Gold and Silver Profit Taking, U.S. Debt Default Risks Increase Insurance Costs

Commodities / Gold and Silver 2011 May 26, 2011 - 10:41 AM GMTBy: GoldCore

Gold and silver are lower today with profit taking, Chinese bond buying and increased risk appetite being cited for the price falls. Gold is marginally lower in all currencies and is 0.2% lower in U.S. dollar terms despite the dollar coming under selling pressure again this morning. Risky assets have recovered somewhat from recent losses with Asian and European equities and commodities receiving a bid.

Gold and silver are lower today with profit taking, Chinese bond buying and increased risk appetite being cited for the price falls. Gold is marginally lower in all currencies and is 0.2% lower in U.S. dollar terms despite the dollar coming under selling pressure again this morning. Risky assets have recovered somewhat from recent losses with Asian and European equities and commodities receiving a bid.

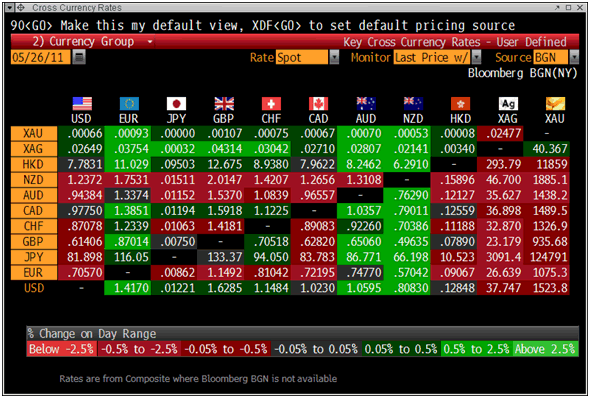

Cross Currency Rates

Reports of China buying Eurozone government debt may have led to a rise in the euro and equities. However, the scale of sovereign debt risk internationally is such that even significant and ongoing Chinese buying would be unlikely to contain the crisis.

Sovereign debt risks in Europe and internationally continue to threaten the increasingly fragile economic recovery.

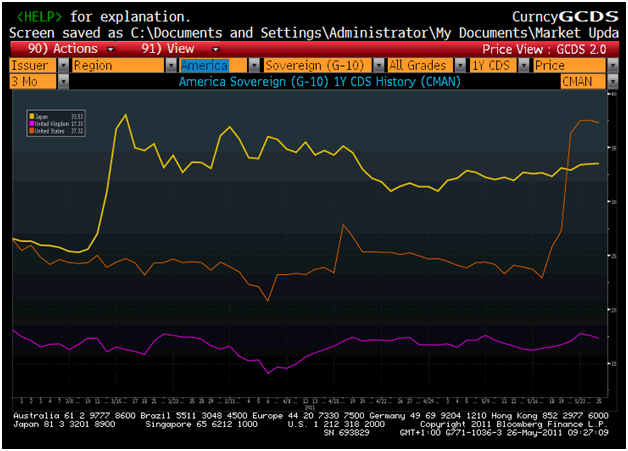

While most of the focus has been on Greece and Eurozone sovereign debt issues, the not insignificant risk posed by a U.S. sovereign debt crisis increases by the day. The risk of a US default continues to rise which can be seen in the sharply increased cost to insure U.S. sovereign debt.

Risk of a U.S. default can be seen in the credit default swap (CDS) market. 1 year U.S. CDS has risen from 23 to 37 or by 60% in the last six trading days (see chart below). According to this measure, the U.S. is now more likely to default than Slovenia and Indonesia in the next year.

US CDS 1 Year – 3 Month Duration – US (brown), Japan (Yellow), UK (Purple)

In the more liquid 5 year U.S. CDS, the cost to insure has risen by some 50% in the last week. The U.S. is considered more likely to default in 5 years time than South Africa, Malaysia, Panama, Brazil and Colombia.

Credit default swaps on U.S. debt saw a flutter of activity in the past week with investors placing 135 trades in U.S. CDS in the week ended May 20, far above previous weeks, when in some cases only one contract trade was seen.

This compares to 360 CDS trades in the week on Spain's sovereign debt, 191 on Greece, 142 on Portugal and 136 on Italy.

Volumes in U.S. CDS have been ticking up, though at about $4 billion they remain significantly lower than the $9 trillion in outstanding U.S. Treasuries.

The squabbling between Democrats and Republicans last week as the U.S. debt ceiling of $14.3 trillion was being reached did not help sentiment towards U.S. debt.

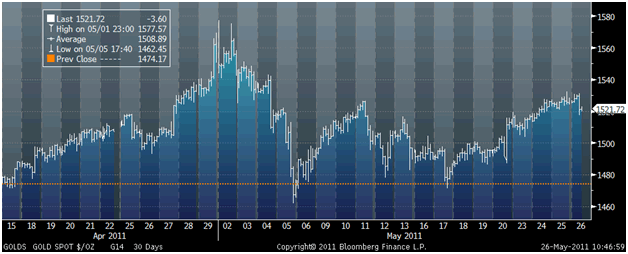

Gold Bullion in US Dollars – 30 Days (Tick)

Nor did former Soros’ partner Stanley Druckenmiller, the billionaire former-hedge fund manager and legendary investor, comment in the Wall Street Journal that the Federal Reserve’s bond purchases are a fraud and a “Ponzi scheme”.

He advocated a U.S. default or a technical default, saying “technical default would be horrible, but I don't think it's going to be the end of the world. It's not going to be catastrophic."

Credit default swaps are far from a perfect way to establish credit worthiness and risk of default of countries. However, it is arguable that quantitative easing and governments internationally, including the US, electronically creating money in order to buy huge tranches of newly created government debt has significantly distorted the government debt markets. Thus, record low yields are artificial and are not a good way of measuring fiscal and monetary risk.

The market manipulation that is QE1, QE2 (and possibly QE3, QE4 etc.) has completely distorted the free market in U.S. government debt and indeed all capital markets. It has led to artificially low interest rates in the US and internationally.

It has been successful in the short term in keeping yields low but short term panaceas have a habit of becoming long term illnesses.

While a US default would not be “catastrophic” it would likely lead to a very sharp fall in the U.S. dollar, (especially versus the hard currency, collateral and monetary asset that is gold), sharp fall in U.S. bonds and sharply higher interest rates.

This has the potential to create another systemic crisis involving sovereign nations and banks globally and could lead to a deep recession, a Depression and in a worst case scenario - hyperinflation.

Gold

Gold is trading at $1,520.69/oz, €1,072.87/oz and £932.65oz.

Silver

Silver is trading at $37.13/oz, €26.20/oz and £22.74/oz.

Platinum Group Metals

Platinum is trading at $1,770.75oz, palladium at $745/oz and rhodium at $2075/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.