Gold Strengthens in Real Terms

Commodities / Gold and Silver 2011 May 27, 2011 - 01:54 PM GMTBy: Jordan_Roy_Byrne

My favorite form of technical analysis is intermarket analysis which is the comparison of various markets and sectors. All markets relate in one way or another. The current market cycle is being dominated by macro-related events. Since all markets have had a stronger link than in the past, it makes intermarket analysis very important. By analyzing markets in the context of one another we can decipher or confirm the cycles within the current secular trends.

My favorite form of technical analysis is intermarket analysis which is the comparison of various markets and sectors. All markets relate in one way or another. The current market cycle is being dominated by macro-related events. Since all markets have had a stronger link than in the past, it makes intermarket analysis very important. By analyzing markets in the context of one another we can decipher or confirm the cycles within the current secular trends.

Most markets and sectors are digesting recent gains after a very strong run in the past six months. Recently we’ve pointed out that Bonds have caught a bid. More importantly, Gold is strengthening in real terms for the first time since the start of QE 2. Gold outperforms ahead of inflation and underperforms the Commodities sector during an inflationary phase.

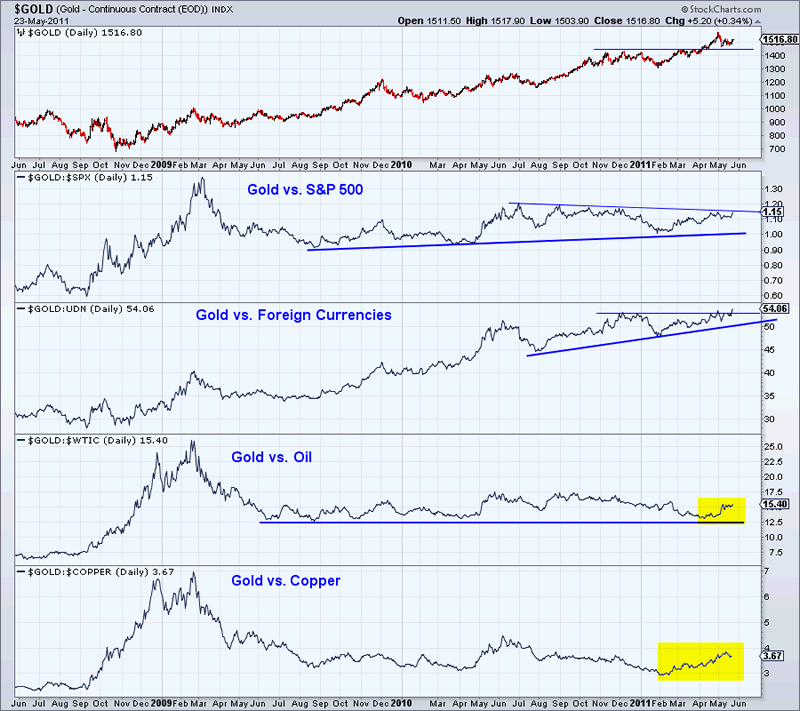

Below we chart Gold against other markets.

Note that Gold priced in foreign currencies reached a new all-time closing high today. Keep an eye on Gold against the S&P 500. It is not far from reaching a two year high. Meanwhile Gold is strengthening against Oil and Copper.

Why should we care?

Since early 2009, Gold has actually underperformed equities and Commodities. When the economy rebounds, Commodities will outperform Gold. When the economy is stagnant and there is the threat of inflation or deflation, Gold will outperform. Also, as we’ve written numerous times, the real price of Gold is a leading indicator for the gold shares. The real price of Gold was stagnant over the past nine months and that is why the gold shares haven’t performed as well as anticipated.

With equities nearing multi-year resistance and the economy at risk of rolling over, Gold is currently quietly reasserting its strength against all other classes (except Bonds). This is the type of activity that precedes big moves in the metal and in the shares. This is setting the stage for the move out of conventional assets like equities and Bonds and into Gold.

To find out more about how we manage risk and volatility and what stocks we are following, then consider a free 14-day trial to our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.