Bernanke - Accommodative Monetary Policy is Still Necessary

Interest-Rates / US Interest Rates Jun 08, 2011 - 03:02 AM GMTBy: Asha_Bangalore

If financial markets were expecting hints about QE3, Bernanke did not offer it in today's speech. However, he noted that "the Committee also continues to anticipate that economic conditions are likely to warrant exceptionally low levels for the federal funds rate for an extended period."

If financial markets were expecting hints about QE3, Bernanke did not offer it in today's speech. However, he noted that "the Committee also continues to anticipate that economic conditions are likely to warrant exceptionally low levels for the federal funds rate for an extended period."

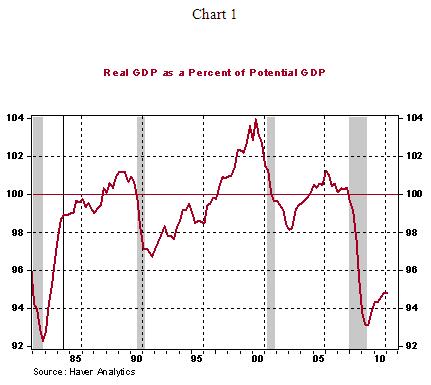

He also indicated that "although it is moving in the right direction, the economy is still producing at levels well below its potential: consequently, accommodative monetary policies are still needed. Until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established." Chairman Bernanke remains frustrated about the loss momentum as seen in recent economic indicators but he expects improved conditions in the second half of the year. Essentially, in the months ahead, the Fed will remain on the sidelines with the federal funds rate holding at 0%-0.25% for an extended period.

Consumer Borrowing: Details Suggest Caution in Drawing Conclusions

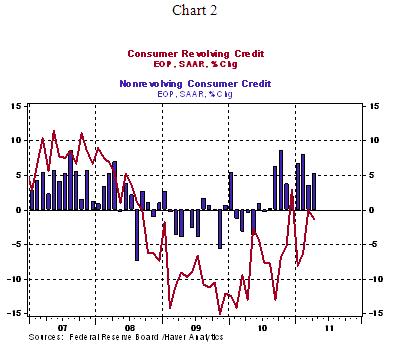

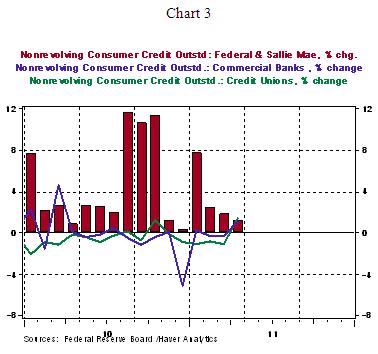

Consumer credit increased for seventh straight month, which is good news. The gains were entirely from the non-credit card loan category. In April, loans extended by commercial banks and credit unions rose in addition to student loans. However, during October 2010 - March 2011, a large part of the increase in consumer credit was entirely student loans (see Chart 2 and 3).

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.