Central Bank Monetary Policy Update

Interest-Rates / Central Banks May 21, 2011 - 07:28 AM GMTBy: CentralBankNews

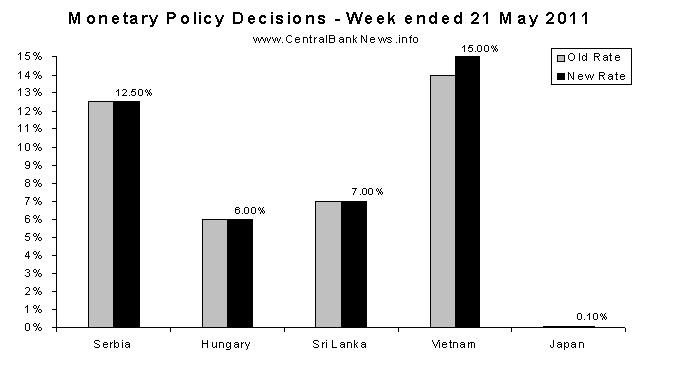

The past week in monetary policy was relatively quiet with only 5 central banks announcing monetary policy decisions, and of those, only 1 adjusting its policy stance. Vietnam was the only bank to adjust monetary policy settings; increasing its reverse repurchase rate by 100 basis points to 15.00%. Meanwhile those that held their monetary policy interest rates unchanged were: Serbia (12.50%), Hungary (6.00%), Sri Lanka (7.00%), and Japan (0.10%). Elsewhere in monetary policy news, the Reserve Bank of Australia, Bank of England, and US Federal Open Market Committee all released the minutes from their recent monetary policy meetings.

As noted the week in monetary policy was quiet, certainly compared to the previous week where 12 central banks announced interest rate decisions and a further two made changes to required reserve ratios. In terms of themes, the trend of slowing policy tightening in emerging markets continued with Serbia, Hungary, and Sri Lanka holding off on rate increases as global inflation impulses i.e. commodity prices begin to show signs of tapering off, and more importantly; as policy risks increased, making the economic growth outlook less certain. Vietnam was an outlier in terms of the rapid pace of inflation and overheating that it is seeing. Meanwhile Japan continues to be somewhat of an outlier as it tackles deep structural economic and fiscal challenges.

Next week the following central banks are scheduled to review monetary policy interest rates: the Bank of Israel (23 May) - which last held its benchmark lending rate unchanged at 3.00%, the Central Bank of the Republic of Turkey (25 May) - which last held its interest rate at 6.25% and increased reserve requirements, and the Banco de Mexico (27 May) - which last held its interest rate unchanged at 4.50%.

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/05/monetary-policy-week-in-review-21-may.html

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.