Stock Market Near and Medium Term Outlook

Stock-Markets / Stock Markets 2011 May 16, 2011 - 06:48 AM GMTBy: John_Hampson

I took partial profits on my stock indices longs on Friday as the market action reflected Friday morning's post:

I took partial profits on my stock indices longs on Friday as the market action reflected Friday morning's post:

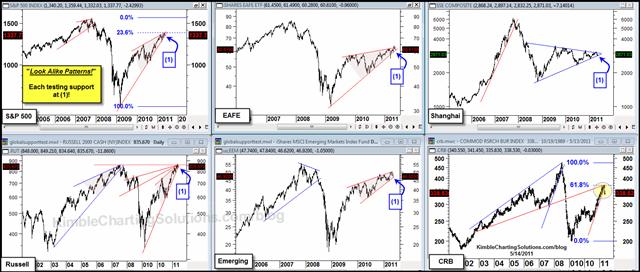

I maintain the forecast of a mid-year correction / consolidation in an ongoing stocks cyclical bull and re-post the following two charts:

Stock markets globally could potentially pull back here - see the similar wedge formations in the S&P500, non-US shares index and Shanghai Composite in the top row here:

Source: Chris Kimble

Diving in closer on the Chinese index, it is at the bottom of its triangle threatening to break down, but yet it also has potentially made a near term double bottom within that structure:

Source: Swing Traders Edge

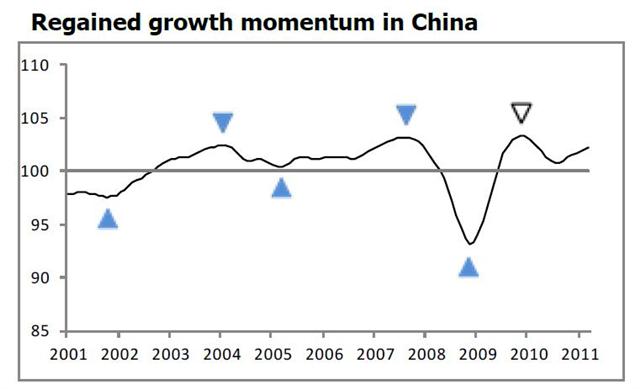

And China leading indicators have recently turned up, suggesting that despite inflation cooling efforts, growth is set to accelerate. This could potentially provide the impetus for the Chinese index to break upwards out of its range rather than downwards.

Source: OECD

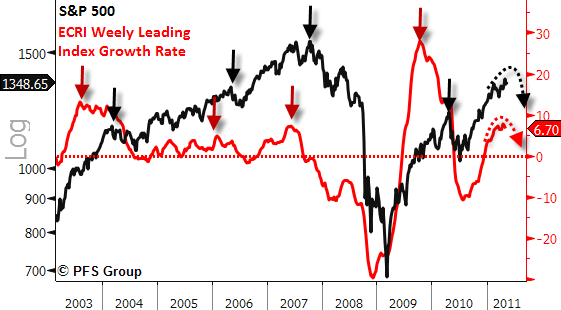

Turning to US leading indicators, the ECRI WLI could perhaps be rolling over from a peak here, though it's too early to tell:

Source: Dshort / ECRI

But if it is rolling over then historically stocks have not peaked for several months following the turn:

Source: PFS Group

So, if leading indicators were to turn down and stocks press on to make a higher high in the next couple of months, supported by the remaining QE, then I would look to sell out of my remaining stock indices longs, and buy back in after the anticipated delayed correction, for the cyclical bull continuation into 2013.

However, if leading indicators do not turn down, then there remains the possibility of mid-year consolidation with an upward bias, re-posting this potential historical rhyme:

For the above reasons my strategy is a reduced long position on the stock indices until further evidence appears.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.