The American Manufacturing Crisis and Why it Matters

Economics / US Economy May 26, 2011 - 10:09 AM GMTBy: Ian_Fletcher

Despite the denial chorus of the same politicians, financiers, and economists who told us prior to 2008 that our financial sector was fine, the American public is increasingly aware of the truth: American manufacturing is in a state of deep crisis. (And ,as I argued in a previous article, the recent small uptick in this sector doesn’t change that fact.)

Despite the denial chorus of the same politicians, financiers, and economists who told us prior to 2008 that our financial sector was fine, the American public is increasingly aware of the truth: American manufacturing is in a state of deep crisis. (And ,as I argued in a previous article, the recent small uptick in this sector doesn’t change that fact.)

Let’s start with manufacturing employment. Below is a chart giving the grim story of job losses in this sector. (Source.)

This degree of manufacturing job loss is not inevitable or normal. The U.S. actually enjoyed relatively stable employment levels in manufacturing as recently as the year 2000. Then, thanks to our burgeoning trade deficit, things fell off a cliff.

Neither is there anything inevitable about our poor export performance—which is, by definition, half the cause of that deficit. Over the decade after 2000, America’s share of world exports dropped from 17 to 11 percent. But the share of the European Union, home of trade-savvy export superstars like Germany, held steady at 17 percent, despite the relentlessly expanding share of China and the rest of the industrializing Third World. (Source.)

Our trade deficit is going to be balanced, the hard way or the easy way, eventually. And it will be essentially impossible for the U.S. to balance its trade without healthy manufacturing exports. Unless, of course, we are willing to radically curtail our imports, which means either:

a) A reduced living standard, or:

b) We start producing the formerly imported goods for ourselves. This, of course, itself

b)requires a strong manufacturing sector, so we’re back where we started.

So there’s no way to avoid manufacturing.

People sometimes imagine that the U.S. can balance its trade by exporting more services or agricultural goods. Unfortunately, the numbers just don't add up.

For example, in 2010, we ran a deficit in goods of $646 billion, while our surplus in services was only $149 billion. (Source.) Even worse, thanks to the offshoring of services, our surplus in services is shrinking, not expanding.

As for agriculture, forget it. Our surplus in agriculture is less than a tenth the size of our overall deficit.

It is crucial to understand that manufacturing is not the “past” of our economy. It is, in fact, a big part of our future (albeit an endangered part).

For example, it is no secret that the U.S. will need to transition, over the next few decades, to green energy technologies—whatever form they ultimately take. And these technologies, be they solar cells, windmills, electric cars, fusion reactors or dilithium crystals, are emphatically not virtual. One cannot download them.

They are good old -fashioned things. And there’s nothing low-tech about an electric car.

Unfortunately, the U.S. is losing its position in green-energy manufacturing, as shown by the fact that we now run a multi-billion dollar deficit in these goods.

One fact that belies the idea that manufacturing belongs to the past is that manufacturing is the origin of 70 percent of U.S. research and development. (According to one recent study, 22 percent of manufacturing firms engage in some kind of innovation, compared to only 8 percent of other companies.) So despite the myth that innovation is a post-industrial activity, losing our manufacturing means losing a lot of our future opportunities to innovate.

Can service industries fill the gap? No. Among other things, even healthy service companies frequently depend upon manufacturing. For example, many companies sell design, customization, operation, optimization, training and maintenance for the products they make. But the skills needed to provide these services often only accrue to those who are intimately involved with building the product in the first place.

Manufacturing tends to draw these other activities along with it. In the words of economist Gregory Tassey of the National Institute for Standards and Technologies—which is, by the way, just about the only serious national civilian industrial-policy agency left in this country:

When technological advances take place in the foreign industry, manufacturing is frequently located in that country to be near the source of the R&D. The issue of co-location of R&D and manufacturing is especially important because it means the value-added from both R&D and manufacturing will accrue to the innovating economy, at least when the technology is in its formative stages. Thus, an economy that initially controls both R&D and manufacturing can lose the value-added first from manufacturing and then R&D in the current technology life cycle—and then first R&D followed by manufacturing in the subsequent technology life cycle.

It is no accident that 90 percent of electronics research and development now takes place in Asia, hardly boding well for America’s future in an industry we dominated as recently as the early 1970s.

This won’t just hurt blue-collar workers. Despite the unfortunate image of manufacturers employing lunch-bucket labor, in reality, 51 percent of their current workforce consists of skilled production workers, 46 percent of scientists and engineers, and only 7 percent is unskilled production workers. (Source.) So losing manufacturing industry means losing not just assembly-line jobs, but many white-collar jobs, too.

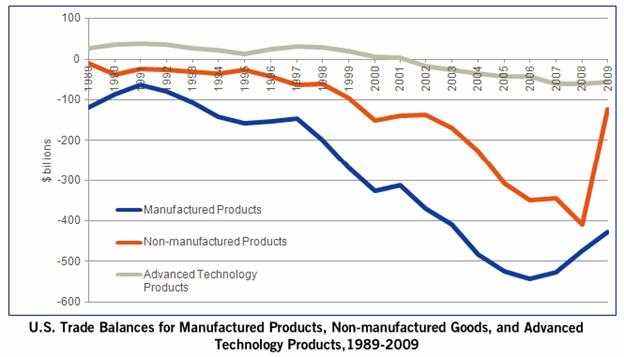

It’s not just electronics that’s decaying. Other high-tech industries are, with a few exceptions, in no better shape, as shown in the chart below. (Source.)

What categories of manufactured goods does the U.S. still have a strong position, signaled by a trade surplus, in? Only aircraft, aircraft parts, weapons, and specialized machine tools (mainly machine tools for making the former). These areas are the last redoubt of American industry largely because they have been the beneficiaries of just about the only institution in the U.S. which still does serious industrial policy and blocks inappropriate trading relationships: the U.S. military.

This may be a clue to what America needs: an appropriate dose of protectionism, plus some serious government-led industrial policy to stoke the fires of industry bright again.

Ian Fletcher is the author of the new book Free Trade Doesn’t Work: What Should Replace It and Why (USBIC, $24.95) He is an Adjunct Fellow at the San Francisco office of the U.S. Business and Industry Council, a Washington think tank founded in 1933. He was previously an economist in private practice, mostly serving hedge funds and private equity firms. He may be contacted at ian.fletcher@usbic.net.

© 2011 Copyright Ian Fletcher - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.