Bank Earnings Rise In Q1 2011

Companies / Banking Stocks May 25, 2011 - 09:55 AM GMTBy: Tony_Pallotta

On Tuesday the FDIC announced that bank earnings in Q1 2011 are improving, up 66.5% from Q1 2010. In fact bank earnings are back to Q2 2007 levels. Sounds great on the surface.

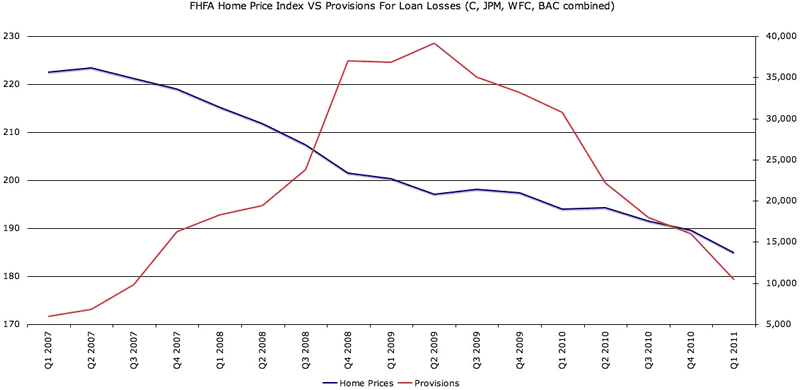

The problem is what has driven earnings is not real growth but rather an accounting gimmick. Provisions for loan losses or the amount of money reserved for future losses have fallen from $39.2 billion in Q2 2009 (the peak) to $10.3 billion in Q1 2011, a 76% reduction.

Ordinarily one could argue that banks took a hit to earnings back in 2009 and in fact are simply reversing larger anticipated losses than were realized. Problem though is home prices are falling not rising. The further home prices fall the greater the provisions for loan losses will be.

The chart below shows how the banks are lowering provisions when they should in fact be maintaining levels if not increasing. Should home prices continue to depreciate banks will be forced to increase provisions and many if not all of the TBTF's will be reporting record losses, again.

Even FDIC Chairman Sheila Bair could not release this report without a word of caution. "There is a limit to how far reductions in loan-loss provisions can boost industry earnings."

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.