U.S. Dollar Rallys Sharply After ECB Backs Off From Interest Rate Rise

Currencies / US Dollar May 06, 2011 - 01:47 AM GMTBy: Mike_Shedlock

ECB President Jean-Claude Trichet has backed off his usual way of signaling a rate hike, which is to use the phrase "strong vigilance". Instead, Trichet said today "the ECB will monitor inflation risks very closely".

ECB President Jean-Claude Trichet has backed off his usual way of signaling a rate hike, which is to use the phrase "strong vigilance". Instead, Trichet said today "the ECB will monitor inflation risks very closely".

The market interpreted this change as a pause in rate hikes by the ECB. Unlike most, I had been expecting this action by Trichet for many reasons. I gave some of those reasons in my speech last week at Saxo bank. (See Meeting with Saxo Bank Chief Economist; My Speech in Copenhagen; Images of Stockholm and Copenhagen) for a discussion and lots of digital images.

Why I expected Trichet to Curtail Rate Hikes

- Strengthening Euro is hurting European exports

- ECB's One Size Fits Germany Policy is not viable.

- Rate hikes would exacerbate problems Spain, Greece, Portugal, Italy, Ireland, Greece, and Spain (the PIIGS)

- The recovery in Europe is not on solid footing

- Hiking rates to combat oil prices makes no sense if the spike in oil prices is not caused by a rise in demand

- Expected and actual interest rate actions

- Direction of interest rate differentials

- Actual interest rate differentials

- Demand for dollars in debt deflation credit crunch

- Deficits

- Actions on Deficits

- Trade imbalances

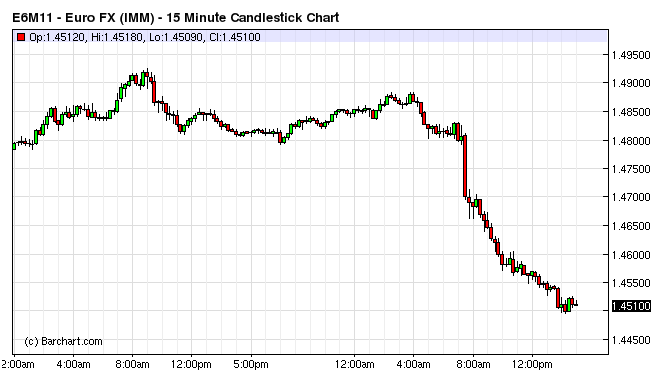

The top reason the Euro has been soaring was an expectation the ECB would hike three times or more and the Fed none. Trichet threw cold water on that expectation today, and the Euro promptly sank 3 cents vs. the US dollar.

Euro 15-Minute Chart

Minneapolis Fed Noise About Rate Hikes

Meanwhile, not that anyone believes it (I sure don't), but Minneapolis Fed President Narayana Kocherlakota says ‘Modest’ Rise in Key Rate Is Desirable This Year.

Federal Reserve Bank of Minneapolis President Narayana Kocherlakota said it would be “desirable” to lift the target for the benchmark U.S. interest rate by a “modest amount” this year, based on his inflation forecast.

The Federal Open Market Committee “should raise the fed funds rate by around 50 basis points” if core inflation rises by 1.5 percent this year, he said today in remarks prepared for a speech in Santa Barbara, California. “Under my baseline forecast, it would be desirable for the FOMC to raise the fed funds target interest rate by a modest amount toward the end of 2011,” said Kocherlakota, who votes on monetary policy.

Fed Won't Hike

I highly doubt the Fed seriously entertains the notion of hiking this year. I even have a December Eurodollar options bet on inaction by the Fed. I see a slowing economy and a likely collapse in commodity prices to boot.

However, the noise from Kocherlakota comes at the perfect time today to support the US dollar given the widely unexpected announcement from Trichet today.

Commodity Factor

Moreover, should commodities collapse, it is highly likely the commodity currencies such as the Australian dollar and Canadian dollar sink with it.

If the Reserve bank of Australia acts to support the Australian property bubble collapse with rate cuts (an action I expect but the market doesn't), that will pressure the Australian dollar.

Note once again points number 1-3 above regarding currency fundamentals. Although there is a huge interest rate differential between Australia and the US, if the direction of differential narrows, especially if it narrows unexpectedly, the Australian dollar will likely give up ground to the US dollar.

Finally, should there be another US credit crunch (an event I think is probable but have no specific time frame in mind), demand for US dollars to pay back debts will be high.

Few understand the role of credit and debt when it comes to debt-deflation demand for dollars.

All things considered, anti-US Dollar sentiment is so extreme and fundamentals so poor for other currencies (as compared to widely expected actions and commodity fundamentals), a rise in the US dollar could easily last for months to the absolute astonishment of the hyperinflation fanatics.

Everyone understands the problems with the US dollar. Few bother to look at problems elsewhere or other factors including reversals in extreme sentiment.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.