Understanding The Yuan, U.S. Dollar Relationship To Gold, Silver And Commodities

Commodities / Gold and Silver 2011 May 06, 2011 - 05:04 PM GMTBy: Jeb_Handwerger

In early January of 2011, a top secret candlelight dinner was held at the White House. There was no fanfare and meager publicity. Present were the industrial, military and governmental heads of both China and the United States. Our government had just digested the failures of Lehman Brothers, AIG and other corporate icons by creating massive bailouts and running up trillion dollar budgetary deficits.

In early January of 2011, a top secret candlelight dinner was held at the White House. There was no fanfare and meager publicity. Present were the industrial, military and governmental heads of both China and the United States. Our government had just digested the failures of Lehman Brothers, AIG and other corporate icons by creating massive bailouts and running up trillion dollar budgetary deficits.

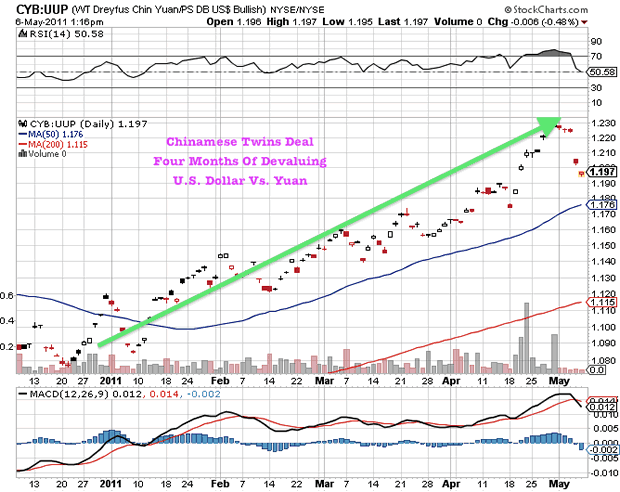

China was also concerned about inflation and soaring prices due to the intentional debasement of the U.S. currency (UUP) by the Federal Reserve. Both sides reached a modus vivendi, so they could mutually profit from these agreements. Please see my article on the "Chinamese Twins" back from January 2011 to understand these past few weeks.

Since my January article highlighting the deal, the yuan has steadily risen versus the greenback. China had long wanted to enter the American financial markets. It had abundant U.S. dollars (UUP) to make acquisitions and at the same time needs to diversify out of its enormous U.S. Debt(TLT) position. The solution was simple the U.S. would deliberately weaken the U.S. Dollar in order to hope to fortify the proposed elevation of the Yuan. Consider the cleverness of these stratagems. A bolstered Yuan could allow the growing Chinese Middle Class to improve their lifestyle. In addition, China would now be able to go on a buying spree for foreign companies particularly in the area of commodities and natural resources.

With the improved Yuan (CYB) they would now be able to acquire foreign companies at more attractive prices then heretofore. An elevated Yuan would allow them entree into American Institutions and Banks. It would also allow U.S. citizens to transfer their cheap U.S. dollars into the Yuan at bank windows right here in the United States.

Remember that noises have been made establishing the Yuan as the World's Reserve Currency. The agreement to facilitate Chinese acquisitions and financial entry into the U.S. markets and thus establish a pro quid pro with the United States. Conversely America also benefits by being able to sell products at advantageous prices and to pay off our colossal trillion dollar debts with cheap dollars. Basically, this was the scheme achieved by China and the United States at that candlelight dinner.

The game-plan was conceived in Washington in early January of 2011 and delivered by Bernanke in Washington at the end of April with his grand debut in front of the media. The head of the Fed could regale his audience with phrases like interest rates, transitory inflation and other tropes.

One question remained that no one would dare to ask. If there is no concern of rising silver prices and the falling dollar then why are precious metals especially silver (SLV) soaring into new highs? Obviously the plan to devalue the dollar had seen silver, poor man's gold and a highly speculative market made up of mostly retail investors reache record heights. To combat this "bad inflation" would come not in the form of interest rate hikes to slow down the acceleration of the dollar decline but through a series of margin rate increases which would cause a temporary shakeout of speculators. Raising the costs of owning silver began a quick de leveraging of risky traders taking on too much risk at frothy level. This has sent fear throughout the commodity sector. This correction should be short lived as strong hands will come in and silver will regain its footing and find support after the washout has concluded.

I have researched natural resource assets that might prove to be attractive to the Chinese. On our list are companies some of which already have Chinese participation. Just this year alone Minmetals was outbid by Barrick (ABX) to takeover copper miner Equinox. Jinchuan is making a bid for base metal producer Lundin (LUN.TO) Mining. General Moly (GMO) has received major assistance to build North America's largest molybdenum mine in Nevada. General Moly is currently writing its feasibility study in Chinese to secure the necessary financing.

The Chinese are very willing to partake in these world class assets and are not hiding that fact. This aggressive search for strategic metals may transfer into the rare earth sector (REMX) as well. Prices are continuing to soar and hybrid car manufacturers are looking for supply over the next 3-5 years as demand is rapidly advancing for the crucial heavy rare earths used in the fuel efficient engines. Manufacturers are trying to get all the ore they can and after this runs out I expect some off take deals to occur in late 2011 with some of these key rare earth assets in North America and Europe. Let us not forget that China made an unsuccessful bid for Lynas (LYSCF) not too long ago.

We expect China to now aggressively pursue these strategic metal mining companies (REMX) as part of this little publicized arrangement between these two powerful nations which I have called the "Chinamese Twins" who are now conjoined intimately.

I invite you to partake of my members only stock analysis service for free by clicking here.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.