Goldman Sachs Using Currency Swaps to Hide Greek Debt Iceberg

Interest-Rates / Global Debt Crisis May 15, 2011 - 07:43 AM GMTBy: Mike_Shedlock

By now, most realize that Greece used currency swaps with Goldman to hide debt. However, Bloomberg has some new details about those transaction in its report Greece Had 13 Currency Swaps With Goldman, Eurostat Says

By now, most realize that Greece used currency swaps with Goldman to hide debt. However, Bloomberg has some new details about those transaction in its report Greece Had 13 Currency Swaps With Goldman, Eurostat Says

Greece had 13 off-market derivative contracts with Goldman Sachs Group Inc. (GS), most of which swapped Japanese yen into euros in a 2001 transaction aimed at concealing the true size of the nation’s debt, according to the European Union’s statistics office.

The amount borrowed through the swaps was due to be repaid with an interest-rate swap that would have spread payments through 2019, Eurostat said in a report on its website today. In 2005, the maturity was extended to 2037, the report said. Restructuring the swaps spread the cost over a longer period, leading to an increase in liabilities and debt, Eurostat said.

Repeated revisions of Greece’s figures, beginning in 2009, spurred a surge in borrowing costs that pushed the country to the brink of default and triggered a region-wide debt crisis. The use of off-market swaps, which Greece hadn’t previously disclosed as debt, let the country increase borrowings by 5.3 billion euros ($7.5 billion), Eurostat said in November.

Today’s report provides details of Eurostat’s analysis of data obtained by its inspectors in Greece last year. Eurostat said most issues surrounding the swaps were resolved in September, when Greece agreed to correct its debt figures.

Tip of the Iceberg

Dr. Evil, a former government bond trader for a very prominent bank pinged me with a brief comment on the above article "13 with just 1 bank, in just 1 small country. This is but a tip of a huge iceberg".

For more on Dr. Evil, secret trades, and Citigroup's involvement, please see Italy The Invisible Elephant

Italy 10-Year Sovereign Debt Yield

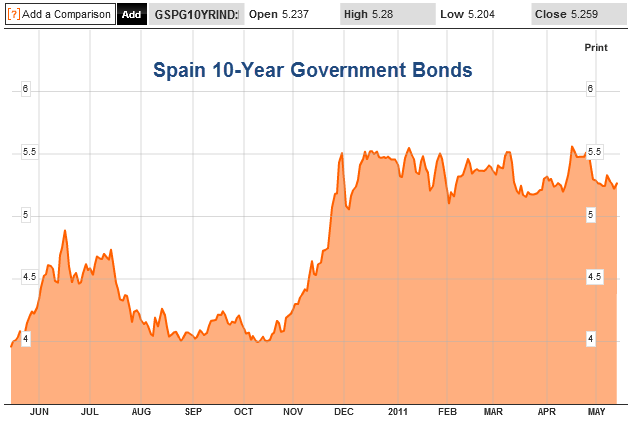

Spain 10-Year Sovereign Debt Yield

Germany 10-Year Sovereign Debt Yield

10-Year Government Bond Yield Comparison

Italy: 4.61%

Spain: 5.26%

Germany: 3.08%

So far, government bond yields in Italy and Spain remain "contained". However, as compared to German 10-year bonds, the Spanish 10-year bond yield is 2.18% higher and Italian debt is 1.53% higher.

Things will get interesting in a hurry should the market start having doubts about the debt of Spain or Italy, especially the latter.

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.