Market Vectors Junior Gold Miners GDXJ ETF: How Junior?

Commodities / Gold and Silver 2011 May 18, 2011 - 05:23 AM GMTBy: Bob_Kirtley

A number of our readers are fans of the junior section of the precious metals mining sector with the Market Vectors Junior Gold Miners ETF (GDXJ) forming part of their investment strategy. The mantra of juniors, juniors, is also alive and well in cyberspace, so we thought that it might be prudent to touch base with this ETF.

A number of our readers are fans of the junior section of the precious metals mining sector with the Market Vectors Junior Gold Miners ETF (GDXJ) forming part of their investment strategy. The mantra of juniors, juniors, is also alive and well in cyberspace, so we thought that it might be prudent to touch base with this ETF.

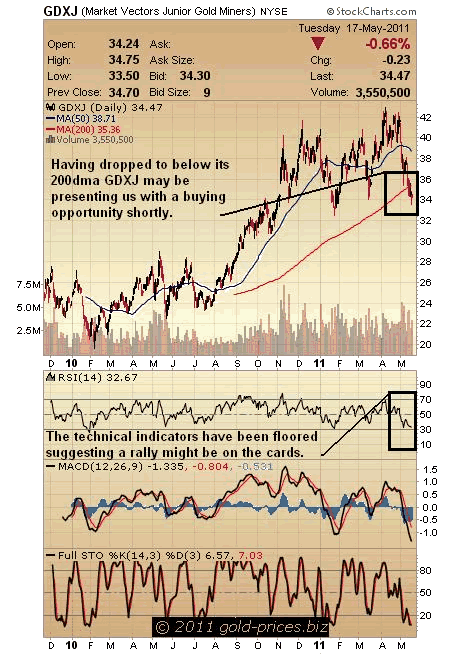

We will start with a quick look at the chart where we can see that having dropped below its 200dma GDXJ may be presenting us with a buying opportunity shortly. The technical indicators have been floored, the RSI is currently standing at 32.67 and the MACD and the STO have almost bottomed, suggesting a rally might be on the cards.

Since inception about eighteen months ago this ETF has grown considerably and now has a market capitalization of $1.99 billion. Its 52 week trading range has oscillated between $24.25 - $44.86 on a good trading volume of around 3.0 million shares per day.

What follows is a brief description of the fund and their interpretation of what constitutes, roughly, a junior mining company.

The Junior Gold Miners ETF seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Junior Gold Miners Index.

The Index provides exposure to a global universe of publicly traded small- and medium capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company's revenue from gold or silver mining when developed, or primarily invest in gold or silver. The Fund will normally invest at least 80% of its total assets in companies that are involved in the gold mining industry. As such, the Fund is subject to, among others the risks of investing in international equities and small- and mid-cap mining companies. Many companies may not have begun to generate material revenues and operate at a loss, contributing to greater volatility, lower trading volume and less liquidity than larger companies.

A Dynamic Industry Segment

A dynamic and important subset of the global gold mining industry is a group of companies known as "juniors". These are small- to medium-size market capitalization companies that are generally actively engaged in the development of new sources of gold either through green fields exploration or the use of new geologic models to prospect for gold in overlooked or abandoned properties. For investors, juniors may offer characteristics similar to an investment in venture capital -- early stage, high risk, but with a potential for high growth.

While there is no strict definition of what constitutes a junior, they generally have market capitalization of up to $1.5 billion and/or production levels of less than 300,000 oz/yr. Juniors can be at different stages of development -- some operate small-scale mines; some are developing large-scale operations, while others are in the process of defining gold or silver ore bodies through drilling. Many may not even be in the production phase yet. They tend to not have the operating track record of the larger producers and there are often uncertainties surrounding the size and potential of their properties. These features increase the risk associated with these companies and the sensitivity of a junior's business to gold and equity markets.

We draw your attention to the size of a company they regard as juniors, 'market capitalization of up to $1.5 billion' which appears to us to be rather large for a junior, however, they have made it clear.

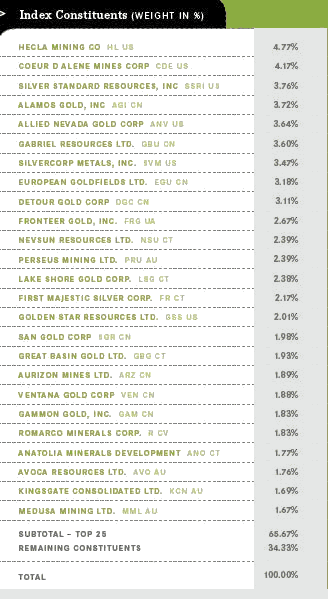

So now lets take a look at their list of juniors, as we can see the first four companies all exceeded the $1.5 billion mark and have a market capitalization of over $2.0 billion.

Allied Nevada Gold Corp.

(Public, AMEX:ANV)

Mkt cap 2.96B

Alacer Gold Corp

(Public, TSE:ASR)

Mkt cap 2.27B

Silver Standard Resources Inc. (USA)

(Public, NASDAQ:SSRI)

Mkt cap 2.21B

Detour Gold Corporation

(Public, TSE:DGC)

Mkt cap 2.33B

We would have expected to see juniors with a much smaller market capitalization than those mentioned above and so we struggle with the concept that this ETF truly represents the junior gold mining sector, but that's just our opinion.

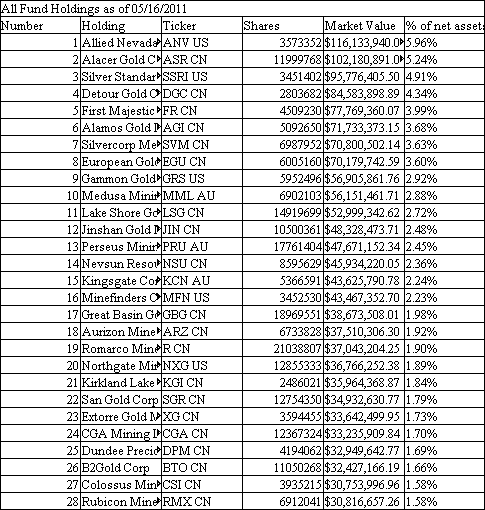

In our search to ascertain just who they have invested in we came across this list on their web site, however it does reference another list which we have placed below the first one. We believe this to be the true list as it has a date on it of 05/16/2011. However, it is a tad irritating that an organization of this size has conflicting data on its web site.

In conclusion, as an investment vehicle for exposure to the junior sector it is not for us at the moment. However, if the investment community perceives this ETF to replicate the junior sector then it could get some real traction once the junior sector takes off. For those who are more cavalier in their approach to investment, there is a fair amount of liquidity in this ETFs options market so a nimble trader should be able to get in and out of positions without too much hassle.

We will observe for now, with the view to snapping up a real bargain on a dip.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.