Africa Investor Profit Opportunities

Economics / Africa May 07, 2011 - 06:33 AM GMTBy: Richard_Mills

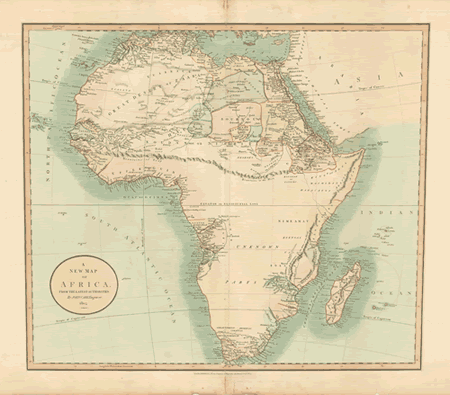

Little was known about Africa's interior so early map makers would often leave this region blank. Today's investors may be the equivalent of yesterdays mapmakers.

Little was known about Africa's interior so early map makers would often leave this region blank. Today's investors may be the equivalent of yesterdays mapmakers.

Africa is a continent of opportunity.

According to The Economist, between 2000 and 2010, six of the world's ten fastest growing economies where in Sub-Saharan Africa. The only BRIC (Brazil, Russia, India and China) country to make the top ten was China which came in second behind Angola - the fastest growing country in the world.

Nigeria, Ethiopia, Chad, Mozambique and Rwanda made up the rest of the African countries within the top ten and all had annual growth rates of around 8% or more.

The International Monetary Fund (IMF) says Africa will own seven out of the top ten places for fastest growing economies between now and 2015. The World Bank raised its forecast for economic growth in Sub-Saharan Africa to 5.3% for 2011 - the highest forecast rate of growth outside Asia.

Africans, on a per capita basis, are richer than Indians and a full dozen African states have higher gross national income per capita than China.

A lot of this growth is driven by a blossoming domestic market - the largest domestic market outside India and China. Much of the funding for Africa's private sector comes from domestic banks and investors - their returns on investment are among the highest in the world. In the last four years private consumption of goods and services has accounted for two thirds of Africa's GDP growth. In Africa's 10 largest economies the service sector makes up 40 percent of GDP - as a comparison India's is at 53 percent.

Today Africa has 14% of the world's population and by 2050 one in every four people on the planet will be African - by 2027 Africa will have more people than does China or India. Development expert Vijay Majahan, author of Africa Rising, said the rapidly emerging African middle class could today number almost 300 million people - that's out of a total population of one billion.

Many African stock markets performed very well last year - eight out of the eleven main Sub-Saharan African markets closed the year in positive territory. Leading the way was the Uganda Securities Exchange (USE) with a 34.16% gain.

Some of the factors contributing to the high growth rates:

- China's demand for raw materials

- Higher commodity prices

- Big inflows of foreign direct investment

- Foreign aid and debt relief

- Urbanization - rising incomes - growth in domestic demand

"Africa could be on the brink of an economic takeoff, much like China was 30 years ago, and India 20 years ago." The World Bank report - Africa's Future and the World Bank's Role in it

bigthink.com

Africa is incredibly resource rich, natural resource extraction and the necessary infrastructure investment is driving the development of its growing industrial and service sectors. Some of the new prosperity results from better economic policies but the ongoing explosion in commodity prices drives investment in exploration, development and mining which leads to the building of bridges, roads and power lines. Infrastructure build out is ultimately responsible for the boom in prosperity. This is because much of the same infrastructure needed for mining is also the same infrastructure essential for growth in:

- Agriculture

- Manufacturing

- Services

- Trade

The latest African Mining Indaba in Cape Town, South Africa was attended by 6,000 delegates.

A number of economies are increasingly becoming more important in terms of resource extraction:

The West African greenstone belts have seen strong investment and has transformed countries like Burkina Faso

- Mining investment – nickel, copper and cobalt - has the potential for encouraging the same kind of transformation in Cote d’Ivoire and Guinea

- Zambia, Mozambique, Burundi and Malawi are all of increasing interest to Rare Earth Element (REE) investors

- Namibia may become a leading resource economy due to its enormous uranium potential

- Zambia is experiencing a revival of its major copper industry with new mines being developed

Conclusion

There are African countries with a well founded, and much publicized, reputation for corruption and poor governance - to put it bluntly, some of Africa's economies are too poorly run for there to be any hope of secure investment opportunities. But, in much of Africa, there has been a sea change underway for sometime - a substantial chunk of the continent has experienced a stealthy, economic renaissance because of unprecedented, long term, political stability.

Steven Radelet, author of Emerging Africa: How 17 Countries are Leading the Way, says five fundamental changes are at work:

- More democratic and accountable governments

- More sensible economic policies

- The end of the debt crisis and changing relationships with donors

- The spread of new technologies

- The emergence of a new generation of policymakers, activists, and business leaders

Africa is the last continent to be developed - ironic considering that research confirms the "Out Of Africa" hypothesis that all modern humans stem from a single group of Homo sapiens who emigrated from Africa 2,000 generations ago.

Over the next generation Africa could very well be where some of the best returns on investment will be made - thanks to the increasing global appetite for natural resources. Many of the countries (Nigeria with its 150 million people comes to mind) in Africa will take their place on the world stage - much as the resource rich nations of Australia, Brazil and Canada have.

Africa has long been neglected by exploration and mining companies - and their investors - but resource extraction will constitute the most important economic opportunity in Africa's history over the coming decades.

Here is the opportunity - find the countries that match your risk acceptance level, find suitable investments within these countries and watch the others that presently do not meet your guidelines. Sooner, rather than later, after seeing their neighbors prosper, they will come to see the light and change their ways opening up the country for investment and meeting your risk levels.

Ahead of the herd investments in Africa's resource sector could be represented in an investor's portfolio, country by country, for years to come.

Are Africa's resource rich countries on your investment radar screen?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.