What's the Real U.S. Unemployment Rate?

Economics / Unemployment May 09, 2011 - 06:05 AM GMTBy: Mike_Shedlock

Every month the government posts the unemployment rate yet few know where the unemployment rate comes from, how it is determined, and the relationship between the unemployment rate and the monthly reported jobs total.

Every month the government posts the unemployment rate yet few know where the unemployment rate comes from, how it is determined, and the relationship between the unemployment rate and the monthly reported jobs total.

For a quick recap, the unemployment rate comes from a "Household Survey" while the reported headline jobs total comes from the "Establishment Survey". The former is a monthly phone survey, the latter is a sample of actual business employment.

The reason for the "Household Survey" is that it will pick up new business formation, especially small businesses that might not be on the radar of the "Establishment Survey" sample. Even if the "Establishment Survey" sample size was 100%, unless duplicate names were weeded out, it would double-count those holding multiple jobs.

The "Household Survey" attempts to determine five key items.

- Do you have a job?

- Is so was it full or part-time?

- If not, do you want a job?

- If you do not have a job and want a job, did you look for a job in the last 4 weeks?

- Are you in school, on leave, etc.

The BLS does not ask the questions like that, instead the BLS attempts to determine those answers by a detailed list of questions.

For a discussion of exactly what questions the BLS asks to determine the unemployment rate, please see Reader Question Regarding "Dropping Out of the Workforce"; Implications of the Falling Participation Rate

Definition of Unemployed

Logically, one might think one would be unemployed if they want a job and do not have a job.

However, the official definition of unemployed is you do not have a job, you want a job, and crucially, you have looked for a job in the last 4 weeks.

Every month the government reports "alternative" numbers but even though many of the alternate numbers are a more accurate representation of the unemployment rate, the media focuses on the headline number, ignoring millions who have "dropped out of the labor force" simply because they stopped looking for work.

Millions more are in "forced retirement", which I define as someone over 60 whose unemployment benefits ran out so they retired to collect Social Security even though they really want a job.

244,000 Jobs Added Last Month, So Why Did the Unemployment Rise?

Last month many were surprised to see the jobs report claim 244,000 jobs were added yet the unemployment rate ticked up 2 tenths from 8.8% to 9.0%.

The widely proclaimed reason from mainstream media was that jobs were more plentiful and because more people were looking for jobs.

That explanation makes sense on the surface in light of the official definition of unemployment (you had to have looked for a job in the last 4 weeks to be counted as unemployed). However, the explanation does not stand up to scrutiny.

The fact is, employment fell by 190,000 according to the Household Survey and another 131,000 people dropped out of the labor force last month or the unemployment would have been even higher. Fewer people (131,000 to be precise) wanted a lob and looked for jobs in April than in March.

The Obama administration as well as mainstream media wants to play job numbers both ways, that is to say they want to use the Household Survey when it suits their purpose and the Establishment Survey otherwise.

Regardless, close scrutiny of the details in the report shows the headline numbers were far worse than they looked.

I commented on that in my Friday post BLS Jobs Report: Nonfarm Payroll Headline Number Looks Good, Beneath the Surface, Awful where I said ...

In the last year, the civilian population rose by 1,817,000. Yet the labor force dropped by 1,099,000. Those not in the labor force rose by 2,916,000. In January alone, a whopping 319,000 people dropped out of the workforce. In February another 87,000 people dropped out of the labor force. In March 11,000 people dropped out of the labor force. In April, 131,000 dropped out of the labor force. The 4-month total for 2011 is 548,000 people dropped out of the labor force.

Many of those millions who dropped out of the workforce would start looking if they thought jobs were available. Indeed, in a 2-year old recovery, the labor force should be rising sharply as those who stopped looking for jobs, once again started looking. Instead, an additional 548,000 people dropped out of the labor force in the first four months of the year. Were it not for people dropping out of the labor force, the [U3] unemployment rate would be well over 11%. Ilargi at Automatic Earth Blog in Trojan Lies picked up on my post and commented "Indeed, I’d venture that if you add in all those who’ve left the work force since 2008, you’d end up way above 11%. All in all, the total number of people in the working age population who are not in the labor force hit a new all time high of 86.248 million in April. And Wall Street likes that."

Unemployment Math

The math is simple enough, so let's see if Ilargi is correct.

From the latest BLS Jobs Report Table A1 Household Data

Civilian Labor Force: 153,421,000

Unemployed: 13,747,000

Not in the Labor Force (April 2011 vs April 2010): 85,725,000 - 82,809,000 = 2,916,000

If those who dropped out of the labor force in the past year were added back into the labor force (adding 2,916,000 to both the labor force and the number of unemployed) the totals would look like this:

Revised Civilian Labor Force: 156,337,000

Revised Unemployed: 16,663,000

Revised Unemployment Rate = 16,663/156,337 = 10.6%

Unemployment Math Since April 2008

The above number is just for the past year. Ilargi wanted to go back to 2008.

Those not in the labor force as noted in the April 2008 Employment Report = 79,241,000

Those not in the labor force today = 85,725,000

Since April 2008 6,484,000 dropped out of the labor force.

If we add those back into the labor force and to the unemployed, the math look likes this:

Civilian Labor Force: 159,905,000

Unemployed: 20,231,000

Revised Unemployment Rate = 20,231/159,905 = 12.7%

So Ilargi was correct to assume "way above 11%".

Unemployment Math Take III

Bear in mind some of those people retired because they wanted to, some died, some are too sick to work, some are in prison etc. However, I strongly suspect at least 60% of those people who dropped out of the labor force since April 2008 want a job and do not have a job.

Math at 60%

60% of 6,484,000 = 3,890,000

Civilian Labor Force: 153,421,000 + 3,890,000 = 157,311,000

Unemployed: 13,747,000 + 3,890,000 = 17,637,000

Unemployment Rate = 11.2%

If you want a range, assume 10.6% to 11.6%

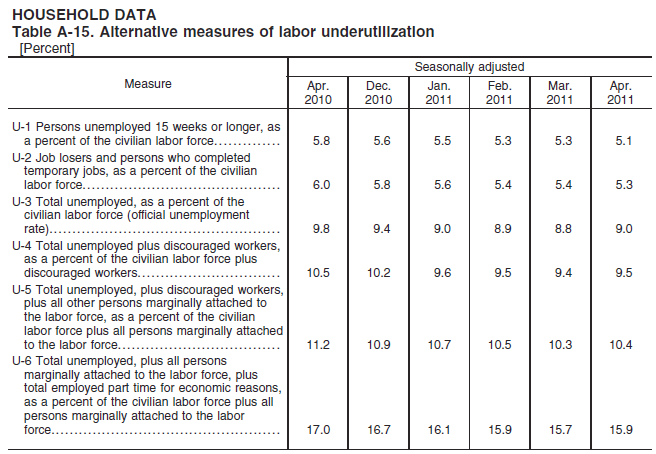

Table A-15 Alternative Measures

Note that the Government reports "Alternative Measures" of unemployment every month in Table A-15.

If you take a look at line "U-5" above you will see the government adds back in "marginally attached" workers defined as those who want a job but did not look in the last 4 weeks.

U-5 is 10.4% which is in the ballpark of my 10.6% to 11.6% seat-of-the-pants calculation made above.

However, U-5 does not include those hiding out in school when they really want a job, and I rather doubt it includes "forced retirement" either. Thus, my number should be a bit higher than U-5, which it is.

What About Part-Time Workers?

The BLS says those who worked as little as 1 hour last week are considered employed.

According to the BLS, there are now 8,600,000 workers who want a full-time job but instead are working part-time. The BLS labels this group "part-time for economic reasons".

The number of rose by 167,000 last month.

Before companies hire full-time workers, many of those working part-time will see their hours rise first.

If you factor in those working part-time for economic reasons the unemployment rate rises to 15.9%, and if you factor in students and those in forced retirement who really would rather be working, it is likely another 1-2 points higher still.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.