Gold, Silver and the Currency Wars

Commodities / Gold and Silver 2011 May 06, 2011 - 05:07 AM GMTBy: Jesse

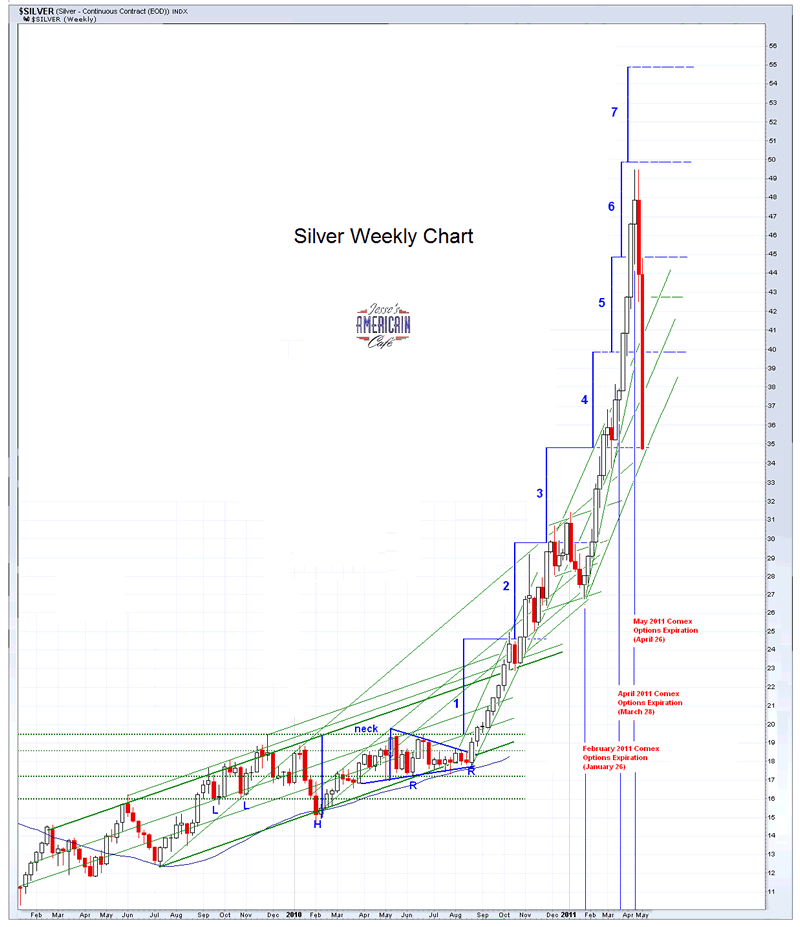

With five margin increases in ten days, one could suggest that the CME and their do-nothing friends in the CFTC are machine-gunning the lifeboats, and the refugees from the currency wars.

With five margin increases in ten days, one could suggest that the CME and their do-nothing friends in the CFTC are machine-gunning the lifeboats, and the refugees from the currency wars.

There is no problem with the exchanges and regulators increasing margin requirements per se, and of course restraining leverage is a good thing. I would just like to see it done more transparently and in a 'rule-based' manner, as opposed to the ad hoc, cronyistic way in which it is done today, most often for the benefit of insiders who control the exchanges, and call for help and rule changes when they get in trouble. And they get into trouble through lax regulation and excessive leverage.

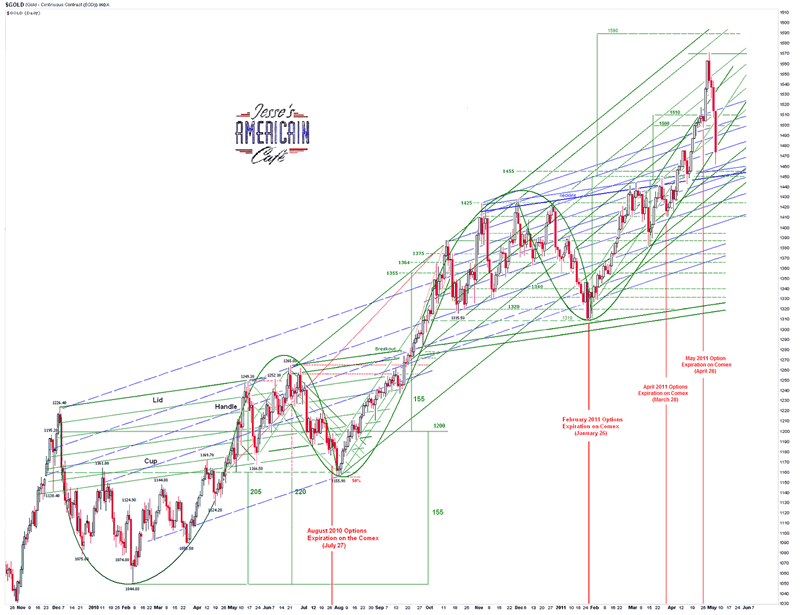

There is no problem with the exchanges and regulators increasing margin requirements per se, and of course restraining leverage is a good thing. I would just like to see it done more transparently and in a 'rule-based' manner, as opposed to the ad hoc, cronyistic way in which it is done today, most often for the benefit of insiders who control the exchanges, and call for help and rule changes when they get in trouble. And they get into trouble through lax regulation and excessive leverage.There are 'crash' silver calls down to below 30 to 22 abounding. Keep in mind I sold my short term silver trading positions last week, and was short term bearish. I have just started buying back in to gold and silver yesterday and a little before with hedges. Also bear in mind that this decline is accompanied by a sell off in equities as we had suggested it would. Hence our hedging strategy has worked.

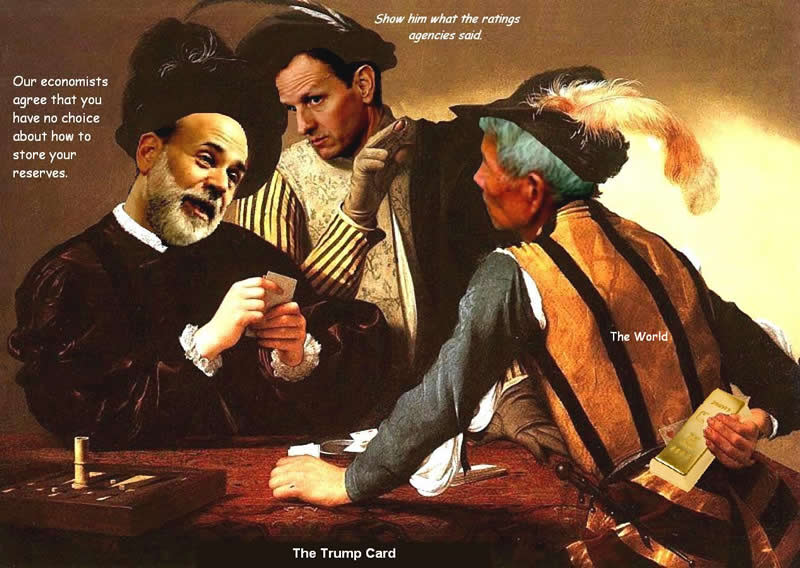

People ask, why do not the sovereign silver and gold bulls, the BRICS, fight this? The answer is that they are long term bullion buyers, and this short term paper strategy benefits them greatly.

I think the comparisons to the Hunt Brothers silver bubble might be a bit difficult to sustain, very big picture to the point of meaninglessness. The circumstances between then and now are very different, with the only thing in coincidence being the technical price action. But a concentrated effort by the government and the banks could write history and draw the graphs to suit themselves.

I think there is more to this than meets the eye. It really centers around a major struggle with regard to international currency, and the methods by which countries denominate their trade, and store the liquid reserves portion of their wealth. This is a currency war.

Certainly there are almost no bull calls for the precious metals here, and only a few neutrals. I am changing from short term bearish to neutral, and holding new light positions, most of them revolving around a few 'special situations.' I am neutral, which implies uncertainty. When in doubt, stay out.

I have touched none of my long term positions.

Let's see how the Non-Farm Payrolls number looks, and how it is received. If there is a liquidation panic in the weeks ahead, then all bets are off of course.

This is going to pivot on the stock market and the Fed's short term liquidity actions. The market swings are being triggered by the opaque and irregular management of the markets and the money supply, and the fraud which still taints much of the financial system. Even the staid Economist magazine is questioning US government economic statistics.

The American oligarchs may be having their own Mubarak moment in the not too distant future.

What has been hidden will be revealed, and what has been whispered will be shouted from the rooftops.

But one day at a time, so let's see what happens tomorrow.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.