Inflation Expectations Reflect Slowing U.S. Economic Conditions

Economics / Inflation Jun 03, 2011 - 02:31 AM GMTBy: Asha_Bangalore

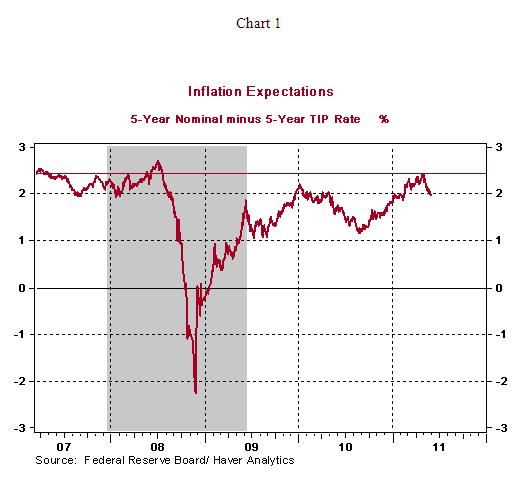

Latest economic data (ISM manufacturing survey results for May, auto sales of May, factory production of April, consumer spending of April) underscore the shift in business momentum to a slower pace during the past two months. Consistent with this change, inflation expectations have declined.

Inflation expectations, as measured by the difference between the 5-year nominal Treasury note yield and inflation protected security, stood at 1.99% as of June 1, down from a recent high of 2.45% on April 29, the Friday after Chairman Bernanke's first press conference. At this press conference, Bernanke indicated that "unmoored" inflation expectations could trigger a tightening of monetary policy even if the jobless rate remained at an elevated level. The latest readings of inflation expectations support the Fed's current easy monetary policy stance.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.