Central Banks Monetary Policy Week in Review

Interest-Rates / Central Banks May 28, 2011 - 02:50 PM GMTBy: CentralBankNews

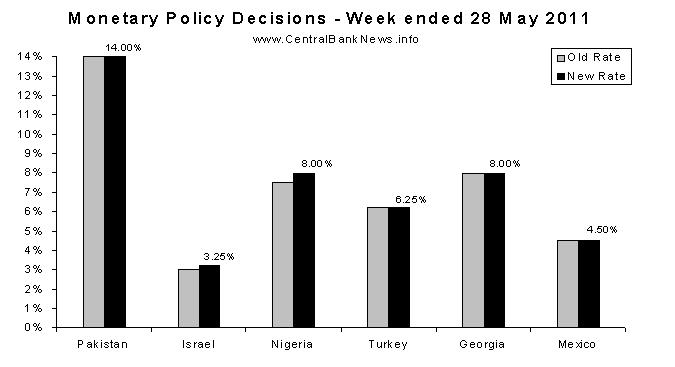

The past week in monetary policy saw six emerging market central banks announce interest rate decisions. Those that altered interest rate levels were: Israel +25bps to 3.25%, and Nigeria +50bps to 8.00%. Meanwhile those that held interest rates unchanged were: Pakistan 14.00%, Turkey 6.25%, Georgia 8.00%, and Mexico 4.50%. The Central Bank of Nigeria also raised its bank cash reserve requirement by 200bps to 4% from 2%.

Looking at the central banks that held monetary policy settings unchanged, there was a growing sense of a need to balance growth risks with inflation risks. Indeed some of the messaging in their media releases included points about increasing risks to the global growth outlook, meanwhile inflation risks are seemingly tapering off in most places, particularly as higher policy rates and stabilizing commodity prices take effect. However the actions of Israel and Nigeria show that the inflation threat for emerging markets is certainly not over yet, particularly in those economies that are still growing strong. Indeed, as we saw last week there are still inflation hot spots in emerging markets like Vietnam, which has undertaken significant policy tightening.

Next week will be relatively quiet on the monetary policy front, but with several central banks announcing policy decisions in the following week. Central banks scheduled to announce interest rate decisions next week include: the Central Bank of Russia (expected to hold at 8.25%) on the 30th, the Bank of Canada (expected to hold at 1.00%) on the 31st, and the Bank of Thailand (expected to raise its interest rate 25bps to 3.00%) on the 1st of June.

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/05/monetary-policy-week-in-review-28-may.html

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.