Methodology of U.S. Monetary Policy Interest Rate Tightening / Normalization Strategy

Interest-Rates / US Interest Rates May 19, 2011 - 02:08 AM GMTBy: Asha_Bangalore

The minutes of April 26-27 FOMC meeting published today contain noteworthy insights about the future course of monetary policy. Financial markets so far have digested the policy statement, published on April 27, and studied the details of the first press conference of Chairman Bernanke. The Fed published economic projections at the close of the meeting in April which previously have been part of the minutes of the meeting.

What is the new information from the minutes? The discussion about how the Fed will implement changes in monetary policy is the latest input from the minutes of the April meeting. The essential question is if the Fed has to engage in asset sales, raise the federal funds rate, or undertake a combination of both to put in place monetary policy tightening.

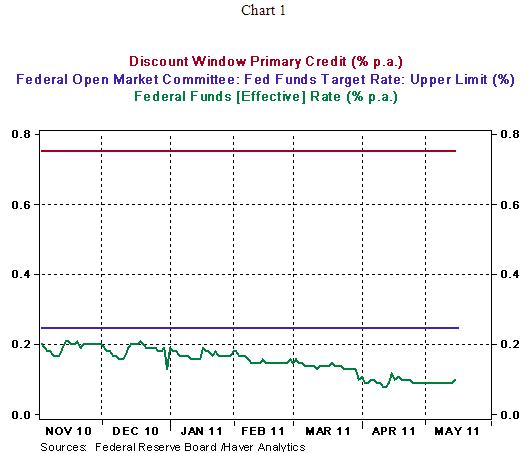

At present, the effective federal funds rate is trading below the upper limit of the target rate. Interest on excess reserves (IOER) is equal to the upper limit of the federal funds rate at 0.25% (see Chart 1) and the discount rate at 0.75% is above the federal funds rate.

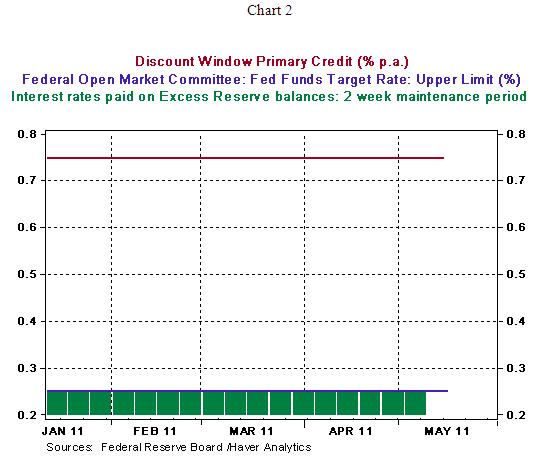

The minutes indicate that the ideal system would be to have IOER as the floor and the discount rate as the cap, with federal funds rate trading between the cap and floor. The Fed uses the term "corridor-type situation" to stand for this arrangement. The current arrangement is different from the ideal. Chart 2 depicts the current situation with the federal funds rate target and IOER at the same level. This type of arrangement is called the "floor-type situation."

In the Fed's opinion, the normalization would entail operating with the "floor-type situation" for a period of time as the Fed gathers experience before adopting the "corridor-type situation." It was agreed that additional discussions would be necessary before final decisions were made. Also most participants saw changes in the target for the federal funds rate as the preferred active toll for tightening monetary policy when appropriate.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.