U.S. Retail Sales, Wholesale Price Inflation, Jobless Claims Economic Worries

Economics / US Economy May 13, 2011 - 02:12 AM GMTBy: Asha_Bangalore

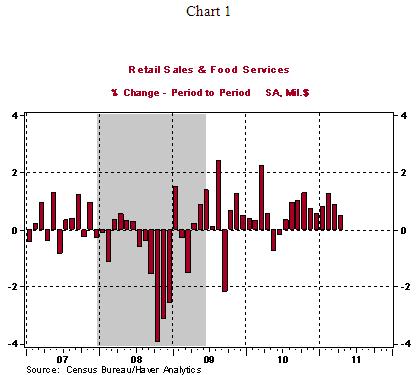

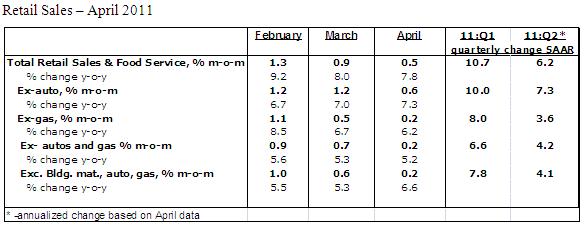

Economic data published this morning contain bothersome aspects. Retail sales recorded the smallest monthly increase since July 2010, initial jobless claims remain at an elevated level, and wholesale prices moved up, inclusive of core prices which exclude food and energy.

Economic data published this morning contain bothersome aspects. Retail sales recorded the smallest monthly increase since July 2010, initial jobless claims remain at an elevated level, and wholesale prices moved up, inclusive of core prices which exclude food and energy.

The 0.5% increase in retail sales during April includes a boost from higher gasoline and food prices. Gasoline sales rose 2.7% in April, after a 4.1% jump in the prior month. Excluding gasoline, retail sales rose only 0.2% in April compared with a 0.5% gain in the prior month. In April, sales of food moved up 1.2% vs. a 0.2% increase in the previous month. Excluding gas and food, retail sales were up only 0.1% in April. The important message, whether one tracks total retail sales or major sub-components, is that consumer spending was lackluster in April and it bodes poorly for the second quarter. From the details of the April report, sales of furniture (-1.1%) fell but purchases of apparel (+0.3%), general merchandise (+0.1%), and building materials (+0.1%) moved up.

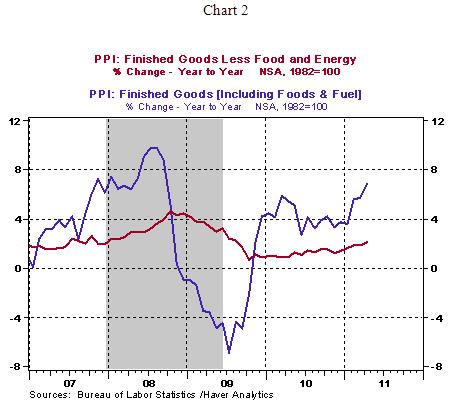

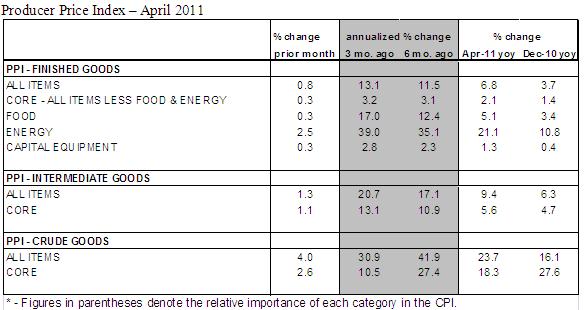

The Producer Price Index (PPI) of Finished Goods shot up 0.8% in April after a 0.7% gain in the prior month. According to the BLS, 75% of the increase in the wholesale price index in April was from a 2.5% jump in prices of finished energy goods such as gasoline (+3.6%) and natural gas (+3.5%). Food prices moved up 0.3% in April, with a large percentage of the increase being attributed to a 56.7% jump in prices of eggs.

The core PPI, which excludes food and energy, increased 0.3% in April after a similar gain in March. In April, a 1.2% jump in the price index of civilian aircraft and a 0.6% gain in the price of light motor trucks were the main sources of the hike in the core PPI. The core PPI numbers are somewhat troubling given that the core PPI has risen for five consecutive months. At the same time, the absence of a significant pass-through of higher wholesale core prices to core consumer prices reduces the level of concern.

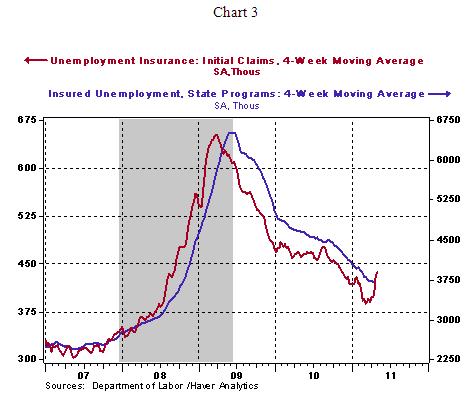

Initial jobless claims fell 44,000 to 434,000 during the week ended May 7. Seasonal distortions lifted the number of jobless claims in the prior week to 478,000. The four-week moving average at 436,750 is a good proxy for underlying trend of jobless claims. The elevated level of initial jobless claims raises the level of unease about the labor market, despite the noticeable increase in private sector payrolls recorded in April (+268,000). Continuing claims, which lag initial jobless claims by one week, rose 5,000 to 3.756 million. The four-week moving average of continuing claims at 3.718 million shows a small increase in the last three weeks.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.