Rhodium and the Silver Crash of 2011 Contagion

Commodities / Commodities Trading May 16, 2011 - 10:04 AM GMTBy: Ned_W_Schmidt

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate.

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate.

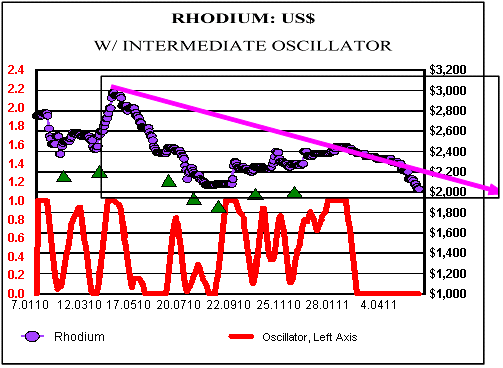

These signals are generally speaking for day they are issued. If price remains below signal price, buying can be done. Do Not Buy signals are given when market is over bought, and buying is unwise. Blue triangles indicate an over bought condition. These would not be good times to buy, so they are labeled Do Not Buy. Software is not showing complete legend, for some reason.

Recent weeks have not been kind to any commodity investments. The Silver bubble had encouraged an unstable narrow focus for investing funds. With the coming of the Great Silver Crash of 2011, contagion caused commodity prices to move lower.

A combination of factors has hurt Rhodium's price. High oil prices, artificially inflated by speculative futures trading, have damaged the psychology of the auto industry. Earthquake and tsunami in Japan have hurt auto production in that nation, damaging demand for all in the PGM. Those are transitory factors. They will again make cars in Japan.

But perhaps more important, Johnson Matthey, kitco.com 16 May, reports that Rhodium demand rose 22% in 2010. Rhodium usage by the glass industry rose 200%. Latter included use for televisions, computer monitors, cell phones, etc.

Bottom chart is of the price of $Rhodium to $Gold. The rally in precious metal prices has pushed the ratio to an extreme level that is not sustainable. The crash of Silver should serve as unquestionable evidence of that. Rhodium's price, relative to $Gold, is much like a coiled spring. This misalignment of values will be corrected.

Rhodium, as shown in the first chart on page one, is deeply over sold. This situation is not likely to persist. When it moves through the down trend arrow, prices should move materially higher. Relative to Silver, which is still over valued and now trading in a bear market, Rhodium is a much preferred choice.

OPINION:

The value of insurance, all of the various kinds, has been vividly demonstrated around us this past month. Tsunami in Japan, tornados in the Southern U.S., widespread flooding of the Mississippi River value, and the collapse of Silver all demonstrate that insurance is wise. As those being pummeled financially in Silver now understand, insurance cannot be purchased after the tsunami hits. Diversification is THE most powerful form of financial insurance. Diversification into Rhodium, especially by those still holding Silver, would be a wise move.

| $Rh Preliminary Price Valuation Range | |||

| US$ Rh Current | Valuation | $Valuation | Potential % Change |

| $2,030 | Over | $7,500 | 269% |

| $2,030 | Fair | $6,000 | 196% |

| $2,030 | Under | $4,500 | 122% |

| US$ SILVER Valuation | |||

| US$Ag Current | Valuation | $Valuation | Potential % Change |

| $34.53 | Sell Target | $35.50 | 3% |

| $34.53 | Long-Term Target | $33.00 | -4% |

| $34.53 | Fair Value | $15.60 | -55% |

"Researchers develop 'greener' hydrogen production method" from www.theengineer.co.uk, 13 May 2011.

"A Dutch research team has found a way to produce hydrogen from natural gas at lower temperatures than existing methods and without releasing carbon dioxide (CO2)."

"The new technique uses a Rhodium catalyst to reduce the temperature of conventional steam reformation from around 850ºC to between 400ºC and 500ºC, while a Hydrotalcite sorbent (a material used to absorb liquids or gases) captures the CO2."

"Eindhoven University of Technology PhD student Mohamed Halabi collaborated with the Energy Research Centre of the Netherlands (ECN) to demonstrate the feasibility of the process."

"'The enormous reduction of the reactor size, material loading, catalyst/sorbent ratio and energy requirements are beneficial key factors for the success of the concept over the conventional technologies,' said Halabi."

"'Small-size hydrogen generation plants for residential or industrial application operating at a relatively low pressure, of less than 4.5 bar, seem to be feasible.'"

"Producing hydrogen using relatively little energy and without releasing large amounts of CO2 could be hugely beneficial in efforts to combat climate change because it burns to release high amounts of energy with only water as a by-product."

What is a catalyst? A catalyst is some chemical or material that facilitates a chemical process. It is not consumed in the chemical process or involved in the chemical reaction. One could drink beer out of a barrel, but a glass facilitates the consumption of the beer. The glass, or catalyst, remains unchanged after the consumption process is complete.

Update: RAPT is up 50+% since our mentioning it last month.

Your Eternal Optimist,

RHODIUM TRADING THOUGHTS is published presently on an irregular basis, and is available only on selected web sites and at our web site: www.valueviewgoldreport.com

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.