Federal Reserve Elitism, Immunity And Outstaying One’s Welcome

Politics / Central Banks May 16, 2011 - 10:35 AM GMTBy: Rob_Kirby

When The Bank of International Settlements was formed back in 1930, two board seats were allocated to the U.S. Federal Reserve but for many years [decades actually] the Fed did not name anyone to these positions. As reported by Reg Howe at the Golden Sextant years ago, The Federal Reserve finally took up their seats as directors of the BIS back in 1994. Howe never did articulate the importance or assign a reason as to why the Fed took their seats on the BIS at that time, but he did question the timing:

When The Bank of International Settlements was formed back in 1930, two board seats were allocated to the U.S. Federal Reserve but for many years [decades actually] the Fed did not name anyone to these positions. As reported by Reg Howe at the Golden Sextant years ago, The Federal Reserve finally took up their seats as directors of the BIS back in 1994. Howe never did articulate the importance or assign a reason as to why the Fed took their seats on the BIS at that time, but he did question the timing:

“To deal with this situation and preserve a certain level of American participation, the Convention established a Constituent Charter for the BIS that gave it a unique corporate structure. Fifteen percent of the original issue of partially paid shares -- the American issue -- was allocated to Morgan and two other private American financial institutions in return for their guarantee of its public subscription in the United States. The remaining shares were allocated to the founding central banks to be taken up by them or subscribed publicly in their respective countries, as was done with parts of the French and Belgian issues. No voting rights attached to any of the shares, which all carried equal rights to participate in the profits of the bank or any distribution of assets. Voting rights were assigned exclusively to the member central banks in proportion to their respective issues. The Constituent Charter also assigned certain seats on the BIS's board to governors of the founding central banks or their designees.

Two board seats were allocated to the United States, but Federal Reserve officials [the Chairman and the head of the N.Y. Fed] did not assume these seats until 1994. Then, as described by Mr. Greenspan in the transcript of the Federal Open Market Committee's conference call on July 20, 1994 (P.A. Ex. I):

[Greenspan explanation] Up until the Maastrich Treaty, our relationships with the BIS seemed to be appropriately constrained to our periodic visits over there to deal with the G-10 on a consultative basis and to be involved with a number of their committees, but to have no involvement at all with the actual management of the BIS. With the advent of the Maastrich Treaty and the development of the European Monetary Institute, the potential of the BIS being effectively neutered because of the overlap in jurisdictions of the EMI and the BIS has led the BIS to move toward a much more global role, one that anticipates inviting a significant number of non-European members, 10 to 25 as I recall the range, to become members of the BIS. That would significantly alter its character from a largely though not exclusively European managed operation to one which is far more global in nature. It is possible, perhaps probable, that the BIS as a consequence will become a much larger player on the world scene. It was our judgment that it would be advisable for us to be involved in the managerial changes that are about to be initiated rather than to stay on the sidelines, as we chose to do through all those decades when we did not want to get involved with a European-type international organization. In contradistinction to that, we think it is important to be an active player in the development of this institution to make certain that we as the principal international financial player have a significant amount to say in the evolution of the institution. That's the basis upon which this decision has been made here at the Board, and it was one which we probably would not have addressed in any meaningful way had not the altered nature of the BIS itself become imminent.”

Greenspan’s explanation seems to be self-serving and misdirection. The Maastrich Treaty was negotiated in Feb. 1992 – a full year and a half before Greenspan had his epiphany. Remember, it was none other than former Treasury Secretary Robert Rubin on page 181 of his book, In An Uncertain World, when he characterizes the manner in which Greenspan intentionally obfuscates facts when responding to direct questioning. Rubin goes on to characterize a typical Maestro response, under oath, to explicit and direct Congressional questioning,

“That’s an interesting observation you make, Senator, about the earth being flat, he’d say. If I might, let me rephrase the question. Alan would then ask himself a completely different question and answer it with such complexity and finely calibrated nuance that the questioner faced a choice between nodding intelligently and acknowledging his own confusion. I must say that testifying next to the chairman, I was sometimes completely baffled myself.”

Indeed, Greenspan was a true charlatan. For years I too wondered about the real reason why the Fed waited so long to occupy their allocated seats on the BIS. It finally became clear to me exactly why – only today, May 15, 2011, when Dominique Straus-Kahn [I.M.F. head] was charged in N.Y. with sexual impropriety. In a forum that I frequent, a poster [2 point] raised the question as to whether Strauss-Kahn would have diplomatic immunity from such charges citing the work of renowned BIS researcher Patrick Wood as he reported years ago:

The BIS can be compared to a stealth bomber. It flies high and fast, is undetected, has a small crew and carries a huge payload. By contrast, however, the bomber answers to a chain of command and must be refueled by outside sources. The BIS, as we shall see, is not accountable to any public authority and operates with complete autonomy and self-sufficiency……

It is not surprising that the BIS, its offices, employees, directors and members share an incredible immunity from virtually all regulation, scrutiny and accountability.

In 1931, central bankers and their constituents were fed up with government meddling in world financial affairs. Politicians were viewed mostly with contempt, unless it was one of their own who was the politician. Thus, the BIS offered them a once-and-for-all opportunity to set up the "apex" the way they really wanted it -- private. They demanded these conditions and got what they demanded.

A quick summary of their immunity, explained further below, includes

- diplomatic immunity for persons and what they carry with them (i.e., diplomatic pouches)

- no taxation on any transactions, including salaries paid to employees

- embassy-type immunity for all buildings and/or offices operated by the BIS

- no oversight or knowledge of operations by any government authority

- freedom from immigration restrictions

- freedom to encrypt any and all communications of any sort

- freedom from any legal jurisdiction9

Further, members of the BIS board of directors (for instance, Alan Greenspan) are individually granted special benefits:

- “immunity from arrest or imprisonment and immunity from seizure of their personal baggage, save in flagrant cases of criminal offence;”

- “inviolability of all papers and documents;”

- “immunity from jurisdiction, even after their mission has been accomplished, for acts carried out in the discharge of their duties, including words spoken and writings;”

- “exemption for themselves, their spouses and children from any immigration restrictions, from any formalities concerning the registration of aliens and from any obligations relating to national service in Switzerland ;”

- “the right to use codes in official communications or to receive or send documents or correspondence by means of couriers or diplomatic bags.”10

Lastly, all remaining officials and employees of the BIS have the following immunities:

- “immunity from jurisdiction for acts accomplished in the discharge of their duties, including words spoken and writings, even after such persons have ceased to be Officials of the Bank;”[bold emphasis added]

- “exemption from all Federal, cantonal and communal taxes on salaries, fees and allowances paid to them by the Bank…”

- exempt from Swiss national obligations, freedom for spouses and family members from immigration restrictions, transfer assets and properties – including internationally – with the same degree of benefit as Officials of other international organizations.11

That’s when everything “clicked”. I know Patrick Wood and the caliber of his work. Second, GATA has long maintained that gold price suppression began in the timeframe circa 1994. Coincidentally, or perhaps not, that is also the same timeframe that wholesale interest rate suppression began. Excerpted from, The Federal Reserve Is Selling Paper Gold and Buying Physical Gold:

Price of Gold and Interest Rates Are Joined at the Hip

The academic research that outlines the inter-relatedness of gold and interest rates is succinctly laid out in a 2001 treatise, Gibson's Paradox Revisited, by Reg Howe. From this one can deduct that ANY rigging of the gold price must go hand-in-hand with simultaneous rigging of interest rates.

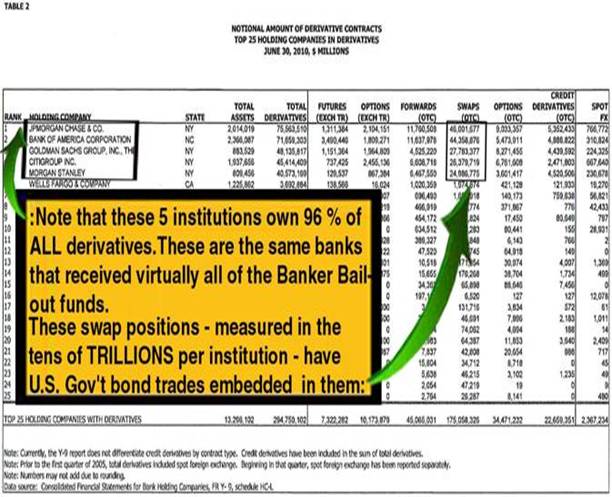

Folks would do well to realize how neatly emerging details of Fed surrogate Morgan's "stealth" activity in the bullion market dovetails with their obscene, obsequious activity elsewhere in their derivatives book—particularly their JUMBO TRILLIONS sized interest rate swap positions.

Stealth activity on the part of the Fed—utilizing proxy institutions to generate limitless artificial demand for any and all U.S. Government Debt—effectively gives the Fed control of the long end of the interest rate curve [the bond market].

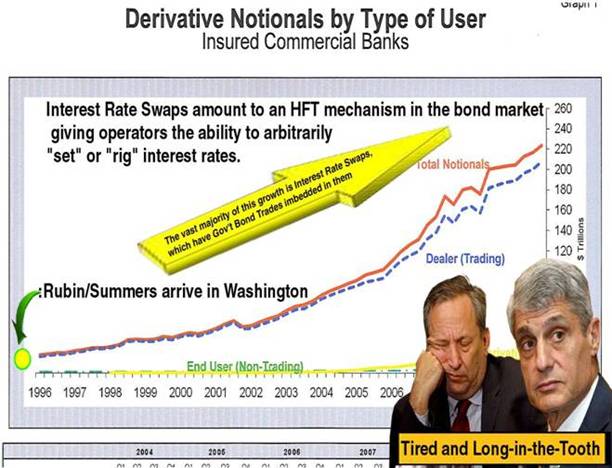

From a timing perspective, it is also noteworthy that gold price rigging—long maintained by GATA—is alleged to have begun in earnest during the Clinton Administration with the appointment of Robert Rubin as U.S. Treasury Secretary [along with understudy Lawrence Summers] in Jan. 1995. Coincidentally [or perhaps not?] we can trace the genesis of the "explosion" in the use of derivatives [mostly interest rate] to that exact same time frame. In fact, if we follow the time line in "reverse"—the growth in the use of derivatives appears like a trail of bread crumbs —right back to the time when Professor Lawrence Summers, under the tutelage of Sir Robert of Rubin, brought his academic alchemy to Washington:

Conclusion: The Federal Reserve began systemically engaging in treasonous financial acts in the timeframe circa 1994. It appears that Mr. Greenspan and his henchmen at the Fed demanded and received the diplomatic “comfort” [immunity] afforded them as DIRECTORS OF THE BIS before they would engage in what otherwise would have been flagrant, manipulative, criminal acts .

The powers extended to American designees on the BIS board of directors appear to contradict the U.S. Constitution, as any clandestine, unethical, illegal, and/or manipulative activities engaged in by or under the auspices of these individuals would flaunt the fiduciary protocols of free markets, regulatory principles, and fair trade. It supposes that these individuals are above the rules, above the democratically elected government, immune from the judiciary rules and answerable to no one but themselves.

One might ask why such extraordinary powers are afforded to this group? In light of the recent financial meltdown and subsequent bailouts by these same individuals, "crony capitalism" has resulted in: a greater consolidation of wealth and power in the hands of the few; more reliance on the too big to fails rather than less; on-going "ever-greater risk" in the system; and deliberate impoverishment of the middle class through the hidden tax of inflation.

The granting of these immunities was the seed for enabling the unbridled growth of manipulative derivatives to impose a draconian, undeclared, stealth system of fascist central planning. Together with "The Great Guttenberg", the banking elites have "murdered" the bond vigilantes, rigged real markets with fractional paper tsunamis, and supported their shenanigans with official data and public relations manipulations. What's an average hard working girl to do?

When leaders of the Federal Reserve require supra constitutional immunity and protections to insulate themselves from treasonous, tawdry acts – we must ask if the Federal Reserve has outstayed its welcome?

Got physical yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2011 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.