Stock Market Outlook for May 2011

Stock-Markets / Stock Markets 2011 May 02, 2011 - 05:26 AM GMTBy: John_Hampson

There is positive pressure for stocks into and around the new moon of May 3rd, then negative pressure after that into and around the full moon of May 17th:

There is positive pressure for stocks into and around the new moon of May 3rd, then negative pressure after that into and around the full moon of May 17th:

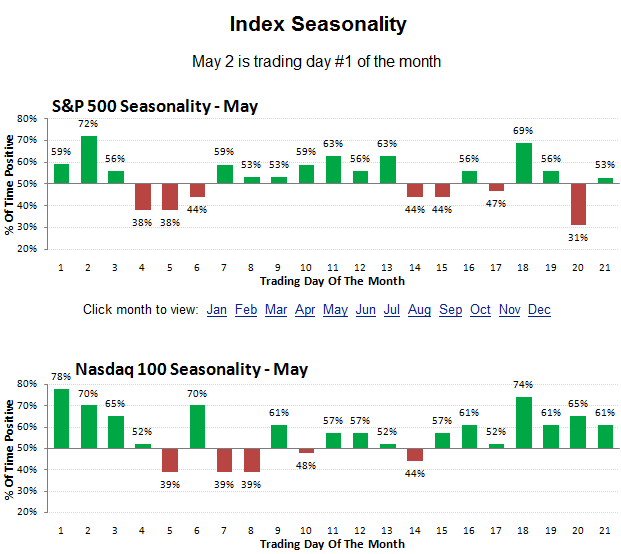

Seasonality fits with that, suggesting a positive bias to the first three trading days of this week:

Source: Market Sci

Source: Sentimentrader / Cobra's Market View

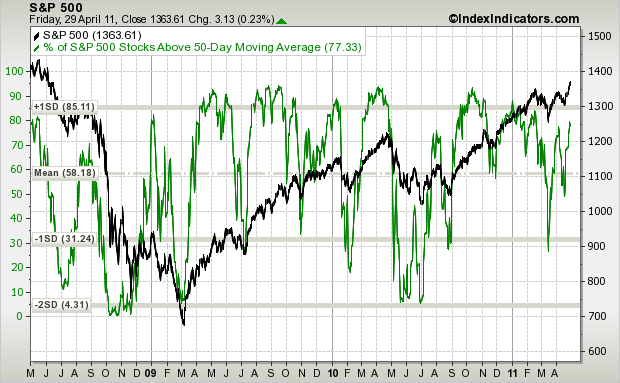

So, expecting gains over the first 3 days of this week I would like to see the below measure reach over the upper grey line into overbought status as a result of that advance:

Source: IndexIndicators.com

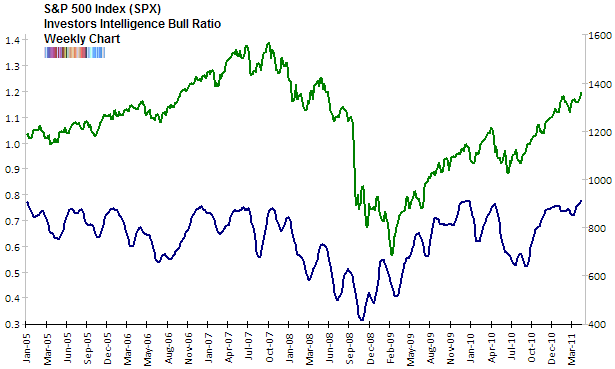

Such action should also lift indices into overbought RSI readings, at which point I would expect to be able to present sufficient collective evidence for a pause or pullback in stocks, given that Investors Intelligence sentiment is calling for a pullback imminently:

Source: Traders Narrative / Investors Intelligence

And copper is diverging negatively - copper tends to be a leading indicator:

Source: Mcoscillator.com

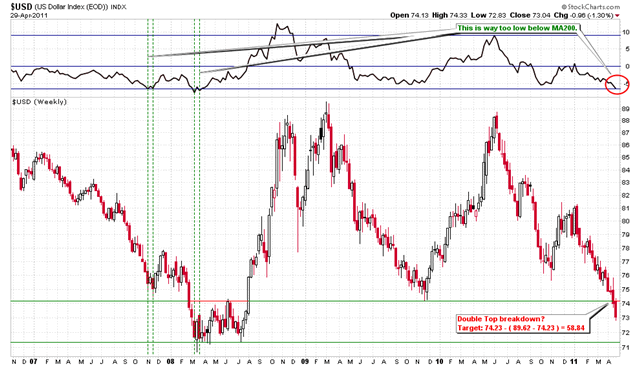

Plus, the dollar index should complete its exhaustion selling towards 72-71 over the next few sessions:

Source: Cobra's Market View

In summary, I believe all the above means I may be in a position later this week where I am looking to take some stock indices profits off the table.

I previously forecast that stocks would make a new nominal high at the end of April into the beginning of May, followed by a correction over mid-2011:

One of the composite reasons for that is May to September is the seasonally weak period for stocks, reflected here:

Source: Seasonalcharts.com

And there is a potential Puetz crash window in mid-June. Note that not all Puetz crash windows have worked, but occurences are sufficient to make it worthy of attention:

So are we going to finally see an extended retreat or consolidation for stocks over the mid part of 2011? If so, the first few days of this week could mark an end to a period of bumper gains since mid-2010. Well, should things come to pass this week as outlined above then I will take partial profits on stock index positions in a few days time and leave a core long position, because the growthflation scenario that I previously analysed as currently in play means we could potentially also see this:

Namely, a crawl along the top side of the bullish channel over the next few months, in a continued rhyme with the last cyclical bull. It would be a consolidation of sorts, but one to be long on, not short.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.