Stock Market Rallies on News of Bin Laden's Death? It's Not So Simple

Stock-Markets / Stock Markets 2011 May 03, 2011 - 12:32 PM GMTBy: EWI

On the morning of May 2, the financial headlines were abuzz with the news of Osama Bin Laden's death and its positive impact on the stock market: "Stock Market Celebrates Killing of Bin Laden" (The Wall Street Journal)

On the morning of May 2, the financial headlines were abuzz with the news of Osama Bin Laden's death and its positive impact on the stock market: "Stock Market Celebrates Killing of Bin Laden" (The Wall Street Journal)

But despite a positive open, stocks closed lower on May 2. Undoubtedly, in the days ahead we'll hear analysts explaining how Bin Laden's death is not that "bullish" of an event, after all.

On that same note, MarketWatch.com ran an interesting story on May 2 that quoted from a research paper which found "little evidence that non-economics events have a big effect on the stock market."

Here at EWI, we go one step further and say the following: Economic events have little impact on the stock market, too.

Don't believe us? Read this excerpt from a free Club EWI resource, the 50-page 2011 Independent Investor eBook, and judge for yourself.

The Independent Investor eBook, 2011 Edition (Excerpt; full report here)

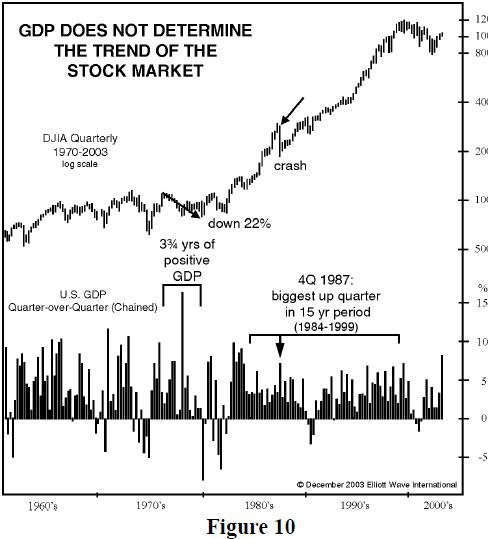

...Economists' Claim #5: “GDP drives stock prices.” Suppose that you had perfect foreknowledge that over the next 3¾ years GDP would be positive every single quarter and that one of those quarters would surprise economists in being the strongest quarterly rise in a half-century span. Would you buy stocks? If you had acted on such knowledge in March 1976, you would have owned stocks for four years in which the DJIA fell 22%. If at the end of Q1 1980 you figured out that the quarter would be negative and would be followed by yet another negative quarter, you would have sold out at the bottom. Suppose you were to possess perfect knowledge that next quarter’s GDP will be the strongest rising quarter for a span of 15 years, guaranteed. Would you buy stocks? Had you anticipated precisely this event for 4Q 1987, you would have owned stocks for the biggest stock market crash since 1929. GDP was positive every quarter for 20 straight quarters before the crash and for 10 quarters thereafter. But the market crashed anyway. Three years after the start of 4Q 1987, stock prices were still below their level of that time despite 30 uninterrupted quarters of rising GDP. Figure 10 shows these two events.

It seems that there is something wrong with the idea that investors rationally value stocks according to growth or contraction in GDP. ... Claim #6: “Wars are bullish/bearish for stock prices.” ... (continued)

Keep reading the 50-page Independent Investor eBook now, free -- all you need is a free Club EWI password.

This article was syndicated by Elliott Wave International and was originally published under the headline Stocks Rally On the News of Bin Laden's Death, You Say? It's Not That Simple. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.