Stock Market Low May be In, Breakout May be Imminent

Stock-Markets / Stock Markets 2011 May 22, 2011 - 07:04 PM GMTBy: Andre_Gratian

Very Long-term trend - The continuing strength in the indices is causing me to question whether we are in a secular bear market or two consecutive cyclical bull/bear cycles. In any case, the very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into 2014-16.

Very Long-term trend - The continuing strength in the indices is causing me to question whether we are in a secular bear market or two consecutive cyclical bull/bear cycles. In any case, the very-long-term cycles are down and, if they make their lows when expected, there will be another steep and prolonged decline into 2014-16.

Long-term trend - In March 2009, the SPX began a move which evolved in a bull market. Cycles point to a continuation of this trend for several more months.

SPX: Intermediate trend - The intermediate trend is still up. After the 1370 projection was reached, the SPX started a normal consolidation pattern which is ongoing, but nearly complete. The intermediate uptrend is expected to resume afterwards.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Market Overview

The SPX correction which has followed the filling of the 1370 count continues, but it could be nearing its end.

Since its inception, the correction has been orderly, traveling in a well-defined channel about 30-points wide. It is now making what could be a terminal pattern in the form of an inverse Head-and- Shoulders pattern which I will point out when we look at the charts. We could be in the process of completing the right shoulder of this pattern, which is itself a potential inverse H&S that may also be putting the final touch on its right shoulder. We seem to have formed a proliferation of H&S patterns (I count at least 5) since the February high. But I must admit that I have only given them a ball-park glance, and have not subjected them to a rigid volume test.

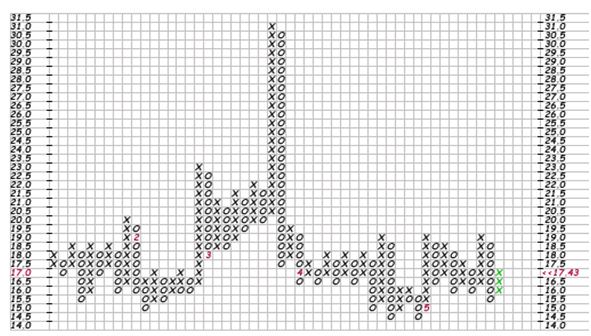

In any case, there are a number of other technical factors which support a near-term resumption of the rally from 1249 which I will point out as I analyze the charts. Beside the potential reverse Head-&- Shoulders pattern, they also include higher Point & Figure projections, bullish sentiment, favorable near-tem cycles, a lack of relative weakness in the NDX/SPX ratio, and a potentially bullish position of the daily indicators. That should be enough to place the odds on the positive side, but I also see the possibility of an attempt by GLD and USO to retrace their recent decline.

If the reversal which took place at 1319 is legitimate, we could have its confirmation as early as Monday.

Chart Analysis

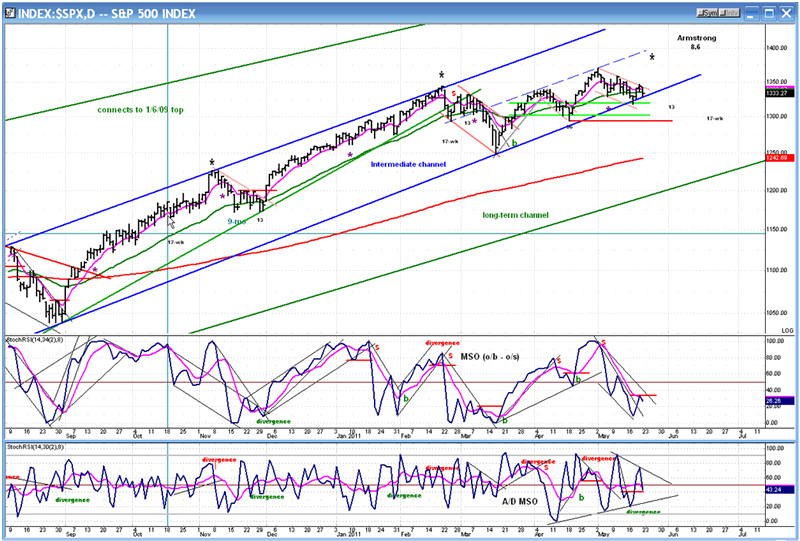

We’ll begin by analyzing the Daily Chart of the SPX, starting with the still bullish, longer-term perspective.

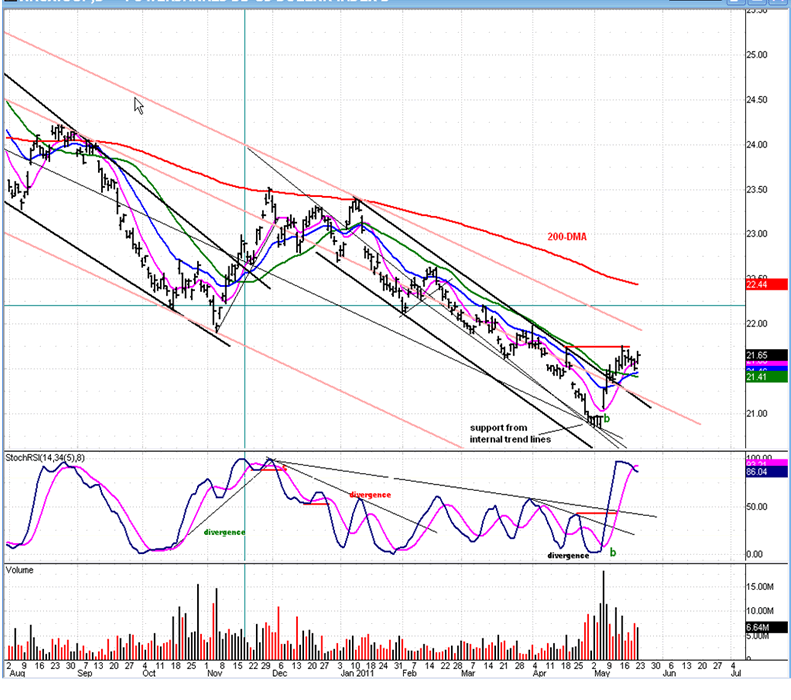

The index is still in an up-trend, trading within its intermediate channel which, itself, continues to rise well inside the long-term channel. However, we must acknowledge that the trend is decelerating. Not only did the intermediate trend not make it to the top of the larger channel, but it is also decelerating within the smaller one. Resistance is developing at a (dashed) line which is a parallel to the channel lines, and the extension of a former support line. The SPX, which had previously tested the bottom of its intermediate channel three times, did so again last Friday.

The blue trend line and the light-green support line both enabled the index to rally, but it is coming back down after failing to overcome the short, red down-channel line. If it breaks both of these lines, it will bring it a little closer to the end of the trail, but it would have to trade below the red horizontal red line in order to give an intermediate sell signal. Trading below that level would stop the steady progression of higher highs and higher lows which have created the uptrend since 1011 in early July.

The top indicator is still in a down-trend, while the bottom one is making a triangle pattern. The lower one has already given a preliminary buy signal, but the top one would have to turn up in order to do so, and the price would have to move up for this to happen.

The black asterisks that you see on the chart represent a 14-15-wk cycle which has very consistently called the top of short-term moves since the 2009 low. The next one comes at the end of the month and could also bring about a high.

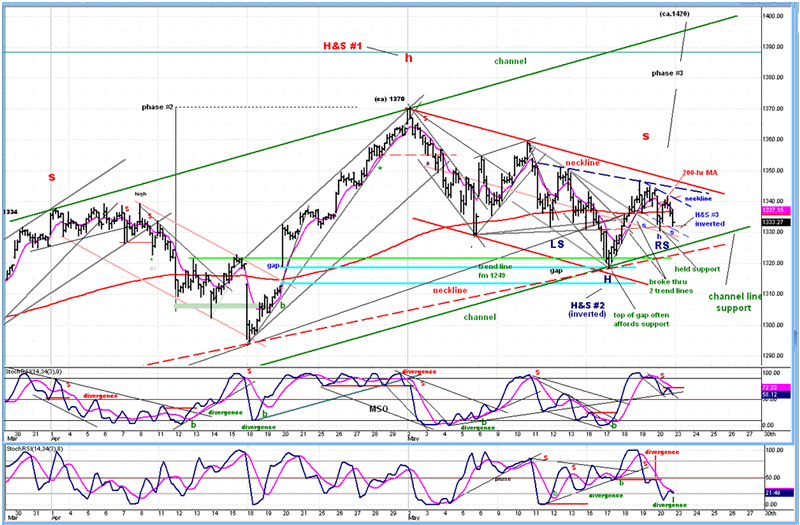

We can continue our analysis on the Hourly Chart where it is easier to observe the very short-term patterns. This finely-tuned analysis could never be done on a daily chart. I have posted a lot of information, but I have made it as clear as possible and will guide you through it.

Two main channels are shown: the large green channel from the 1249 low, and the red channel from the 1370 top. The red channel median has also been drawn. The bottom line of the green channel has already provided support at 1319, last week. This was slightly higher than the bottom trend line of the red channel, and spurred a rally which went almost to the top channel line. Now, the price action appears to have migrated to the top half of the descending channel. If it does not punch back below the median, it will be a sign of deceleration; usually the action which precedes a break-out from the channel.

On Friday morning, the price retraced just shy of .618 of the rally from 1219. There, it found the support of two intersecting trend lines: the mid-channel line, and the top side of a former downtrend line. This caused a re-bound, but it could not be sustained and, at the end of the day, the index was in the process of re-testing the low.

There are some obvious notations on the chart which I don’t need to discuss. Generally speaking, during the rally from 1319, the index broke through two important internal trend lines and has now retraced to an important support level. If it should break back below the gray descending trend line (which starts at the 1350.44 peak), it would be a sign of weakness which would signal additional correction, probably trading outside of the large green channel, and perhaps even forecasting more weakness ahead.

If the index can remain above the mid-channel line and the gray downtrend line, it will probably signal an imminent break-out of the descending red channel, and an attempt at continuing the intermediate uptrend.

Structurally, there are several Head-&-shoulders formations which can notably influence the price if they turn out to be valid. The bearish formation is the one whose peak is 1970 and is identified in red letters. For it to be confirmed, the index will need to break outside of the green channel and continue below the neckline immediately below. That could signal that 1370 is the top of the intermediate trend and that the 1249 low will be broken.

There is also a bullish reverse H&S pattern which has 1319 for a low and is labeled with dark-blue letters. The extension of its neckline corresponds roughly with the top of the descending channel, at about 1343. The right shoulder of this formation also appears to be making a small reverse H&S (blue) pattern. If this small H&S pattern turns out to be valid, and a reversal occurs from roughly its current level, and the index pierces above the dark-blue neckline and the red downtrend line, it would be the start of a bullish move.

There are a couple of other matters to consider, and then we’ll turn to some other technical aspects. We need to take a look at the position of the indicators and what they are telling us. Both are still in a downtrend, but could reverse at any time, especially the lower one (A/D) which is oversold and may be beginning to show some positive divergence. If there is not too much weakness at Monday’s opening, both indicators should complete their corrections and begin to turn up.

The other is the P&F projections. From the very top of 1370, and as the correction progressed, I found several valid phase projections which all suggested a low at 1319. This makes the low which occurred at that price on Tuesday a strong candidate for the lowest point of the correction.

The base which formed just above 1319 had a projection of 1345 which was exceeded by one point before bringing about a reversal in the form of a consolidation which (so far) poses no threat to the 1319 low.

Following this analysis, we have to conclude that there appear to be more positives than negatives, and therefore the odds favor a continuation of the move which started at 1319. The following analyses will add a few more bullish items to that list.

Cycles

I have previously spoken of a 14-15-wk high-to-high cycle which has shown good regularity since the beginning of the bull market. The next high is due approximately at beginning of June. This would be a great time to end this move in the low 1400’s.

On about June 13-15, Martin Armstrong’s 8.6-yr business cycle is supposed to bottom (?). If this is so, it would be a perfect sequel to the high due in about 10 days.

In between, and just a few days after the early June high, a 13-wk low is also scheduled.

Some of these cycles may seem to contradict an upside break-out and we’ll have to see how it all works out.

Breadth

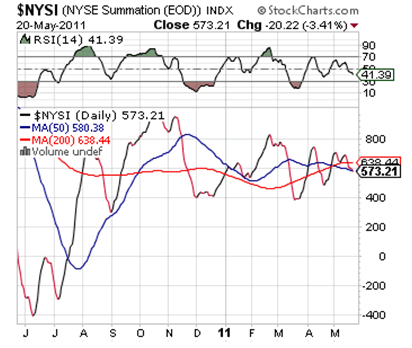

The NYSE Summation Index (courtesy of StockCharts.com) continues to hold up well and is making a triangle pattern. The direction in which it breaks will determine the direction of the trend.

The RSI is essentially neutral, so it could move either way to an overbought or oversold position.

Sentiment

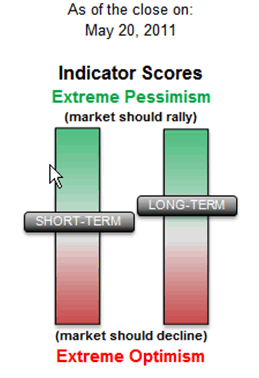

The SentimenTrader (courtesy of same) has visibly improved its condition since last week. This is another strong boost to the bullish scenario.

NDX/SPX ratio is neutral both for the short and intermediate term. If it starts to decline, it will be a bearish warning.

VIX (Chart courtesy of StockCharts.com)

Here is a very clear and simple way to forecast the future market trend. The VIX has been in a base pattern since late march. As long as it remains in that base, the market will continue to move sideways, or up. If the VIX rises above 20, it will be an indication that the market is probably starting a downtrend.

During the SPX rally from 1319, the VIX made a new weekly low but bounced back up right away. If it turns down again, it will be a warning that the SPX is ready to move up.

Dollar index

It is too early to say for sure that the dollar has made an important low. Both the indicator and volume patterns are roughly similar to what we had in November. Before too long, the dollar will have to re-test its low. On this chart of UUP (the dollar ETF), if 20.84 holds and it starts up again, it will be an indication that a substantial uptrend may be starting.

Some analysts believe that the dollar is at the beginning of a multi-month, and perhaps multi-year, move. Based on the chart alone, this cannot yet be substantiated at this time.

Gold

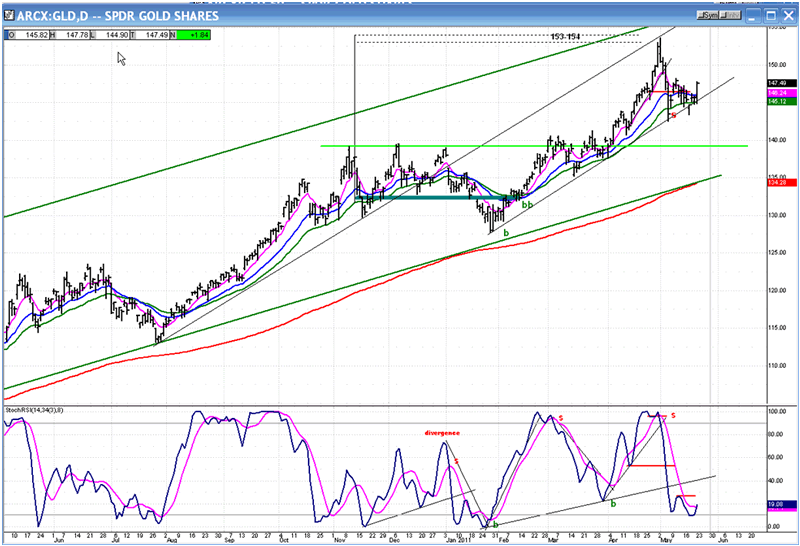

The daily chart of GLD is very similar to that of the SPX. They both started their intermediate uptrend roughly at the same time, had a correction into roughly the same time frame and, since then, both have extended their intermediate trends in roughly the same manner -- making two up-waves, followed by a consolidation. The main difference between the two is that GLD is relatively stronger, and it appears to lead the SPX.

Since its sharp correction from 154, GLD has been consolidating. On the P&F chart, it has formed a small re-accumulation pattern which has the potential of moving the index to 155-56.

On Friday, GLD made a move which looks like the beginning of a break-out of its base formation. In order to succeed, it would have to continue past 148. I am not sure that it can before a little more consolidation, or it could break out first, and then pull-back. If it does break out, it will probably cause the SPX to follow.

All eyes on GLD on Monday!

OIL

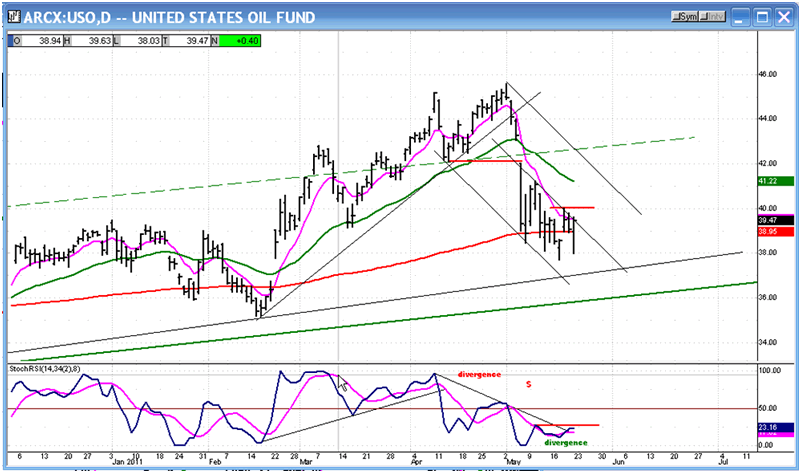

Below is a chart of USO, the oil ETF. Percentage-wise, it suffered a much greater loss than GLD. Therefore, if it makes an attempt at recouping part of its loss, it is very unlikely that it will make a new high.

On Friday, USO closed at 39.38. Should it start to rally, it has two potential targets: a .382 retracement of its decline from 45.60, which would take it to about 41, and a 50% rally to about 42. The P&F chart of USO shows a potential conservative move to 42, and a liberal one to 44. It is possible that the index action over the next few days will alter this count.

Is a rally likely in the near future? Very! If you look at the chart, you can see that USO has found support on its 200-DMA, and has been consolidating around it. That would be a good level from which to start a rally.

More importantly, in regards to the imminence of a move, the indicator is showing strong relative strength. Also, you can see that the price has been pounding at the median of its down-channel. My guess is that on the next attempt (which could have started on Friday) it will break above the trend line and the near-term high as well.

If the P&F pattern of WTIC is not altered, it has a potential to move up to 106.

Summary

The near-term pattern which is being made by the SPX suggests that the low of the correction may have been 1319, and that a break-out from its corrective channel may be imminent.

This is supported, in part, by the sentiment index which has grown more bullish over the last week, and the charts of GLD and USO which may be ready to start retracing their recent decline.

If the SPX extends its down-move below 1328, it will put the break-out scenario in doubt or, at least, delay it.

Andre

Note: I have started to follow TLT closely. I find it to be a valuable addition to the VIX as a predictor of SPX reversals. Both TLT and VIX are part of my leading indicator index. Specific signals generated by TLT and this indicator will only be discussed with subscribers.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time frames is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth.

For a FREE 4-week trial. Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my investment and trading strategies and my unique method of intra-day communication with Market Turning Points subscribers.

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.