncle Ben about how stopping him from screwing over taxpayers is bad for the economy), when you fill up your tank, as Exxon's CEO Rex Tillerson told us last week, without those speculators, a barrel of oil would be $70. You can see Jamie sweating as President Obama said a Justice Department probe will examine the role of “traders and speculators” in oil markets and how they contribute to high gas prices. “The attorney general’s putting together a team whose job it us to root out any cases of fraud or manipulation in the oil markets that might affect gas prices, and that includes the role of traders and speculators,” Obama said April 21st in Reno, Nevada. “We are going to make sure that no one is taking advantage of American consumers for their own short-term gain.”

The group, which includes representatives of federal agencies and state attorneys general, will check for fraud, collusion or misrepresentation at the retail and wholesale level, the Justice Department said in a statement last week. The group also will examine investor practices and the role of speculators and index traders in oil futures markets. One can only hope that Dimon's squeaky wheel will get the grease (prior to having a Government probe shoved up his ass!).

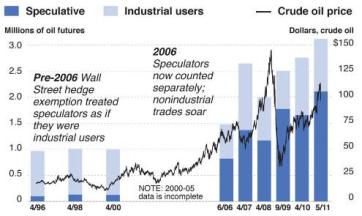

Goldman Sachs and Morgan Stanley today are the two leading energy trading firms in the United States. Citigroup and JP Morgan Chase are major players and fund numerous hedge funds as well which speculate, and let's not forget the Fabulous and Alleged Koch Brothers (I say "Fabulous and Alleged" because, if you don't, you hear from their attorneys, which is why no one ever says anything about that alleged scam!). In June 2006, oil traded in futures markets at some $60 a barrel and a Senate investigation estimated that some $25 of that was due to pure financial speculation. That would mean today that at least $40 of more of today’s $101 a barrel price is due to pure hedge fund and financial institution speculation. However, given the unchanged equilibrium in global oil supply and demand over recent months amid the explosive rise in oil futures prices traded on Nymex and ICE exchanges in New York and London, it is more likely that as much as 60% of today oil price, is pure speculation.

No one knows officially except the tiny handful of energy trading banks in New York and London and they certainly aren’t talking. But I will point out that oil traded between $35 and and $50 between November of 2008 to May of 2009 - AND NO OIL COMPANIES HAD A LOSING QUARTER!

What does that tell you about the real cost of oil? It's not XOM that makes the lions' share of the excess profits as speculators drive the price of oil from $40 to $100, it's JPM, GS et al and THEY HAD LOSING QUARTERS when they were unable to rip off the American public for an extra 100% at the pumps through their blatant manipulation of the energy markets (allegedly).

I am harping on this theme this week because we, the American people, have an excellent opportunity to do what I very much doubt Obama's investigation will be able to - we can stop energy speculation and drive prices back down and all we have to do is agree to sell oil to these jackasses for $101 a barrel. Last Wednesday, I pointed out that there were 367,620 open contracts (1,000 barrels per contract) on the NYMEX at $103 per barrel and I said that the number was total BS and that real demand was 35M barrels at most. One week later, how many contracts are still open for July delivery?

288,420! In just one week, we have pressured them into closing 22% of the contracts by simply offering to sell them the contracts at $103 - oil fell all the way to $97.24 as speculators would much rather take a $456,192,000 loss on the 79,200 barrels they dumped (so far) than get stuck accepting delivery of 79,200,000 barrels of oil that they pay us $8,157,600,000 for (at $103). We "sell" them the barrels by taking naked short positions, using the same loophole in the NYMEX that the speculators are using to fake their demand. We, of course, don't have any oil to deliver and the contracts require us to do so by July if we are foolish enough to hold them to expiration on June 21st.

So Futures Trading is petty much a very dangerous game of financial chicken - they have no intention of buying barrels of oil (because they have no use for them at all) and we have no intention of selling them (because we don't have oil wells) and you can lose Billions as easily as you can make them. What we are doing is accepting their fake offers to buy oil, which is what they do to drive up the prices. Then people like the Kochs (allegedly) and JPM (who hire supertankers to take oil off the market so they can flip it for a profit), who do have access to physical crude, can shift costs of their artificial shortages to the American consumers, who end up paying 100% or more than the oil is actually worth in an unmanipulated market.

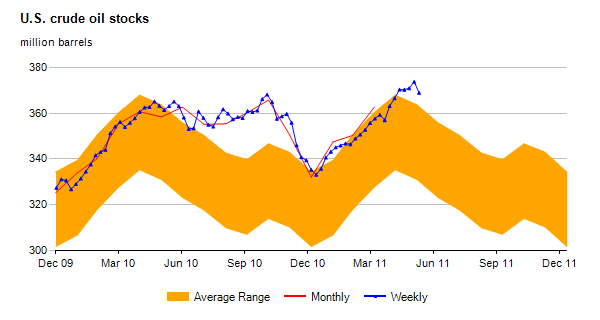

On a global basis, this is a $2.5 TRILLION annual scam that funnels money from the bottom 99% to the top 1%, but mostly to the top 0.01%. Those guys will do ANYTHING to keep the price of oil as high as possible, no matter how much suffering it causes and no matter how much damage it does to the Global economy. The scam works because nobody calls their bluff - these speculators do not REALLY want 288,420,000 barrels of oil delivered to them in July. That would cost them (at $101.60) $29.3 Billion! It's not just the cost of the oil, they would also have to find a place to put 288M barrels of oil and the US storage system is full. So once we drop 1,000 barrels off in Jamie's garage and put another 2,000 barrels in Lloyd's swimming pool (84,000 gallons) - they begin to run out of space pretty quickly. That's the formula that can give us our "Trading Places Momemt":

IN PROGRESS

How do Winthorpe and Billy Ray get rich while bankrupting the Kochs Dukes? The Dukes are nothing but vile speculators who feel they have inside information and are attempting to buy up all the frozen orange juice futures ahead of the crops report. They instruct their floor trader to buy contracts at pretty much any price, expecting to sell at an even higher price once the data is announced. Obviously, the two old men have no interest in buying Billions of gallons of orange juice for physical delivery. In fact, they are buying all those contracts on margin, using the tremendous leverage of futures contracts to control hundreds of times more orange juice than they can possibly afford to buy.

So, to totally screw speculators like these guys, all you have to do is what Billy Ray and Winthorpe do in this clip. They wait until the speculators drive the price past any reasonably affordable level and then they simply accept their offers to buy. The speculators, especially at the NYMEX where they churn over 100% of the contracts every day, operate under the assumption that NOBODY actually wants oil and they are all in on the same scam, just churning their barrels and racking up fees that will be passed along to the American consumers - until they can roll their open contracts to the next month and do it all over again.

We throw a wrench into the works by simply accepting their offers to buy and NOT flipping them over. As the day drags on and more and more people accept the buy orders but don't have the courtesy to flip the barrels back into the churn, the speculators begin to rack up more and more open contracts and that costs them more and more margin and suddenly, it's not a funny little clubby game anymore, now someone (us) actually EXPECTS them to pay us $29.3Bn for the 288M barrels they pretended to want.

What can they do about it? Well, they could screw us by pretending to want another 200M barrels at $105. That would hit us for a $4 loss per contact at $5 per penny or $2,000 and, when we capitulate, we have to BUY contracts (because we only pretended we had oil to sell when we naked shorted) to cover our sales. That causes what is called a "short squeeze" as people who had short positions are forced to buy to cover, further driving up prices. That's why we scale in and scale out of positions and use razor-tight stops at our resistance lines. If they want to take oil up to $105 again - that's fine with us, we'll lose a few nickels along the way but they'll have to come up with another Billion Dollars to accept delivery.

That's the danger of shorting the futures but I will tell you now as I told you last week, it's not very likely because THEY DO NOT WANT 288M barrels of oil to be delivered to them in July and they will panic and they will sell those barrels until there are LESS than 40M barrels left to deliver. In order to get out of their obligation to buy oil from us for $101.60, they have to find another buyer but, if only 14% of the contracts remaining have real buyers - that should prove difficult.

On Wednesday, OPEC failed to come to a supply agreement and Obama said he would release oil from the Strategic Petroleum Reserve if necessary and also, we had an oil inventory report that showed a 2M barrel BUILD in gasoline over the holiday weekend, indicating a tremendous drop in demand. You would think that would drive prices DOWN but, instead, oil went UP yesterday, from $98 at 8:30 am to $101.89 at 12:30. As we planned yesterday morning, we waited patiently for our target to be hit and then we went short again.

I frankly didn't expect to get another chance to stick the speculators for oil at $101.60 but here we are this morning as Criminal Narrators Boosting Crude on TV this morning are pulling out all the stops to create the impression that there is suddenly a shortage of oil. You will never see the above chart of the US Crude Stockpiles on television because oil companies and speculative IBanks are their primary advertisers (along with Monex, but that's another post) so all you will hear is an endless supply of BS with "analysts" who lie to the public and use the whoreish (for lack of a better word) Mainstream Media to play to retail investors fears and drive an endless stream of suckers into speculative bets that have no fundamental basis whatsoever.

It's important to bring in the retail crowd. They are the "bag holders" who end up taking the contracts off the IBanks hands at the very top of the market (usually a couple of days after GS predicts $200 oil) and they are the suckers who have their 401K money tied up in doomed ETFs like USO, which was at $40 in June of 2009, when oil was $70 a barrel and is still at $40 with oil at $101.60 a barrel. What a stupid F'ing thing to buy! Yet retail bagholders own $1.4Bn worth of futures contracts and, even worse, THEY TELL THE HEDGE FUNDS WHAT THEY ARE GOING TO TRADE IN ADVANCE! No wonder the people who invest in this POS get raped on a monthly basis!

Most commodity ETFs are just clever ways to screw retail investors into taking delivery of whatever hedge funds are dumping but, as you can see from the above chart, USO is one of the worst as their constant rolling over of contracts and 0.45% "management expenses" virtually guarantees long-term holders nothing but PAIN. If you want to invest in oil long-term, buy XOM - they are UP 40% over the same period (and they pay a 2.4% dividend while you wait. All you are doing when you buy USO is the same thing the speculators are doing at the NYMEX, pretending you want oil that you will never accept delivery of so all you can do is hope to find a bigger sucker tomorrow to take the contract off your hands. As you can see from the performance of USO - there are no bigger suckers - the buck (or the barrel) stops right there!

To be clear, if you are playing along at home, futures trading is dangerous! If you are going to play you need to scale in and use stops, as outlined in last week's post. You also need to take profits and run on small reversals - we discuss those pivot points every day in Member Chat but you can just keep in mind that every 0.25 cross is very significant and, if we are lucky enough to get that big of a move, we usually use that .25 line as our next stop. That means we ride these contracts down in a series of .25, .50 and $1 moves and we stop out with .05 losses - see the logic? All we have to do is count on the speculators to keep bidding their contracts up once we leave them alone and then we get a chance to short them again.

As we get closer to June 21, the game becomes much more serious - kind of like playing chicken at a cliff! Just make sure you are the first one to slam on the brakes, not the last and make sure you have a professional investment adviser to help you manage the trades but, if we can get 288,000 people to short just one contract each, we can stick these bastards for Billions of losses and, eventually, the game will fold and this whole country will reap the benefits.

I will update our progress each day between now and the 21st - a great experiment in audience participation!

Try out PSW's Stock World Weekly, free, here >

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.