Agricultural Commodities Sector Remains Attractive: 'A Sense of Panic'

Commodities / Agricultural Commodities Nov 21, 2007 - 02:14 AM GMTBy: Joseph_Dancy

We continue to add to positions that should benefit from a strong global agricultural sector. Like the mining and energy sector, long term capital investments in this sector have lagged, especially in light of growing global demand for grains.

We continue to add to positions that should benefit from a strong global agricultural sector. Like the mining and energy sector, long term capital investments in this sector have lagged, especially in light of growing global demand for grains.

Recent events have occurred in the sector which are of interest to investors:

Wheat prices on the Chicago Board of Trade set record highs 23 times in the three months ended October 1 st after weather hurt crops from Canada to Australia. Global reserves will fall to 107 million tons from 123 million tons last year, the U.S. Department of Agriculture said.

-

Wheat and milk prices have surged to all-time highs while those for corn and soybeans stand at well above their 1990's averages. Rice and coffee have jumped to 10-year records and meat prices have risen recently by up to 50 per cent in some countries. “The world is gradually losing the buffer that it used to have to protect against big swings [in the market],” says Abdolreza Abbassian, secretary of the grains trading group at the U.N.'s Food and Agriculture Organization. “There is a sense of panic.”

-

The tightest world grain stocks in about 30 years are contributing to rising food inflation, fueling worries about food shortages in some countries and straining international aid budgets. Russia recently imposed taxes on barley and grain exports to control domestic food prices before pending presidential elections. India, Yemen, Mexico, Burkina Faso and several other countries have had, or been close to, food riots in the last year, something not seen in decades of low global food commodity prices.

-

Food prices are likely to stay elevated. Global demand is so strong that record crops are needed just to keep up: World wheat consumption has outpaced production for much of the past decade. Better crops next year will not likely allow for significant rebuilding of the grain stockpile due to increasing demand in surging economies such as China and India, according to an October report by the U.N. Food and Agriculture Organization, which characterized the outlook as "grim."

-

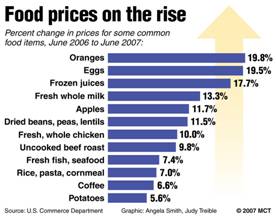

Grain prices, along with higher energy and other costs, are rippling through the agricultural sector. Tight supplies have increased domestic and international demand for alternative feed grains, including barley and sorghum. In the USA, the average price for a loaf of bread is up 11% over the past 12 months. Ground beef has risen 6%, chicken is up 9%, and eggs are up 31%. Overall U.S. food inflation is running 5.6% so far this year, compared with 2.6% for all of 2006. Consumers spend about 10% of take-home pay on food.

-

Food security is not a new concern for countries that have battled political instability, droughts or wars. But for the first time since the early 1970's, when there were global food shortages, it is starting to concern more stable nations as well. “The whole global picture is flagging up signals that we're moving out of a period of abundant food supply into a period in which food is going to be in much shorter supply,” says Henry Fell, chairman of Britain's Commercial Farmers Group.

-

Soaring food and energy prices could trigger political upheaval and riots in developing countries according to experts at the United Nations. Food prices are booming: the Food and Agriculture Organization's food price index in July stood at its highest level since its inception in 1990, and was almost 70 percent higher than in 2000.

-

-

Ned Schmidt, editor of the Agri-Food Value View, prepared the chart above He notes that “as the chart shows, prices are telling investors that the world is generally short Agri-Foods. Investors attuned to these price signals have benefited, and will likely benefit for a decade or more.”

-

Record world prices for most staple foods have led to 18% food price inflation in China, 13% in Indonesia and Pakistan, and 10% or more in Latin America, Russia and India, according to the U.N. Food and Agricultural Organization. Wheat has doubled in price, maize is nearly 50% higher than a year ago and rice is 20% more expensive, says the U.N. Next month the U.N. is expected to say that global food reserves are at their lowest in 25 years and that food prices will remain high for years.

By Joseph Dancy,

Adjunct Professor:

Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2007 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.