HUI Gold Stocks Index Heading for Severe Prolonged Correction

Commodities / Gold & Silver Stocks Jun 11, 2011 - 05:01 AM GMTBy: Ronald_Rosen

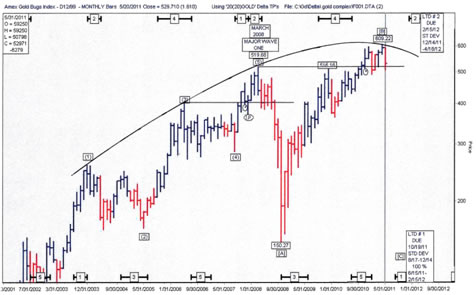

In the month of March 2008 the HUI reached a high of 519.68. For the first time since April 2008 the black line of the monthly MACD indicator has bearishly crossed beneath the red line. Each crossing led to a prolonged and severe correction. The current bearish crossing should also result in a severe and perhaps prolonged correction.

In the month of March 2008 the HUI reached a high of 519.68. For the first time since April 2008 the black line of the monthly MACD indicator has bearishly crossed beneath the red line. Each crossing led to a prolonged and severe correction. The current bearish crossing should also result in a severe and perhaps prolonged correction.

HUI MONTHLY

The XAU is below its high of March 2008. This means that the XAU has not only gone nowhere, it has gone down over a 38 month period. This occurred while gold was rising over 50 % in price.

XAU MONTHLY

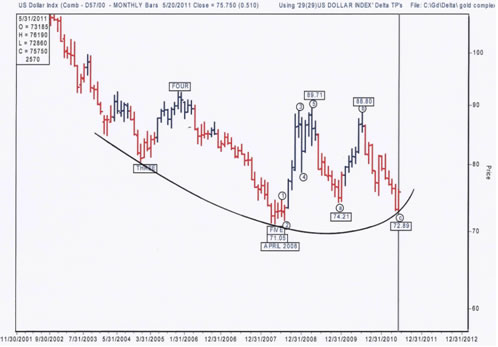

A French curve applied to the monthly chart of the HUI and the Dollar Index shows that the HUI is ready to move down and the Dollar Index is ready to move up. These charts demonstrate that since 2001 their movements have been mostly coordinated but in opposite directions.

HUI MONTHLY THE PRESSURE IS DOWN

DOLLAR INDEX MONTHLY THE PRESSURE IS UP

The extended period of time that the shares have refused to rise while gold has increased in value by more than 50% indicates that, “Something is rotten in Denmark.”

“This is one time when the popular misquotation—"Something's rotten in Denmark"—is a real improvement on the original. But you ought to be careful around purists, who will also remember that the minor character Marcellus, and not Hamlet, is the one who coins the phrase. There's a reason he says "state of Denmark" rather than just Denmark: the fish is rotting from the head down—all is not well at the top of the political hierarchy.”

http://www.enotes.com/shakespeare-quotes/something-rotten-state-denmark

The essence of this statement that, “… all is not well at the top of the political hierarchy.” is most appropriate for many countries, first and foremost the United States of America. Let us hope that the ghosts of our Founding Fathers get angry enough to rise up and straighten out the political culprits so involved.

HUI MONTHLY

For the first time since October 2008 the HUI has closed below its rising trend line.

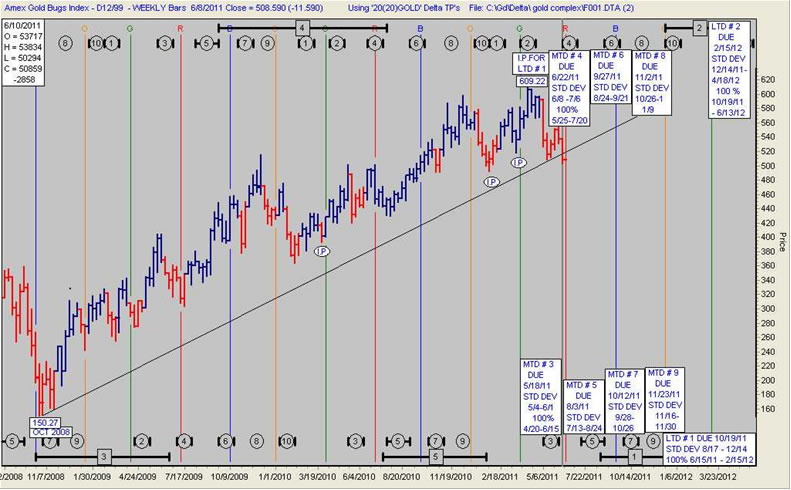

Some months from now when the HUI and the XAU finally bottom, there will most likely be many who say that they won’t ever buy those “damned” gold shares again.

HUI WEEKLY

The ROSEN MARKET TIMING LETTER is available through Welles Wilder’s Delta Society International. Once there, click on Products and Services. If you are interested in knowing when we believe the HUI and XAU have bottomed, the cost of a subscription is $35.00 a month and may be cancelled at the end of any month. www.deltasociety.com

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.