Silver Paper Sell Off Confronted by Significant Physical Bullion Demand

Commodities / Gold and Silver 2011 May 05, 2011 - 08:09 AM GMTBy: GoldCore

Gold stabilised in Asian and early European trading prior to a 1% fall, while silver’s sharp price fall continues and silver is now down 20% in USD terms in 5 days. The huge and unprecedented increase in margin in the paper silver market has forced some weak hands out of the silver market and allowed the concentrated shorts on Wall Street to press their advantage to the downside.

Gold stabilised in Asian and early European trading prior to a 1% fall, while silver’s sharp price fall continues and silver is now down 20% in USD terms in 5 days. The huge and unprecedented increase in margin in the paper silver market has forced some weak hands out of the silver market and allowed the concentrated shorts on Wall Street to press their advantage to the downside.

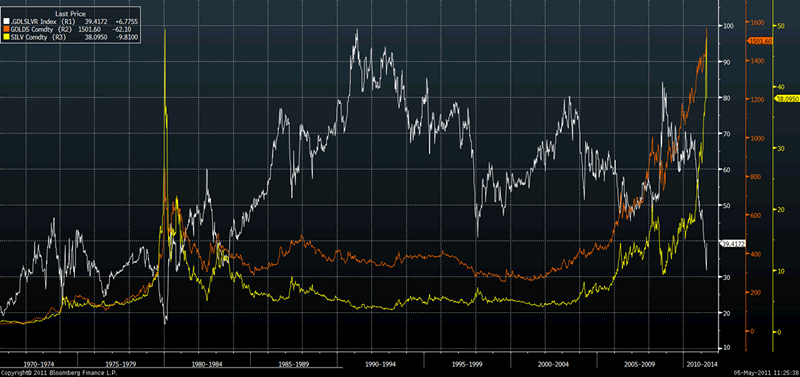

Gold to Silver Ratio – 1971 to Today Gold (orange), Silver (yellow) and Gold/ Silver Ratio (white)

Both gold and silver’s sell off are healthy and are due to them becoming overbought in the short term (particularly silver) and this is once again a paper profit taking and technical driven, speculative sell off as seen in the surge in frenzied dealing and large spike in trading volumes in silver futures in New York.

Gold’s resilience is further confirmation of massive buying of gold by creditor nation central banks which should reassure bullion owners and offer support to silver.

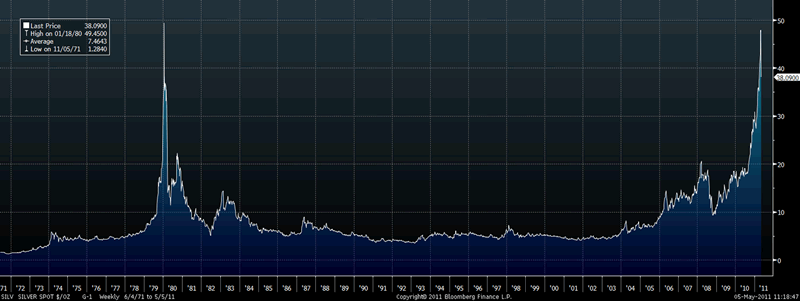

Silver in Nominal USD Terms – 1971 to May 2011 (Weekly)

Some nervous physical silver buyers and more speculative physical buyers have sold today and this week but those buying for diversification and financial insurance are strong hands and have not sold. Indeed, physical buying and buying the dip has continued yesterday and today.

A correction, possibly sharp, was expected after the 28% rise in prices in April alone and the sharp rise seen so far in 2011. Support may be seen at $35/oz but experience shows that paper driven sell offs in the futures markets in New York can surprise to the downside.

COMEX Silver Inventories – 1 Year (Daily)

Store of value, safe haven bullion buyers should hold their nerve and continue to accumulate and to maintain a core holding in gold and silver bullion. In the same way that the sharp falls from over $20/oz to below $10/oz in 2008 are now seen as a wonderful buying opportunity so this sell off will be seen as another buying opportunity.

Those who sell on this sell off and fail to reenter the market or maintain a core holding in gold and silver bullion will likely regret it in the coming months and years.

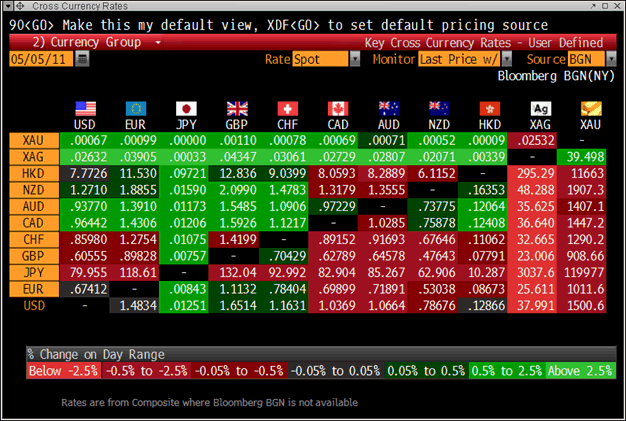

Cross Currency Rates

Inflation risk (and the possibility of stagflation and hyperinflation) today mean that cash can become trash very fast and thus international equities, international government bonds (high credit; very short duration) and gold remain prudent asset allocations.

The cash component of a portfolio should probably include some local currency and a combination of creditor nation fiat currencies and of course silver and gold.

Savers need to protect themselves from local currency risk and diversifying savings through ownership of bullion continues to be prudent.

Gold

Gold is trading at $1,501.40/oz, €1,012.54/oz and £910.27/oz.

Silver

Silver is trading at $37.72/oz, €25.45/oz and £22.87/oz.

Platinum Group Metals

Platinum is trading at $1,796/oz, palladium at $720/oz and rhodium at $2,250/oz.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.